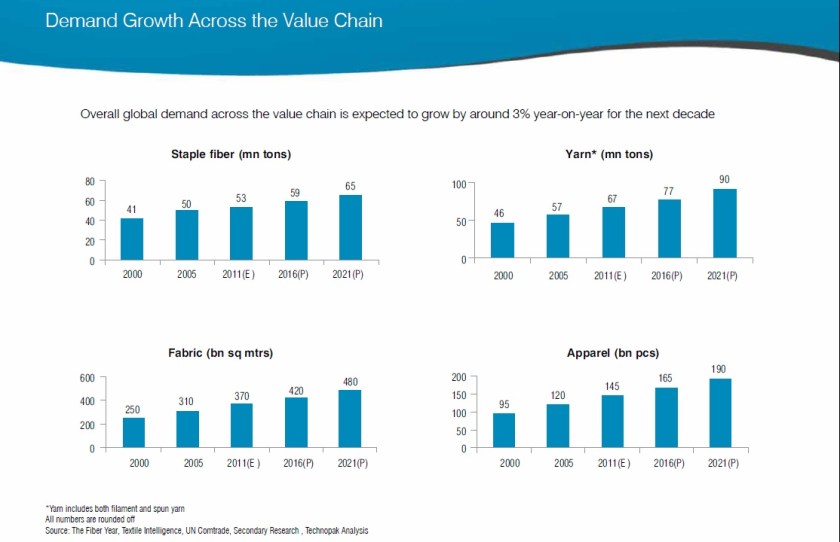

Data source: TechnoPak (2013)

Tag: Global

Trade with EU and Japan is good for the US and Trade with China is bad?

Yesterday in class, we’ve discussed how differently people see the impact of international trade. Here is one more example showing the controversy of the topic: according to a survey conducted by PewResearch in late 2010, 58% of sampled Americans said more trade with European nations would be good for the United States, 60% said increased trade with Japan would be good for the U.S. but only 45% favored increased trade with China. However, statistical data shows that US exports to China outpaced nearly all of the top ten export markets (including Japan and EU) from 2003 to 2012(source: USCBC).

Why would the general public favor a particular trading partner but disfavor another? Should they? By which standard the general public may assume more trade with a particular trading partner would be good or bad for the United States? In your view, is trade beneficial for the US overall? Can we use any trade theories learnt from the class to explain the above phenomenon? Look forward to hearing your thoughts!

Re-shoring, Jobs and Globalization–Perspectives from David Cameron

- How to make a success of globalization and ensure our businesses, our peoples and our societies can benefit from the next phases of globalization?

- What are the opportunities of re-shoring for the West and how to seize them?

- How to secure sustainable and well-paid jobs and give people pride in using their skills?

- Is re-shoring going to bring back all the jobs that were off-shored in the first place?

- What are the factors that are driving re-shoring?

- Does reshoring mean the West wins and the East loses?

- Is there a chance for Britain and US to become the “Re-shore Nations”?

If you care about the questions above, please enjoy the speech given by David Cameron, Prime Minister of the United Kingdom at the 2014 World Economic Forum in Davos. The speech is a great supplement to our discussions this week on globalization.

The international aspect of the US economic policy: why and how we are all connected?

From 0:24′: Please enjoy an enlightening and inspiring dialogue with Penny Pritzker, US Secretary of Commerce and Michael Froman, US Trade Representative, on the international aspect of the US economic policy at the 2014 World Economic Forum in Davos. The dialogue covers many interesting topics closely connected with our class lectures this & next week, for example:

- Do we need more globalization? What is the impact of globalization on jobs and income inequality?

- Why export matters to the US economy?

- What will free trade agreements such as the Trans-Pacific Partnership (TPP) bring to the US?

- Why foreign investment in the US is good for the US economy and job creation?

- What is the connection between “global supply chain” and “made in USA”?

International Trade and Global Supply Chain

Questions to think about:

Why supply chain matters in the 21st century global economy?

What benefits a global supply chain can bring to us?

What unique risks are involved in a global supply chain?

What role the government and policies can play in facilitating the global supply chain?

Are you prepared to embrace the concept of “made in the world”?

Why the General Public Needs to Care About Textiles and Apparel

The TPP would actually benefit whom?: The local Vietnamese companies or rather the global capitals which invest in Vietnam ?

Outcomes of many studies suggest that Vietnam would become one of the largest beneficiaries of the Trans-Pacific Partnership (TPP) by substantially expanding its apparel exports to the United States. However, the news report below raises another interesting question to consider: who actually would benefit from the TPP: The local Vietnamese companies or rather the global capitals which invest in Vietnam because of the agreement? This question is important because the answer reflects many debates nowadays about the impact of globalization; particularly, the impact is suggested to be unequally felt by different stakeholders.

From thanhniennews

The US-led TPP trade pact that will include Vietnam among its signatories is expected to be wrapped up this year, but Vietnamese firms are unsure if they will benefit.

Many are anxious since foreign investors with deep pockets are planning to set up operations in the country to take advantage of the lowering of import taxes by many large economies that will sign up for the trade deal.

For instance, import tariffs in the US, the biggest customer for Vietnam’s leading export, textiles, will be cut from 17-32 percent now to zero.

Many textile and garment companies in the region have already begun to move to Vietnam.

Texhong Corporation of Hong Kong, which set up a dyeing factory in the southern province of Dong Nai in 2006, recently opened another one in the northern province of Quang Ninh with an investment of US$300 million.

One of Hong Kong’s leading textile companies, TAL Apparel, has plans to set up a second textile-dyeing -apparel factory worth hundreds of millions of dollars. It has eight factories worldwide, including one in Vietnam’s northern province of Thai Binh since 2004.

Unisoll Vina, owned by South Korean Hansoll Textile Ltd, has also got a license to build a $50-million factory to make fur and leather clothing and accessories.

According to the Ho Chi Minh City Association of Garment, Textile, Embroidery and Knitting, Japanese companies Toray International and Mitsui, Austria’s Lenzing, and China’s Sunrise are also exploring investment opportunities in the country.

Vietnamese companies are meanwhile trying to enlarge their limited feedstock production capacity to comply with TPP’s regulations on origins – for instance apparel has to be made using yarn and other materials produced in member countries.

The Vietnam National Textile and Garment Group (Vinatex) has opened three yarn factories this year in Hanoi and the central provinces of Ha Tinh and Thua Thien-Hue with an annual capacity of 1,270 tons.

It started work on 11 others in the first half of the year.

Figures from the Vietnam Textile and Apparel Association (Vitas) showed that 70 percent of more than 3,700 textile factories in the country make apparel; only 6 percent produce yarn and 17 percent make cloth while 4 percent dye.

Local producers depend largely on fabric imported from China.

Insiders said a yarn factory costs tens of millions of dollars, a sum most Vietnamese businesses cannot afford.

Pham Xuan Hong, deputy chairman of Vitas, said unless the government helps by making cheap loans available for yarn projects, the industry would not benefit from the TPP at all.

The government also needs to zone certain areas for dyeing plants since they are shunned everywhere due to pollution concerns, Hong said.

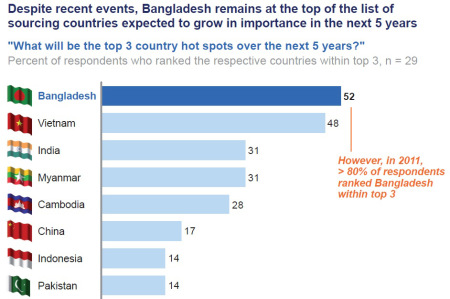

The 2013 global apparel sourcing map – balancing cost, compliance, and capacity

Mackenzie & Co., a well-known consulting firm, recently released their latest report on the global apparel sourcing map. The report is drafted based on a 2013 summer survey with 29 chief purchasing officers (CPOs) in Europe and the U.S. who were responsible for an annual total sourcing value of $39 billion USD. According to the report:

First, the global apparel sourcing cost is expected to rise modestly in the next 12 months (1.7% increase on average). Labor cost is tagged as the No.1 driving force of the rising sourcing cost.

Second, companies are sourcing less apparel from China, but they move in a very cautious way. In the meanwhile, Asia is still seen as the world hub for apparel manufacturing & exports in the years to come. Such a pattern reflects the exact criteria for sourcing decisions: a balance of price, quality, capacity, speed and risk. Particularly, “proximity sourcing” is becoming increasingly important according to the surveyed CPOs. This rule shall also apply to China which has emerged as one of the world’s fastest growing apparel retail markets.

Third, despite the frequent reported corporate social responsibility problems, a combined consideration of labor cost advantage, free trade agreement benefits and capacity make Bangladesh remain the No. 1 hot pot for apparel sourcing for the next 5 years. 83% of surveyed CPOs plans an increase of apparel sourcing from Bangladesh in the years ahead.

Overall, sourcing will continue to be one of the most critical success factors for the global apparel industry. The survey results reflect a more structural shift in the industry, while the traditional apparel company “caravan journey” becomes more complex.

Travels of a T-shirt with Pietra Rivoli (2013)

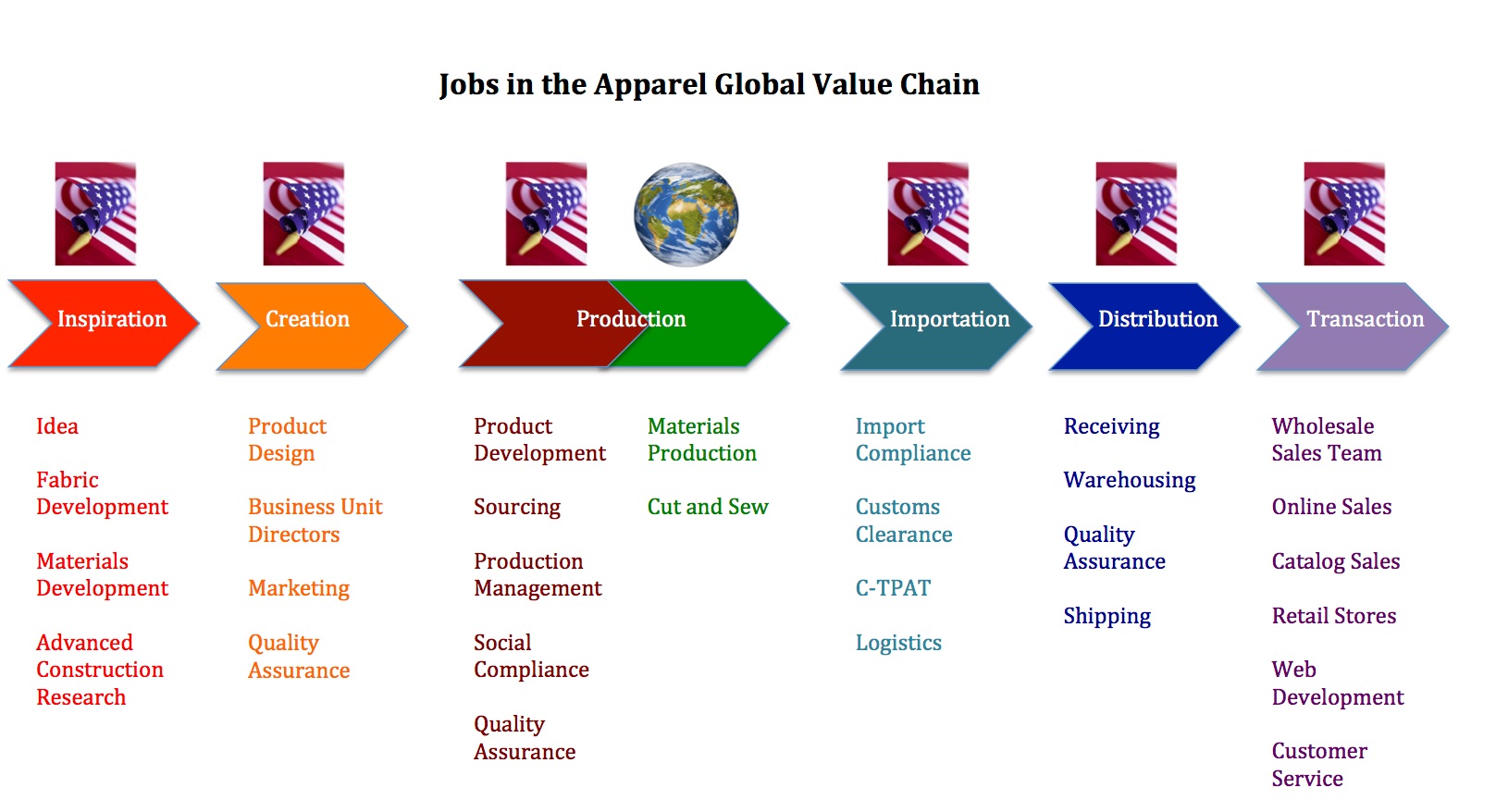

A Global View in Mind Means More Job and Career Oppertunities in the Fashion Apparel Industry

(Note: the functions & jobs below the U.S. flag mean they are based in the United States; Remember, apparel are “made in the world”–just like iphone and ipad. Even imports contain U.S. added value.)

Source: Moongate Association (2012). Analyzing the Value Chain for Apparel Designed in the United States and Manufactured Overseas

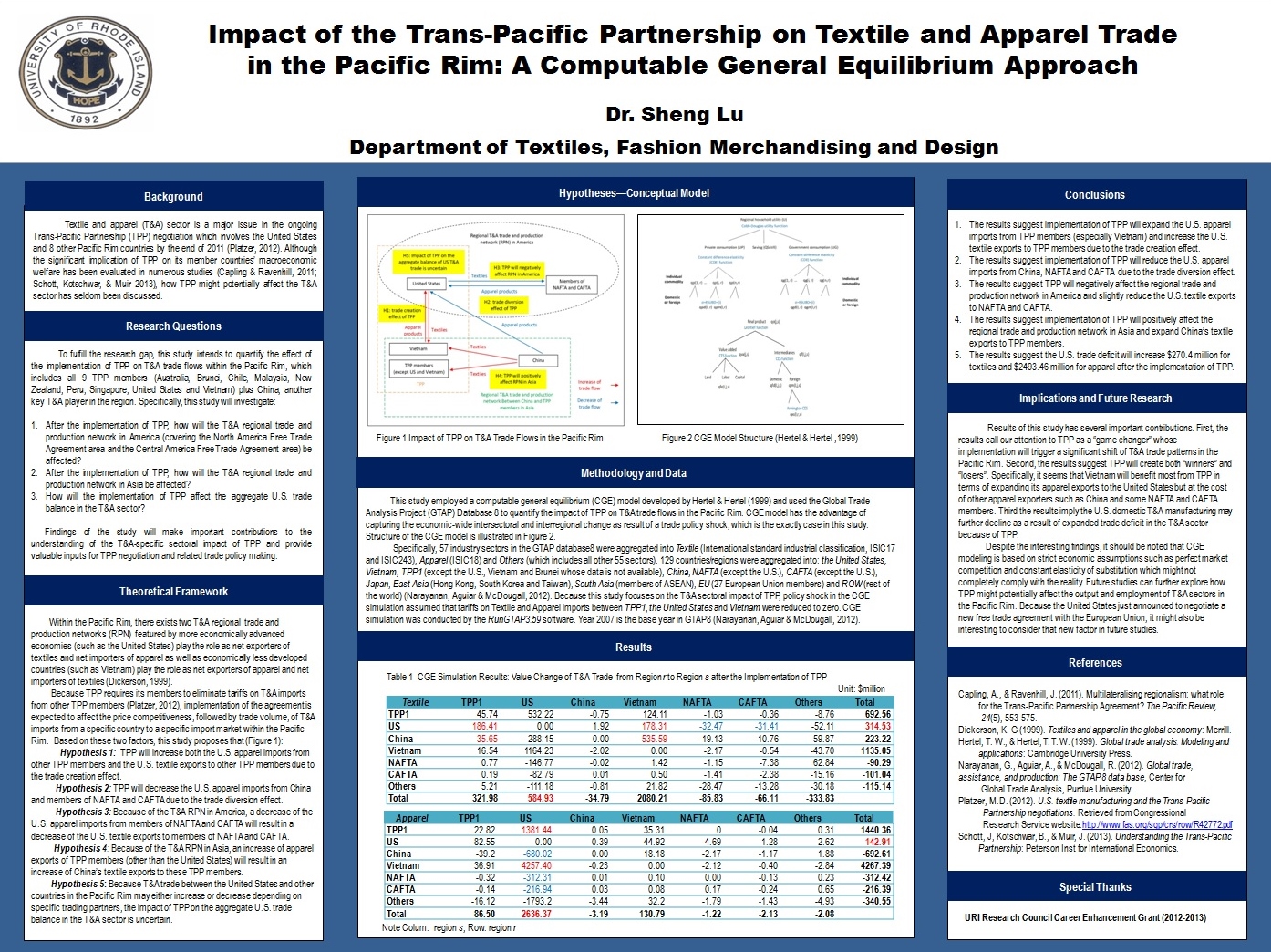

Impact of the Trans-Pacific Partnership on Textile and Apparel Trade in the Pacific Rim

Citation: Lu, S. (2013). Impact of the Trans-Pacific Partnership on textile and apparel trade in the Pacific Rim. World Trade Organization Focus, 20(5), 67-77.

For questions, please contact the author: shenglu@mail.uri.edu

Global Apparel Sales Push Ahead in 2012

Scenarios on the Future of the International Monetary System

China’s textile and clothing firms expand in Africa

Faced by rising labor cost, China has started thinking about “going globle” for its T&A sector: not product, but capital.

“According to William Gumede, a senior research fellow at the University of Witwatersrand’s school of public and development management in South Africa, Chinese domination of Africa’s textile markets and its industry has promoted significant job losses.

“For instance in South Africa, employment in the textile industry dropped from 300,000 workers in 1996 to 120,000 in 2010,” says Gumede when reached for comment by just-style.

And the situation is worse in Nigeria where the country has seen its once burgeoning US$1.3bn spinning industry in disarray, with Chinese cheap fabrics being highlighted as the culprit.

“Since 1995, over 175 textile manufacturing factories have shut down, leaving more than 250,000 workers jobless,” says Jaiyeola Olanrewaju, the director-general of the Nigerian Textiles Manufacturers Association.

And there is concern that some Chinese producers are not playing fair – being accused of mimicking African textile trade marks and unique designs.

“In order to compete favourably, African governments must stop [the] influx of counterfeit and smuggled textiles,” says Dr Walid Jibrin, the chairman of the Northern States Chapter of the Nigerian Textiles Manufacturers Association.

He identifies African prints, shirts, fine wax print textiles, unique Guinea brocades and lace embroideries as examples of African designs and textile trade marks being copied on cheap Asian fabrics and dumped in West Africa.

“The counterfeits have destroyed the handmade traditional textile industry in Nigeria, Ghana, Ivory Coast and Guinea,” says Dele Hunsu, the president of the National Union of Textile Garment and Tailoring Workers of Nigeria.

AGOA’s preferential access

But probably the most devastating effect of the Chinese textile industry on sub-Saharan Africa’s economic growth is its ability to piggy-back on the US’s year 2000 African Growth and Opportunity Act (AGOA).

Chinese firms have benefited from the region’s preferential access to the US by establishing Chinese-owned subsidiaries in the region. AGOA of course creates a trading advantage for sub-Saharan Africa’s textile industries to access the United States market.

According to Ms Ciliaka Millicent Gitau, a lecturer at the University of Nairobi’s School of Economics, its success was rapid but short-lived. By 2005, many Chinese companies had established subsidiaries in countries including Ghana, Kenya, Lesotho, Madagascar, Malawi, Mauritius, Namibia, Nigeria, Tanzania and South Africa.

“The issue is that AGOA did not have rules of origin that would have curbed transhipment of the Chinese textile commodities,” said Gitau who is an expert on the emerging Sino-Africa geo-politics and trade relations.

The result has been local African clothing and textile companies closing, unable to compete with Chinese firms’ aggressive export-oriented tradition, low production costs and technological superiority.

And while AGOA has been extended to 2015, Chinese clothing makers in sub-Saharan Africa will continue exporting more textiles to the US at the expense of African companies.

“In essence, in the last two decades, China has placed itself in a strategic position to reap benefits from sub-Saharan Africa, not only in the textile industry but in other sectors as well,” says Gitau.

New sales opportunities

And Chinese manufacturers are in no mood to pull back. With weakening demand in Europe and the US since the financial crisis, plus continuing disputes at the World Trade Organization (WTO) with key mature market trading partners, China’s clothing and textile industry wants to diversify its sales.

From January to August 2012, China Customs figures show textile and apparel exports to the European Union (EU) dropped 14.4% year-on-year to US$32.02bn, while they rose 12.2% to US$9.82bn to Africa.

“We have got lots of inquiries from clients in Africa recently. They are less demanding, and some of them are happy to accept our private brands,” says a director at a Shanghai clothing manufacturer who so far has been supplying the EU, US and Japanese markets.

“There are many economic communities in Africa, which allows us to enter other African countries easily once we are in one of the community countries. We would like to look into the African market,” she adds.

Other Chinese manufacturers are using Africa as a hassle-free, alternative way to access the US and EU markets.

“In Ethiopia, we rent a plant and hire local workers make clothing for clients in the US and EU,” says a business manager at a Shandong province-based textile firm, who stresses that the African Growth and Opportunity Act offers companies such as his legal opportunities to access the US market.

And Chinese companies continue to see Africa not only as a huge market for export, but also a possible place for massive investment.

For example, in August, China Garments, a Beijing-based former state-run manufacturer, announced it will invest about US$29.7m in Zimbabwe to form a joint venture with the Cotton Company of Zimbabwe. The JV is expected to be a major cotton supplier of China Garments.”

How many U.S. consumers are willing to spend $1,300 for a blazer, $170 for a dress shirt, $80 for a tie and $390 for a pair of jeans?

Recently, WSJ wrote a story about apparel “made in USA”. Although apparel manufacturing will never disappear in the U.S. (as the case elsewhere in the world), neither is it likely that those lost labor-intensive manufacturing jobs in the apparel sector will come back in the future. Why? Just ask yourself: Am I willing to spend $1,300 for a blazer, $170 for a dress shirt, $80 for a tie and $390 for a pair of jeans? These are the price tags associated with “Made in USA” for apparel.

Apparel is not a single case. If you’d like to enjoy your iPhone “Made in USA”, please add two “00” to the current price tag. Like it or not?

Similar questions can also be raised to the Europeans, Chinese, Koreans and everyone else in the world. For example, what will happen if China does not import U.S. cotton but totally relies on its domestic supply? What will happen if each country tries to produce their own air plane instead of using Boeing’s aircraft? How about European retailers only accept credit card issued by an European financial service provider and reject Visa or America Express? And how long will it take to deliver a package to Asia if FedEx and UPS are not allowed to operate in these regions? Will these “changes” improve or worsen people’s daily life? The answer is obvious.

Globalization does not mean “Made in China”nor “Made in USA”. Rather, it means “Made in the World” based on each country’s comparative advantage, it means getting access to the world resources and using them more wisely and more efficiently. Why not everyone engages in doing something they are good at doing and then exchange? This is why we go grocery instead of growing vegetables nor raising cows by ourselves today.

Globalization also means a product now can reach the world market beyond the limited domestic market. But a country can only successfully export when another country is willing to import. This is why we need to support trade liberalization so that every country can export more of those products they are competitive in making. And definitely more jobs will be created domestically. I mean every country that engages in such global “exchange”.

We no longer live in the 15th century when the Mercantilism was born. In the 21st century, export is good and import is equally good for the economy. Embrace globalization and enjoy better life~

Sheng Lu

Data source: American Apparel and Footwear Association (2012)

Data source: U.S.-China Business Council

OTEXA identifies top export markets for U.S. textile and apparel

The Office of Textiles and Apparel (OTEXA) recently released its 2012 Going Global Report, which identifies 15 top export markets for U.S. made textiles and apparel. The report also includes statistical profile of these 15 countries, including their GDP per capita, GDP growth and bilateral trade with the United States in recent years.

It is interesting to note that the top export markets for textile and for apparel are very different. Wonder why? Please think about the “stages of development theory” we discussed in class.

HS code refers to the “Harmonized tariff schedule” (HS), a classification system for commodities. Textile and apparel are covered by HS code chapter 50-63. Detailed list can be found at http://www.usitc.gov/tata/hts/bychapter/index.htm

The report can be downloaded from here

WTO Public Forum 2012: “Is Multilateralism in crisis?”

For your reference. Many issues are relevant to textile and apparel sectors (for example: global value chain, trade and job, trade facilitation, competition policy, intelletrual property right protection, green economy, pluralism/regionalism as well as trade and development).

This year’s WTO Public Forum will debate:

- formulating new approaches to multilateral trade opening in areas such as trade facilitation;

- addressing 21st-century issues and identifying areas in need of new regulations;

- looking at the role of non-state actors in strengthening the multilateral trading system

The session will cover the following sessions

- Global value chain: implications for trade policy

- Trade and job

- The multilateral trading system in the 21st century: interaction between trade and competition policy

- Plurilaterals and Bilaterals: Guardians or Gravediggers of the WTO?

This year’s Ideas Workshops will cover:

- How to ensure green economy policies are implemented in a co-ordinated manner rather than at cross-purposes?

- The future of the WTO dispute settlement system.

- Rethinking trade-related aspects of intellectual property in today’s global economy.

WTO’s first ever Youth Ambassadors, selected by separate video and essay contests, will discuss the topic “How can trade promote development?”

Technology is driving a revolution in manufacturing

A latest comment made by the Economist on Peter Marsh’s book The New Industrial Revolution.

As metioned in our class, globalization does not mean “made in China” or “off-shore production”, but rather a much freeer movement of goods, services, capital and labor around the world, thanks to the economic growth, lowered trade & investment barriers and advancement of technologies.

In today’s global economy, “any firm, anywhere, can hook up to a global supply chain. A product may be designed in one country and assembled in another, using components from dozens more. Even a small local manufacturer can use the best suppliers the world has to offer.”

This concept is associated with the “new international division of labor” concept, which we will discuss this coming Tuesday.