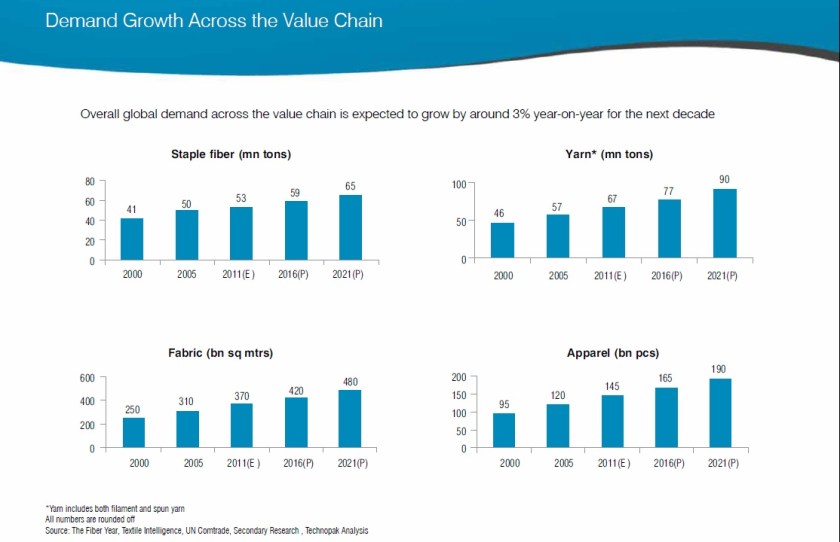

Data source: TechnoPak (2013)

Author: Sheng Lu

Professor @ University of Delaware

Trade with EU and Japan is good for the US and Trade with China is bad?

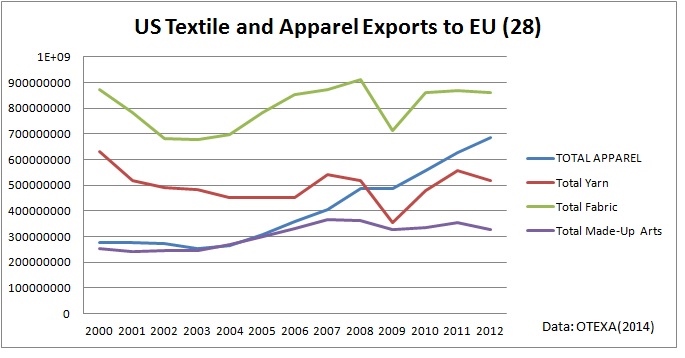

Yesterday in class, we’ve discussed how differently people see the impact of international trade. Here is one more example showing the controversy of the topic: according to a survey conducted by PewResearch in late 2010, 58% of sampled Americans said more trade with European nations would be good for the United States, 60% said increased trade with Japan would be good for the U.S. but only 45% favored increased trade with China. However, statistical data shows that US exports to China outpaced nearly all of the top ten export markets (including Japan and EU) from 2003 to 2012(source: USCBC).

Why would the general public favor a particular trading partner but disfavor another? Should they? By which standard the general public may assume more trade with a particular trading partner would be good or bad for the United States? In your view, is trade beneficial for the US overall? Can we use any trade theories learnt from the class to explain the above phenomenon? Look forward to hearing your thoughts!

Re-shoring, Jobs and Globalization–Perspectives from David Cameron

- How to make a success of globalization and ensure our businesses, our peoples and our societies can benefit from the next phases of globalization?

- What are the opportunities of re-shoring for the West and how to seize them?

- How to secure sustainable and well-paid jobs and give people pride in using their skills?

- Is re-shoring going to bring back all the jobs that were off-shored in the first place?

- What are the factors that are driving re-shoring?

- Does reshoring mean the West wins and the East loses?

- Is there a chance for Britain and US to become the “Re-shore Nations”?

If you care about the questions above, please enjoy the speech given by David Cameron, Prime Minister of the United Kingdom at the 2014 World Economic Forum in Davos. The speech is a great supplement to our discussions this week on globalization.

Apparel Issues to Watch in 2014

In the year ahead, the following issues are suggested to watch for the apparel industry according to the latest just style management briefing:

Responsible sourcing: a variety of different themes inclusive of sustainability, compliance, chemical safety and product safety. In the past, the apparel industry has been very reactive in these areas, and efforts have accelerated to move to a more proactive model in 2014.

Demand for greater supply chain visibility: a higher level focus and a lot more time will be required to look at the supply chains from end to end, especially for tier 2 and 3 component suppliers. Apparel industry needs to be focused on preparing to be more transparent on what goes into making its products and the carbon and water footprint it leaves behind. There will also be a stronger emphasis on quality, and more intelligence and agility in the supply chain, including how to achieve global flexibility in supply to maximize advantages and benefits offered by different regions.

Adjust to the industry “new normal”: speed, efficiency and cost management. ‘Quick response’ or ‘fast fashion’ is no longer a catch phrase, it’s a business reality. Speed is king. Retailers have learned to manage with smaller inventories and to quickly react to consumer needs. Additionally, there are no more low cost countries (with capability and capacity) to tap into, which requires more efficient cost control through supply chain design and management.

Internet and omni-channel retailing. The internet continues to upend the apparel industry. Brick and mortar companies are still struggling to figure out how to harness the power of the internet – and struggling to figure out how big of a threat pure-play internet companies are. Meanwhile, the proliferation of internet-only companies continues, increasing the competitive pressure on everyone (including the older internet-only companies!). All of this will end up resulting in a much stronger industry overall – but in the meantime there will be a lot of hand-wringing and heartache.

Economic outlook. Overall, 2014 will be a year better off than 2013. The US economy continues to improve, the Eurozone recession has stabilised and there is the huge opportunity Asia offers.

Country risk. Whatever happens in the real economy, political tensions throughout developing countries (except possibly China and Vietnam) are growing. They are about more than working conditions in garment factories – and we cannot expect the garment industry to remain immune from them.

International market expansion. Global vertical retailers and brands need to balance the efficiency of global assortments with being able to cater to a broad range of consumer purchasing preferences across cultural groups. Winners manage to preserve their brand identity while offering attractive choices to this diverse customer group.

Trade policy and trade politics. 2014 is an election year for US Congress. It will only be tougher to find bipartisan consensus. Things to watch include whether the Obama Administration is going to finalize the Trans-Pacific Partnership (TPP) during 2014, whether the Trade Promotion Authority (TPA) can get passed as well as the renewal of the Generalized system of Preferences (GSP) and African Growth and Opportunity Act (AGOA).

China’s role in the global apparel supply chain. China’s productivity miracle has been the single major influence on global sourcing over the past five years. While this cannot go on forever it is hard to see a significant change in its share in 2014. China’s dominance of upstream textile production (spinning, weaving and knitting) is under greater threat. Its main operators are making substantial overseas investment, and while the timing of major upstream projects means this will have little impact on fabric and yarn manufacture in 2014, the subject will preoccupy observers. Onshore garment development in Japan, Germany, the UK and US will continue to create much publicity, but limited amounts of garments. Nearshoring continued to lose market share in the EU and US during 2013, though many buyers express growing interest, and there are signs of growth in some categories. It will be surprising if it shows any significant increase in 2014.

The international aspect of the US economic policy: why and how we are all connected?

From 0:24′: Please enjoy an enlightening and inspiring dialogue with Penny Pritzker, US Secretary of Commerce and Michael Froman, US Trade Representative, on the international aspect of the US economic policy at the 2014 World Economic Forum in Davos. The dialogue covers many interesting topics closely connected with our class lectures this & next week, for example:

- Do we need more globalization? What is the impact of globalization on jobs and income inequality?

- Why export matters to the US economy?

- What will free trade agreements such as the Trans-Pacific Partnership (TPP) bring to the US?

- Why foreign investment in the US is good for the US economy and job creation?

- What is the connection between “global supply chain” and “made in USA”?

The Apparel Industry on Both Sides of the Atlantic Push for Regulatory Coherence in the TTIP negotiation

The European Apparel and Textile Confederation (EURATEX) and the American Apparel and Footwear Association (AAFA), the two leading trade associations representing the apparel industry in the EU and US respectively, released their joint comment on the Trans-Atlantic Trade and Investment Partnership (TTIP) on December 13, pushing negotiators of the agreement to address the regulatory challenges that affect the apparel business across the Atlantic. Specifically, the diverse labeling and product safety requirements between EU and US are identified as the two leading regulatory hurdles for the apparel business. Other issues of concern to the EURATEX and AAFA include conflict minerals reporting requirements, customs procedures and chemical management regimes.

TTIP, launched in June 2013, is one of the most important and economically influential free trade agreements currently under negotiation. If implemented, the agreement is expected to create additional $65 billion and $86 billion GDP to the US and the EU respectively.

It is argued that because the implementing tariff rate in the EU and US on average is already quite low, harmonizing regulatory differences rather than eliminating tariffs will be the key to the TTIP negotiation.* However, the very different and rigid legislative procedures in the EU and US may complicate the negotiation on regulatory coherence. Particularly, both the EU and US may want to convince the other side that their current regulations/standards are the better ones. And the political implication will be bad if trade negotiators of either side leave the impression domestically that the TTIP would lower down their current standards for sensitive topics such as “product safety” and “environmental protection” .

Note*: as one of the few exceptions, the tariff rates for T&A are still relatively high: 6.6% for textiles and 11.5% for apparel in the EU as well as 7.9% for textiles and 11.6% for apparel in the US according to the World Trade Organization.

by Sheng Lu

International Trade and Global Supply Chain

Questions to think about:

Why supply chain matters in the 21st century global economy?

What benefits a global supply chain can bring to us?

What unique risks are involved in a global supply chain?

What role the government and policies can play in facilitating the global supply chain?

Are you prepared to embrace the concept of “made in the world”?

Despite growth of production, no sign of jobs recovery in the US textile and apparel manufacturing sector

According to the latest World Manufacturing Production Quarterly Report released by the United Nations Industrial Development Organization (UNIDO), for the first time over the past few years, production of wearing apparel enjoyed a positive growth of 3.9% in the third quarter of 2013 compared to the same period of 2012 in the United States. This statistics seem to support the argument that “made in USA” is making a coming back when “made in Asia” is losing cost advantages. A Just-style report quotes that “A growing number of US apparel manufacturers, government officials and industry leaders have been working on initiatives to increase domestic production. As an example, Wal-Mart has recently made a commitment to buy an additional $50 billion in U.S.-made products over the next ten years.”

However, statistics from the US Bureau of Labor Statistics show that the employment level in the US textile and apparel manufacturing sector continues declining in 2013 despite the positive growth of industry output. Specifically, total employment in the US textile mills (NAICS 313), US textile product mills (NAICS 314) and US apparel manufacturing (NAICS 315) sectors were 2.7%, 3.1% and 5.4% less in November 2013 respectively compared to the average level in 2012 after seasonal adjustment.

The mixed pattern imply the changing nature of textile and apparel manufacturing in the United States. Particularly, it is important to realize that the industry is NOT going back to the old days, but rather the resurgence of “made in USA” may be the result of a new round of capitalization in the industry, which is manifested by a growing number of modern-looking plants with “floors empty of people”.

by Sheng Lu

Exclusive Interview with Julia K. Hughes, President of the United States Fashion Industry Association

(Photo above: Julia Hughes presented at the 25th Annual Textile and Apparel Importer Conference. Courtesy of the United States Fashion Industry Association)

Julia K. Hughes is the President of the United States Fashion Industry Association (USFIA). USFIA represents all segments of the fashion industry, from apparel brands to retailers to service companies. Ms. Hughes represents the interests of textile and apparel importers on trade policy issues to government officials, both in the United States and overseas. She has testified before Congress and the Executive Branch on textile trade issues. Ms. Hughes is also recognized as an expert in textile and apparel issues and is a frequent speaker at international conferences including the Apparel Sourcing Show, MAGIC, Foreign Service Institute, National Association of Manufacturers, Cotton Sourcing Summit, USIA’s Worldnet, the International Textiles and Clothing Bureau, Young Presidents’ Organization, World Trade Organization Beijing International Forum and others.

Julia Hughes is also well known to students enrolled in TMD433. She is featured in the book Travels of a T-shirt in the Global Economy, which highlights the global nature of the textile and apparel industry in the 21st century and those complicated economic, social and political factors associated with this important sector.

Interview Part

Sheng Lu: Would you please briefly introduce the current status of the U.S. fashion industry which your organization represents? For example, how large is the industry, how important is it to the US and the global economy, and what types of companies are involved as well as their business functions?

Julia Hughes: The phrase “the fashion industry” may call to mind images of Fashion Week and photo shoots. In this era of global trade, however, the high-fashion runways are just one part of the broader textile and apparel industry that ranges from high-end luxury brands to fast-fashion retailers—and the thousands of companies in between that produce and sell clothing, shoes, and other textile products.

United States Fashion Industry Association members and affiliates include companies across the value chain, which support our mission to remove barriers to textile and apparel trade. These companies include:

- Brands, retailers, importers, and wholesalers of textiles and apparel.

- Service providers, including consultants, customs brokers, freight forwarders, law firms, logistics providers, steamship lines, and testing and certification companies that help those brands, retailers, importers, and wholesalers.

- Manufacturers and suppliers of finished products and inputs for finished products, as well as supplier associations, business councils, and promotional groups.

- Agencies that promote the industry from a specific region, country, city, or other geographic entity.

- Academic institutions.

This industry includes companies and professionals across the value chain, working in roles ranging from design and development, to sourcing and logistics, to trade policy and compliance, to retail and marketing. USFIA members include all of these types of companies and individuals…

Sheng Lu: The United States Association of Importers of Textiles & Apparel (USA-ITA) has been a big name in the industry for 25 years. What leads your organization to change the name and rebrand yourself? Particularly, how will the USFIA distinguish itself with the American Apparel and Footwear Association (AAFA), whose members also include many US-based apparel companies and retailers?

Julia Hughes: The United States Association of Importers of Textiles & Apparel (USA-ITA), founded in January 1989 by nine U.S. importers, was instrumental in eliminating the global apparel quota system. At that time, it seemed like an almost insurmountable task to change the political dynamic enough so that the special protection for textiles and apparel would finally end.

On January 1, 2005, the quotas were officially eliminated, and since then, the industry has increasingly globalized. As a result, new challenges arise every day for apparel brands, retailers, and importers, ranging from challenges with compliance at the factories to challenges with transportation at the ports of entry. Over the years, the association has evolved with our members to address these new challenges—but our brand, including our name, logo, and official mission statement, had not changed in over two decades.

Accordingly, our major project in 2013 was rebranding the association to more clearly communicate our purpose and our direction for the future. It’s important to note that this project was not about changing our purpose or direction, but about ensuring that our brand accurately reflects the reality of the industry and the work we had already been doing for our members. The new brand—the United States Fashion Industry Association—was developed over 10 months with input from members and our trusted network across the value chain who participated in comprehensive overviews.

Why did we choose this name? First, our members are no longer just “importers.” While importing will be a critical aspect of our members’ sourcing plans for the foreseeable future, many of our members are truly global brands—for instance, designing product in the United States, producing that product in Asia, and then selling that product in Europe or Australia. Additionally, many of our members are also making product in the United States from U.S. and/or imported inputs. As we told WWD, “We are very supportive of Made in USA, and we sponsored some of the very first programs about Made in USA at MAGIC. It is a very important element, but it is one part of sourcing decision making.” Considering these realities, the phrase “Importers of Textiles and Apparel” no longer accurately described the industry or our members, so we needed to update it. (It was also a mouthful!) We settled on this exact name because “the fashion industry” is the phrase that companies, government, and the media uses most commonly to describe the wide variety of companies and professionals across the value chain—it best describes our association in 2013 and moving forward.

We spoke to our members and some trusted partners in our network about who we are and what sets us apart. From those conversations, we developed five values that we keep in mind with every decision we make. They are:

1. Integrity: Our members tell us that we listen to them, support them, and defend them—while our government partners tell us that we work with them to find creative solutions.

2. Substance: We maintain and articulate a deep understanding of the industry and challenges most important to our members—the sourcing and compliance executives who make tough decisions every day on how to address these challenges.

3. Focus: We keep a laser focus on our mission, which allows us to be agile and quickly seize upon opportunities to move the needle.

4. Collaboration: Our members collaborate to share best practices and amplify the industry’s voice on the critical issues, putting aside marketplace competition to work together toward common goals.

5. Foresight: We keep our members informed not only about the regulatory challenges today, but also the regulatory challenges of tomorrow—and as our industry globalizes, we likewise expand our reach.

Sheng Lu: As mentioned in your mission statement, the USFIA is dedicated to the removal of barriers that impede the free movement of textile and apparel products to the United States and international markets. What are the top trade policy and market access concerns for the USFIA right now?

Julia Hughes: For 25 years, the United States Fashion Industry Association (USFIA)–formerly the United States Association of Importers of Textiles & Apparel (USA-ITA)–worked to eliminate barriers that impede the free movement of textile and apparel products to the United States and international markets. We participate in advocacy activities on a number of issues related to our mission in order to eliminate the tariff and non-tariff barriers that impede the industry’s ability to trade freely and create economic opportunities in the United States and abroad. Our top issues include:

- Negotiation of a successful Trans-Pacific Partnership (TPP) agreement

- Negotiation of a successful Transatlantic Trade & Investment Partnership (TTIP) agreement

- Expansion of the “trusted trader” programs with U .S. Customs & Border Protection

- Extension and expansion of the African Growth & Opportunity Act (AGOA)

- Ethical sourcing and the industry’s commitment to address the challenges in Bangladesh

- Working with the International Labour Organization (ILO) and NGOs to help eliminate forced and child labor in the cotton industry in Uzbekistan

Sheng Lu: You are featured in the well-known book Travels of T-shirt in the Global Economy. Interestingly enough, your counterpart in the book—Mr. Auggie Tantillo, now taps to lead the National Council of Textile Organizations (NCTO) which represents the US textile industry. In the T-shirt book, you two held very different views on whether the U.S. should restrict apparel imports from China. Now almost 8 years later, do you (and the USFIA) still debate often with Auggie (and the NCTO) on textile and apparel trade policy issues? If so, what are you mainly debating about?

Julia Hughes: Today, Auggie and I still disagree on some of the basic trade policy issues–especially the negotiations for new free trade agreements. NCTO is trying to hold onto the same textile rules of origin that were negotiated in the 1990s, the yarn-forward rule of origin. USFIA and our members continue to encourage the U.S. textile industry to take a fresh look at the global industry. But, so far, we remain far apart.

Nonetheless, we also have some areas where we can work together. Both our organizations support efforts to promote Made in the USA activities, as well as manufacturing in the Western Hemisphere. And, just this week I asked Auggie to help us with information about U.S.-based fabric mills. We also have collaborated on some proposals with Customs and Border Protection that build on the “trusted trader” concept and would focus enforcement measures on the companies who are not already proven to be compliant. And if I had to make a prediction, I would predict that in the next few years, we will find other areas where we can worth together productively.

Sheng Lu: Most of our students in the Textiles, Fashion Merchandising and Design (TMD) department will become professionals working for the US fashion industry after graduation. Does the USFIA have any resources available to our college students or have any future plans to expand the collaboration with the textile and apparel educational programs/academic institutions?

Julia Hughes: Yes! We welcome participation from universities, educators, and students in the fashion industry.

First, our website is a wonderful resource for information about the industry and our key issues. In addition to our issue pages, you’ll also find resources including recaps of past seminars, recordings of past webinars, our member publications, and more. (Some of this information is locked to USFIA members, but in the spirit of helping to grow our industry and future members, we’re always happy to help you access specific information you need! Just ask us!) We continue to build on the website, and in 2014, we will be launching a Value Chain Directory, which will provide comprehensive information on service providers and sourcing opportunities around the world.

Additionally, we host a number of events throughout the year, including our annual conference. We’re happy to work with educators and students to make attendance affordable, and we even have opportunities for universities to exhibit and students to volunteer.

We also encourage current and former students to visit our Career Center, which contains job opportunities at USFIA member companies. Even if you’re not looking for a job at the moment, it may be helpful to see what types of candidates these companies are seeking.

We’re always happy to work with universities, educators, and students to ensure that we educate the next generation of fashion industry leaders and professionals—future USFIA members!

China as an Apparel Importer: A Big Picture View

China is well-known as the single largest apparel exporter in the world. However, with the critical changes of the world economy as well as the evolution of the global textile & apparel sector over the past decade, it is the time to seriously study China as a fast-growing apparel import market.

First and foremost, it is a wrong perception that Chinese consumers only consume clothing “made in China”. On the contrary, as put it by a 2011 ITC consulting report on the Chinese market for Clothing: “in Zara’s stores in Shanghai, over 90% of stock-keeping units (SKUs) are imported, with Bangladesh, Egypt, Morocco, Portugal, Spain, Turkey, and Viet Nam and being the main import sources. Bangladesh, Cambodia, India and Indonesia are also important procurement target countries. Shoes made in Viet Nam and Spain account for a high proportion in Zara. New H&M stores in Shanghai attracted thousands of consumers when they opened in April 2007 Of H&M’s SKUs, 75% are imported, with Bangladesh, Cambodia, India, Indonesia and Turkey being the main source countries.”

However, like any other countries in the world, the apparel import market in China also has its unique features & patterns. For example, woven men’s wear accounted for almost 1/3 of China’s total apparel imports. Actually, the aggregate import demand for men’s wear was 17%-20% larger than the import demand for women’s wear in China from 2008 to 2012. As another important feature: in 2012, 83% and 13% of China’s apparel imports came from Asia and Europe respectively, leaving only 4% market share for the rest of the world. This pattern implies that China’s apparel import demand could be rather polarized: either extremely price competitive products (even cheaper than “made in China”) or very high-end luxury goods (such as those made in Germany, Italy, UK and France).

Additionally, it should be highly noted that “China is not a single unified market but a collection of local markets, each with different market demands, consumer behaviors, competition levels, and market access conditions.” (More reading: Understand China’s retail market) This feature is particularly important for those Western-based apparel retailers interested in entering China’s retail market. In general, Eastern coastline cities are the wealthiest part of China, where a high concentration of apparel stores can be found. Many famous international brands set up mainly in first-tier cities and then establish their presence in affluent second-tier cities. Currently, the tendency is for famous brands to penetrate into more second-tier cities. Among the first-tier cities, Shanghai plays a significant role in setting fashion trends on the mainland. Therefore, many foreign and domestic apparel suppliers choose to first establish a foothold in Shanghai before seeking further expansion.

When Apparel “Made in China” Become More Expensive, Will U.S. Consumers Have to Pay More?

(This study was presented at the 2013 International Textile and Apparel Association Annual Conference)

By

Sheng Lu (University of Rhode Island) and Jessica Ridgeway (University of Missouri)

China’s soaring labor cost in recent years has triggered heated discussions on the future of “made in China” and its implication for U.S. consumers who rely heavily on “made in China” products (Rein, 2012). This is particularly the case in the U.S. apparel retail market, where over 98% of consumptions are supplied by imports and nearly 40% of them come from China in value (AAFA, 2012). Although numerous studies have been conducted to evaluate the relationship between imports and the U.S. domestic apparel production or employment (Martin, 2007), the direct linkage between the price of imports and the U.S. apparel retail price has seldom been explored. Because such a price linkage is the key to understand the implication of a more expensive “Made in China” for U.S. consumers, this study tries to fulfill the research gap and specifically investigate to which extent the U.S. apparel retail price is influenced by the price of U.S. apparel imports from China.

Through investigating the impact of the average unit price of U.S. apparel imports from China, the average unit price of U.S. apparel imports from sources other than China and the annual U.S. apparel retail sales on the annual U.S. consumer price index from 2001 to 2011 based on a revised Armington model, this study finds that:

First, for menswear, more expensive “made in China” will result in a higher retail price in the U.S. market. Specifically, the U.S. retail price is suggested to change by 0.137% in the same direction given a 1% change of the price of U.S. imports from China. Second, for womenswear, there is no evidence showing that the price of U.S. imports from China has statistically significant impact on the U.S. retail price Third, the U.S. apparel imports from China and from rest of the world are suggested to constitute higher degree of price elasticity of substitution for womenswear than for menswear.

Findings of this study contribute to the understanding of the direct price linkage between the U.S. apparel import market and the U.S. apparel retail market and have several important implications:

First, the results imply that when “made in China” becomes more expensive, U.S. consumers may not have to pay more, largely because of increased substitution supply from other apparel exporters. Second, the results suggest that the U.S. apparel market is highly competitive and suppliers may not own much market power in price determination despite their large market shares.Third, the results imply that although “made in China” may lose market share in the U.S. market when it becomes more expensive, the magnitude could vary by product categories.

References:

- American Apparel and Footwear Association, AAFA (2012).Apparelstats 2012. Retrieved from https://www.wewear.org/industry-resources/publications-and-statistics/

- Armington, P.S. (1969). A theory of demand for products distinguished by place of production. International Monetary Fund Staff Papers,16(1), 159-178.

- Martin, M. (2007). U.S. clothing and textile trade with China and the world: Trends since the end of quotas. Congressional Research Services, RL 34106, Washington, D.C..

- Office of Textiles and Apparel, OTEXA (2013). U.S. imports and exports of textiles and apparel. Retrieved from http://www.otexa.ita.doc.gov/msrpoint.htm

- Rodrigo, P. (2012). Re-shoring US apparel making tough but not impossible. Just Style. Retrieve from http://www.just-style.com/analysis/re-shoring-us-apparel-making-tough-but-not-impossible_id115455.aspx

- Rein, S. (2012). The end of cheap China: Economic and cultural trends that will disrupt the world: Wiley.

- U.S. Bureau of Labor Statistics, BLS. (2013). Consumer Price Index. Retrieved from http://www.bls.gov/cpi/

- U.S. Census Bureau, Census. (2013). Monthly and annual retail trade. Retrieved from http://www.census.gov/retail/

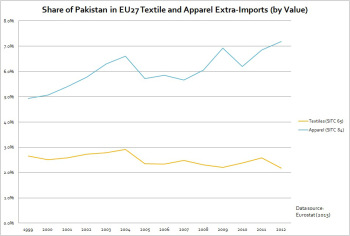

EURATEX Raises Concerns about Pakistan’s Membership in the EU GSP+ Program

In a statement released on November 4, 2013, the European Apparel and Textile Confederation (EURATEX) openly expressed their opposition to the proposed “unique delegated act” for the EU Generalized Scheme of Preferences plus (GSP+) program. Specifically, the EURATEX strongly questioned Pakistan’s qualification as a beneficiary of the GSP+ , saying that “Pakistan has a poor record in matters related to Human rights and in particular to the protection of religious minorities, women and children .”

As put by Mr. Alberto Paccanelli, president of the EURATEX: “During the recent GSP revision it was repeatedly stated by the EU Commission that one of the main objectives of the new regime was to ensure that preferences were given to the countries that need them and in the case of GSP+ to countries that are promoting high Human, Social and Environmental standards.”

The GSP system is an EU trade policy tool specifically designed to help developing countries expand exports to the European Union markets. Beneficiaries of the GSP program can enjoy special favorable market access conditions such as tariff reduction and quota elimination. For example, the EU charges an average 6.2% and 11.2% tariff rate for textile and apparel imports respectively from most sources, but the rates are lowered to 5.0% and 9% respectively for imports from GSP beneficiaries.

As part of the GSP system, the GSP+ program provides additional market access preferences to those economically and socially vulnerable countries under the condition that these countries will “implement core human rights, labor rights and other sustainable development conventions.” For example, textile and apparel imports from beneficiaries of the GSP+ program will be waived for import tariffs in the EU market. This will substantially improve the price competitiveness of products from the GSP+ beneficiary countries when competing with Asian suppliers such as China and India.

Despite the emphasis on Pakistan’s human right practices, the real factor driving EURATEX’s opposition to Pakistan’s membership in the GSP+ program could be market competition. Pakistan is one of the most competitive textile and apparel exporters among the GSP beneficiaries. Data show that Pakistan’s textile and apparel exports to the EU market enjoyed robust growth over the past decade, causing the EU domestic textile & apparel manufacturers to become nervous about import competition. The EURATEX, which represents the commercial interests of the EU local textile & apparel industry, has consistently opposed EU’s duty free access to Pakistan’s textile and apparel products.

Moreover, under the EU GSP system, there is a mechanism called “graduation of competitive sector”, under which imports of particular groups of products originating in a given GSP beneficiary country will lose GSP preferences once the average imports of this particular sector exceed 15% of GSP imports of the same products from all GSP beneficiary countries (12.5% for textile and clothing). However, the “graduation of competitive sector” mechanism will not be applied to GSP+ members. This means that if Pakistan becomes a GSP+ member, the EU domestic textile and apparel manufacturers may have to face increasing import competition from Pakistan but can do little about it.

The most critical yet controversial part of the debate is, to which extent, the GSP system can be built into an effective and balanced development tool. According to a 2012 World Bank study, “the textile and apparel sector is THE most important manufacturing sector of Pakistan, which generated one-fourth of the country’s industrial value-added, recruited more than 40% of industrial labor force, contributed 8% of the country’s overall GDP and accounted for about 60% of Pakistan’s total merchandise exports.” That being said, allowing Pakistan to export more textiles and apparel to the EU market is one of the very few ways to make the GSP system work and bring actual benefits to the country. Yet, the EU domestic textile and apparel industry can also cite statistics, arguing the necessity of protecting the domestic textile mills and saving the jobs there by resisting as many textile and apparel imports as possible.

On the other hand, the GSP system needs to take into consideration the benefits of all beneficiaries, especially to avoid creating “losers” and “winners” within the group. This is the philosophy behind the introduction of the “graduation of competitive sector” mechanism so that the interests of those “small countries” can be particularly taken care of. For example, when Pakistan is gaining additional market shares in the EU textile and apparel import market because of the GSP+ status, other less competitive developing countries may see decline of their exports. The textile and apparel industry is as important to these “losers” as it is to Pakistan.

Overall, the GSP debate reflects the significance and the complexity of the textile and apparel sector in the 21st century global economy. Particularly, trade policy will continue playing a key role in improving the situation, yet it calls for courage and wisdom of policymakers.

by Sheng Lu

Why the General Public Needs to Care About Textiles and Apparel

International Trade Administration Reorganized

From Just Style:

As part of its first major reorganization in more than 30 years, the US Department of Commerce’s International Trade Administration (ITA) has consolidated its four business divisions into three units.

The new units are Global Markets, Industry and Analysis, and Enforcement and Compliance.

Global Markets combines ITA’s country and regional experts, overseas and domestic field staff, and specific trade promotion programmes.

The Industry and Analysis (I&A) unit brings together ITA’s industry, trade, and economic experts to help US industries develop and execute international trade and investment policies to increase exports.

And the Enforcement and Compliance unit helps enforce US trade laws and ensure compliance with trade agreements.

The Office of Textiles & Apparel (OTEXA), which oversees apparel and textile trade, supervises the implementation of all textile trade agreements, formulates trade policy, performs research and analysis, compiles industry data, and promotes US trade events, is now part of the new Industry & Analysis division. Key staffs at the OTEXA and their responsibilities can be found HERE.

“Just as companies must change and adapt to ensure they provide cost-effective, high-quality products and services that meet the demands of their clients, so too must government agencies adapt to continuously improve their performance and make the best use of scarce public funds,” explained Francisco Sánchez, undersecretary for international trade.”

The TPP would actually benefit whom?: The local Vietnamese companies or rather the global capitals which invest in Vietnam ?

Outcomes of many studies suggest that Vietnam would become one of the largest beneficiaries of the Trans-Pacific Partnership (TPP) by substantially expanding its apparel exports to the United States. However, the news report below raises another interesting question to consider: who actually would benefit from the TPP: The local Vietnamese companies or rather the global capitals which invest in Vietnam because of the agreement? This question is important because the answer reflects many debates nowadays about the impact of globalization; particularly, the impact is suggested to be unequally felt by different stakeholders.

From thanhniennews

The US-led TPP trade pact that will include Vietnam among its signatories is expected to be wrapped up this year, but Vietnamese firms are unsure if they will benefit.

Many are anxious since foreign investors with deep pockets are planning to set up operations in the country to take advantage of the lowering of import taxes by many large economies that will sign up for the trade deal.

For instance, import tariffs in the US, the biggest customer for Vietnam’s leading export, textiles, will be cut from 17-32 percent now to zero.

Many textile and garment companies in the region have already begun to move to Vietnam.

Texhong Corporation of Hong Kong, which set up a dyeing factory in the southern province of Dong Nai in 2006, recently opened another one in the northern province of Quang Ninh with an investment of US$300 million.

One of Hong Kong’s leading textile companies, TAL Apparel, has plans to set up a second textile-dyeing -apparel factory worth hundreds of millions of dollars. It has eight factories worldwide, including one in Vietnam’s northern province of Thai Binh since 2004.

Unisoll Vina, owned by South Korean Hansoll Textile Ltd, has also got a license to build a $50-million factory to make fur and leather clothing and accessories.

According to the Ho Chi Minh City Association of Garment, Textile, Embroidery and Knitting, Japanese companies Toray International and Mitsui, Austria’s Lenzing, and China’s Sunrise are also exploring investment opportunities in the country.

Vietnamese companies are meanwhile trying to enlarge their limited feedstock production capacity to comply with TPP’s regulations on origins – for instance apparel has to be made using yarn and other materials produced in member countries.

The Vietnam National Textile and Garment Group (Vinatex) has opened three yarn factories this year in Hanoi and the central provinces of Ha Tinh and Thua Thien-Hue with an annual capacity of 1,270 tons.

It started work on 11 others in the first half of the year.

Figures from the Vietnam Textile and Apparel Association (Vitas) showed that 70 percent of more than 3,700 textile factories in the country make apparel; only 6 percent produce yarn and 17 percent make cloth while 4 percent dye.

Local producers depend largely on fabric imported from China.

Insiders said a yarn factory costs tens of millions of dollars, a sum most Vietnamese businesses cannot afford.

Pham Xuan Hong, deputy chairman of Vitas, said unless the government helps by making cheap loans available for yarn projects, the industry would not benefit from the TPP at all.

The government also needs to zone certain areas for dyeing plants since they are shunned everywhere due to pollution concerns, Hong said.

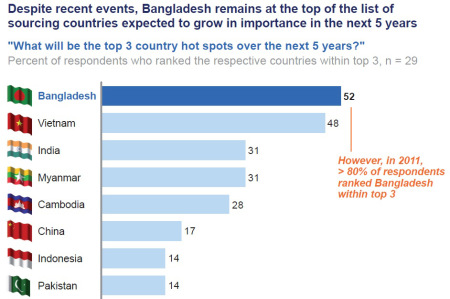

The 2013 global apparel sourcing map – balancing cost, compliance, and capacity

Mackenzie & Co., a well-known consulting firm, recently released their latest report on the global apparel sourcing map. The report is drafted based on a 2013 summer survey with 29 chief purchasing officers (CPOs) in Europe and the U.S. who were responsible for an annual total sourcing value of $39 billion USD. According to the report:

First, the global apparel sourcing cost is expected to rise modestly in the next 12 months (1.7% increase on average). Labor cost is tagged as the No.1 driving force of the rising sourcing cost.

Second, companies are sourcing less apparel from China, but they move in a very cautious way. In the meanwhile, Asia is still seen as the world hub for apparel manufacturing & exports in the years to come. Such a pattern reflects the exact criteria for sourcing decisions: a balance of price, quality, capacity, speed and risk. Particularly, “proximity sourcing” is becoming increasingly important according to the surveyed CPOs. This rule shall also apply to China which has emerged as one of the world’s fastest growing apparel retail markets.

Third, despite the frequent reported corporate social responsibility problems, a combined consideration of labor cost advantage, free trade agreement benefits and capacity make Bangladesh remain the No. 1 hot pot for apparel sourcing for the next 5 years. 83% of surveyed CPOs plans an increase of apparel sourcing from Bangladesh in the years ahead.

Overall, sourcing will continue to be one of the most critical success factors for the global apparel industry. The survey results reflect a more structural shift in the industry, while the traditional apparel company “caravan journey” becomes more complex.

EU Textile and Apparel Industry Sees Positive Impact of the TTIP

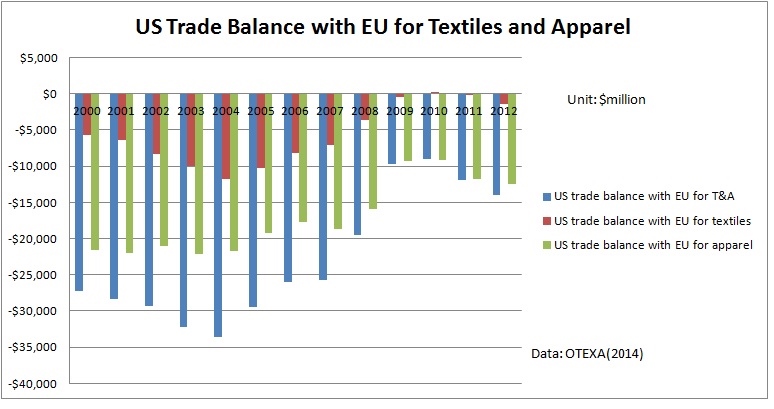

The European Apparel and Textile Federation (EURATEX) on September 26, 2013 hosted a luncheon event on the current US-EU negotiation on the Trans-Atlantic Trade and Investment Partnership (TTIP), particularly the impact of the agreement on the EU textile and apparel sector. According to Mr. Alberto Paccanelli, president of the EURATEX, the United States currently is the EU 2nd largest export market for T&A (over $4.5 billion Euros) and the largest when counting textiles alone. Alberto said that the US market is highly price sensitive and this is one of the reasons why tariffs remain an effective barrier to EU exports. For example, the US still charges a tariff rate as high as 28.2% for imported man-made fiber overcoat and 32% tariff rate for man-made fiber T-shirt. Alberto further added that:

“The EU-US negotiations are the key priority for the EU Textile and Clothing Industry. EURATEX has made a rough assessment on the benefits of the Agreement: it is estimated that exports would register possible annual increases between 2.5% and 3.5% on top of the normal growth rate in Exports due to the Agreement. The EU should strive for duty free access from day one without exceptions and in what concerns Non-Tariff Barriers we should aim at harmonization and mutual recognition. It is also critical to improve access to the Public Procurement Markets and ensure a high level of intellectual property right (IPR) protection and enforcement. The TTIP Agreement should improve business conditions for small and medium-sized enterprises (SMEs), simplifying customs procedures and the costs associated. For the EU Textile and Clothing Industry Rules of Origin are also critical and double transformation should be ensured.”

Expanding Global Trade through Innovation and the Digital Economy

This is the introductory video of this year’s World Trade Organization (WTO) Public Forum hosted from Oct 1 to Oct 3. The WTO Public Forum is an annual event that provides a platform for public debate across a wide range of WTO issues and trade topics. The Public Forum is also an opportunity for us in the WTO to listen and exchange views with non-government organizations (NGOs), academia, the private sector, with those of you who are increasingly participating in shaping the world’s economic and political environment. This year’s Public Forum looks at the future of trade in an era of innovation and digitalization.

As put it by Michael Froman, the U.S. Trade Representative :” The global marketplace has experienced a sea change. Combining globalization with new technology and with new business models has dramatically accelerated the pace of change and innovation. The flow of data is as important as the movement of goods. Services are an increasing share of value-added manufacturing. And the market is determining standards at an increasingly rapid pace.”

U.S. Textile Plants Return, With Floors Largely Empty of People

This is a strongly recommended New York Times article which focuses on the current status of the U.S. textile industry.The article reflects many things we’ve discussed in the class.

First, we still live in a world of “specialization”, in which each country produces something but not everything based on their respective comparative advantage. It is important to realize that the reason why textile manufacturing is coming back to the United States is because the manufacturing process has become more “capital and technology intensive” in nature. Therefore, it makes senses for the United States as a capital and technology abundant country to focus on producing “capital and technology” intensive products. At the same time, with the fast rising labor cost in recent years, some developing countries are gradually losing “comparative advantage” in making labor intensive apparel products. This factor further affects T&A companies’ decision making on where to produce.

Second, textile and apparel industry is NOT disappearing in the U.S., but it evolves constantly in response to globalization and technology advancement. “Made in America” is starting to mean something again, but not the same as what it used to mean. As the business function of the textile and apparel industry in the US becomes more capital, knowledge and technology intensive, it provides even more promising career options and opportunities for our TMD/TM graduates than in the past. That’s also why in the classroom, we emphasize creativity, critical thinking, analysis skills, playing with technology, leadership skills and having a big landscape of the industry in mind.

Third, as we discussed in the class, the “made in ___” label can no longer reflect the whole supply chain of finished textile/apparel products in the 21st century. Instead, we live in a “made in the world” era in which different countries share responsibilities in T&A product development, manufacturing and distribution. Neither is it the case that the U.S. textile and apparel industry is all about “manufacturing” today. Those non-manufacturing functions such as retailing, merchandising, branding and marketing actually contribute much higher added values and result in a U-shape global apparel value chain called “smiling curve”.

Travels of a T-shirt with Pietra Rivoli (2013)

3D Printing as a Game Changer for the Global Textile and Apparel Industry

3D printing is an emerging and transformative technology that adopts a fundamentally new approach of “additive manufacturing” to make things. Textile and apparel (T&A) is one major area in which the 3D printing technology is believed can have a wide application. Companies such as N12 and a few designer-researchers have started the pioneering work of using printer to directly print wearable apparel for consumers.

Moving from “Made in China” to “Design in China”

If you still treat China simply as a low-cost apparel manufacturing workshop or linger on those scenes in the documentary China Blue (produced in 2005), the following story may be a “shock” to you.

During my visit this summer to the Shanghai Silk Group, I was very impressed by how quickly this decades-old company has fundamentally changed its business model, moving away from manufacturing in the past to ambitiously engage in apparel design and branding functions as of today. This is what a 21st century China apparel company actually looks like:

Above: The Shanghai Silk Group displayed its indigenous brand “Lily” .

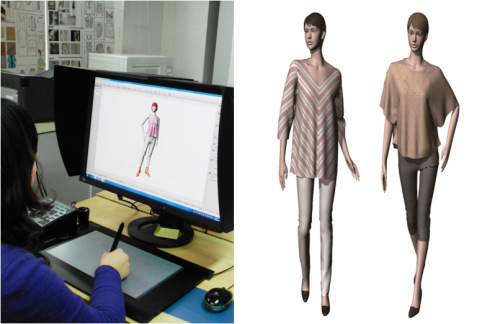

Above: A designer is working on a 3D model @ the Shanghai Silk Group. Each year, the design department of the company will launch around 2,000 new product lines with indigenous intellectual property right.

Above: Product booklet of the Shanghai Silk Group. 2 issues/ year.

Above: To strengthen the design capability, the company purchased the digital printer which can directly print patterns on silk fabrics.

Above: Digital printing silk products of the Shanghai Silk Group

Above: The pattern making and draping team is equipped with the latest Lectra system

Above: To improve efficiency and productivity, the company also uses automatic fabric cutting machine (made in Japan)

Above: Computer-controlled knitting and weaving machines (making samples)

Besides the modern equipments & technologies, the emergence of the “design in China” phenomenon is also underpinned by the increasing supply of skilled talents in the country. Fashion design education is booming rapidly in China in recent years and improving in quality as well. Just in Shanghai alone, a dozen colleges are offering fashion design programs nowadays. For example, the Donghua University (the former China Textile University, where I graduated from) enrolls a total 255 fashion design major freshmen in fall 2013. The enrollment size could be doubled if also counting students enrolled in a dozen other international fashion programs jointly offered by the Donghua University and its partner schools from Japan, UK, France and the United States.

In terms of the curriculum, fashion programs in China typically provide students with more focused training on design and product development compared with the textile & apparel programs in the U.S.. (however, less merchandising and marketing related courses are offered due to the lack of experienced faculty). Thanks to the sponsorship of the local apparel industry and the growing investments made by the university, students are able to learn WITH the industry-standard technologies, ranging from the CAD system, product lifecycle management software, automatic fabric cutting system to 3D body scanner. Provided with the 21st century perspectives and skills, these future Chinese fashion designers will be globally competitive. (you may click here for pictures of students’ design work displayed at the 2013 Fashion Week hosted by the Donghua University)

Above: Chinese students are taking the draping class.

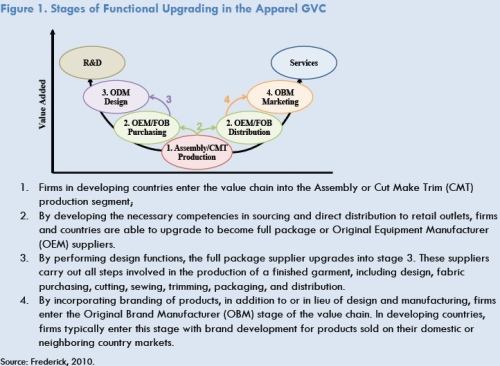

However, the changing face of China’s apparel industry is neither a surprise nor an exception. As suggested by Dr. Gary Gereffi at the Duke University, one of the world’s most distinguished scholars studying the governance of global apparel value chain (GVC), the apparel industry in a country will gradually upgrade following the path of CMT (cut-make and trim)–OEM (the original equipment manufacturing)–ODM (the original design manufacturing)–OBM (the original brand name manufacturing).

To FASH majors: are you ready to compete with “design in China” ? What would be your advantages and disadvantages, opportunities and threats?

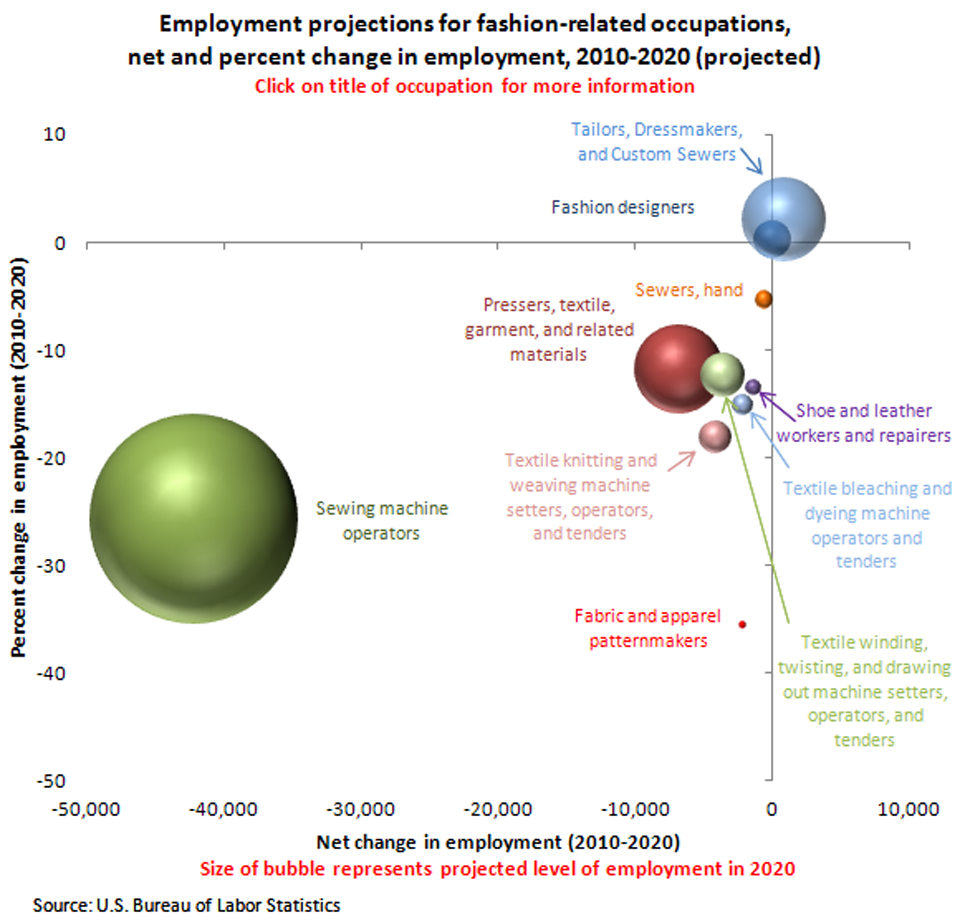

Bureau of Labor Statistics: Manufacturing-related Fashion Jobs Continue to Drop in the U.S.

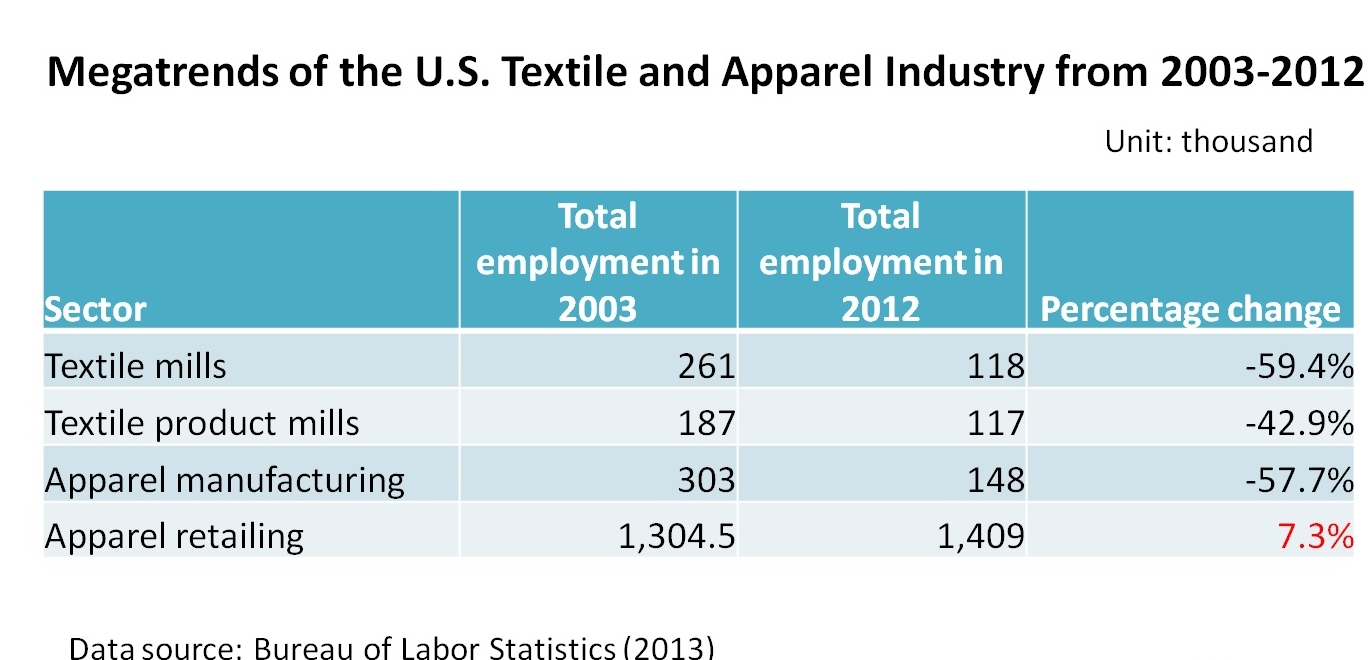

A recent study released by the U.S. Bureau of Labor Statistics (BLS) showed that manufacturing-related fashion jobs in the United States will continue to drop through 2020. Although the occupation of sewing machine operator is projected to face the most significant shrinkage in employment, the job decline is suggested to be an industry-wide phenomenon. According to the BLS, from 2003 to 2012, the U.S. apparel manufacturing industry (NAICS 315) had lost 57.7% of its jobs.

The question open for discussion, yet critical for textile& apparel major college graduates, is that how might the decline in manufacturing affect the destiny of other aspects of the U.S. fashion industry in the long run, such as the design and product development functions. No industry sector can survive as an island. As argued by the world’s leading scholar on the subject Michael Porter in his numerous studies addressing the industry competitiveness, the availability and strength of the local supporting industries have a key role to play in shaping the competitiveness of an industry in a nation. For example, the reason why the United States remains the world leading man-made fiber producer today is largely because the U.S. chemistry industry is able to provide needed inputs (such as raw material, technology and knowhow). By the same token, if fabrics are no longer locally made, compared with their overseas competitors such as Italy and China, the U.S. fashion designers might also be put at a big disadvantage in sourcing the needed material and developing the sample products in a timely manner, with flexible choices and at a reasonable cost.

Technology is another critical factor contributing to job decline in the U.S. fashion industry. As the 2008 study Forecasting the US fashion industry with industry professionals—Part I material and design concluded that “design and production processes would rely heavily on computer and digital technology…the apparel package in the U.S., including creative design, will possibly migrate offshore with the exceptions of heavily technology-involved design and product development tasks.”

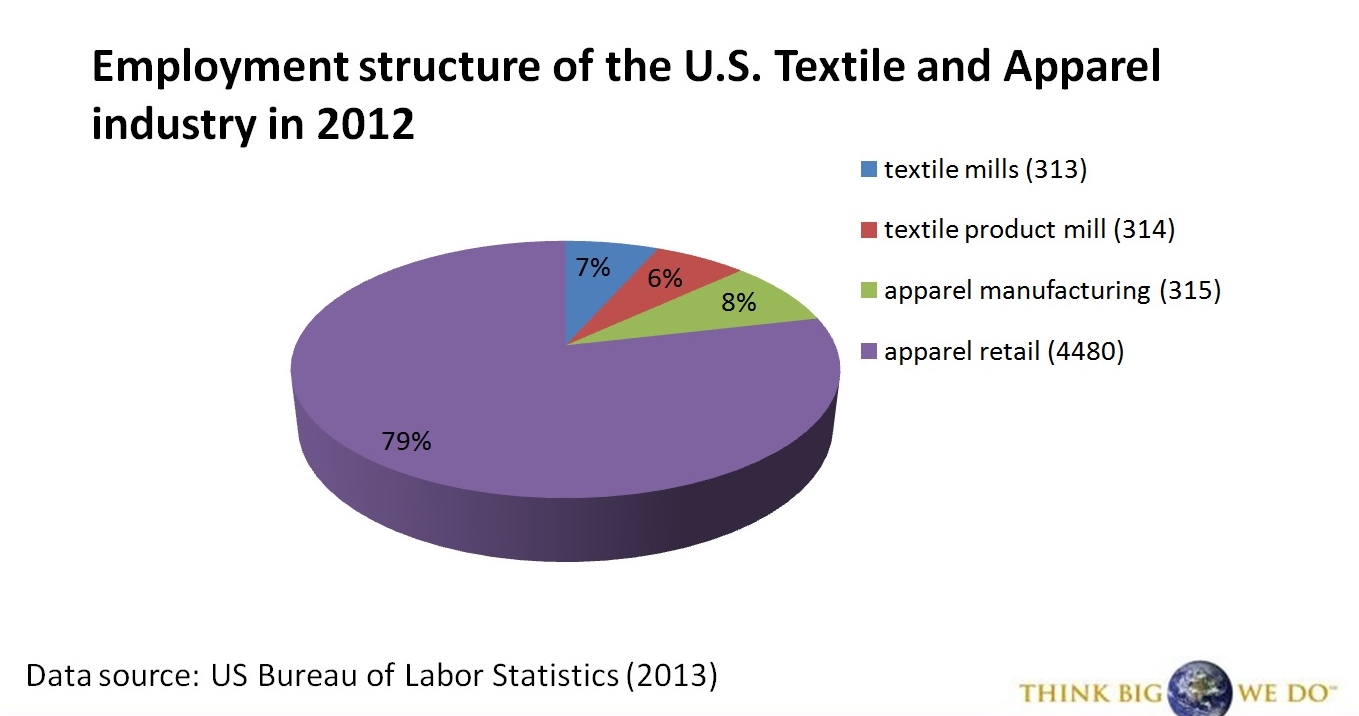

In the meanwhile, the retail sector remains a robust job creator for textile & apparel major college graduates. From 2003 to 2012, total employment in the U.S. apparel retail industry (NAICS 4482) increased 5.7%. By 2012, almost 80% of the occupations in the U.S. textile and apparel industry were offered by retailers.

by Sheng Lu

Is clothing “made in USA” more ethical? How “ethical” should be defined?

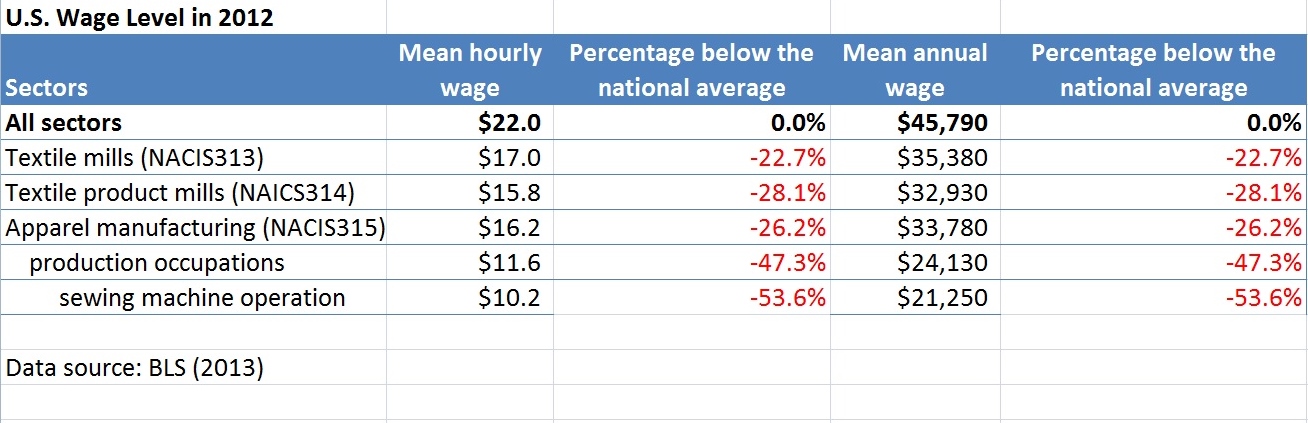

It has become a commonly held view that apparel workers in many developing countries are unfairly treated because they are much lower paid compared with their counterparts in the developed countries. For example, American Apparel, a company that insists all of its products made in USA, claims itself to be sweatshop-free on the basis that it pays workers an hourly wage of $12. However, does an hourly wage of $12 in the USA necessarily mean more “ethical” than an hourly wage of several cents in a poor developing country like Bangladesh?

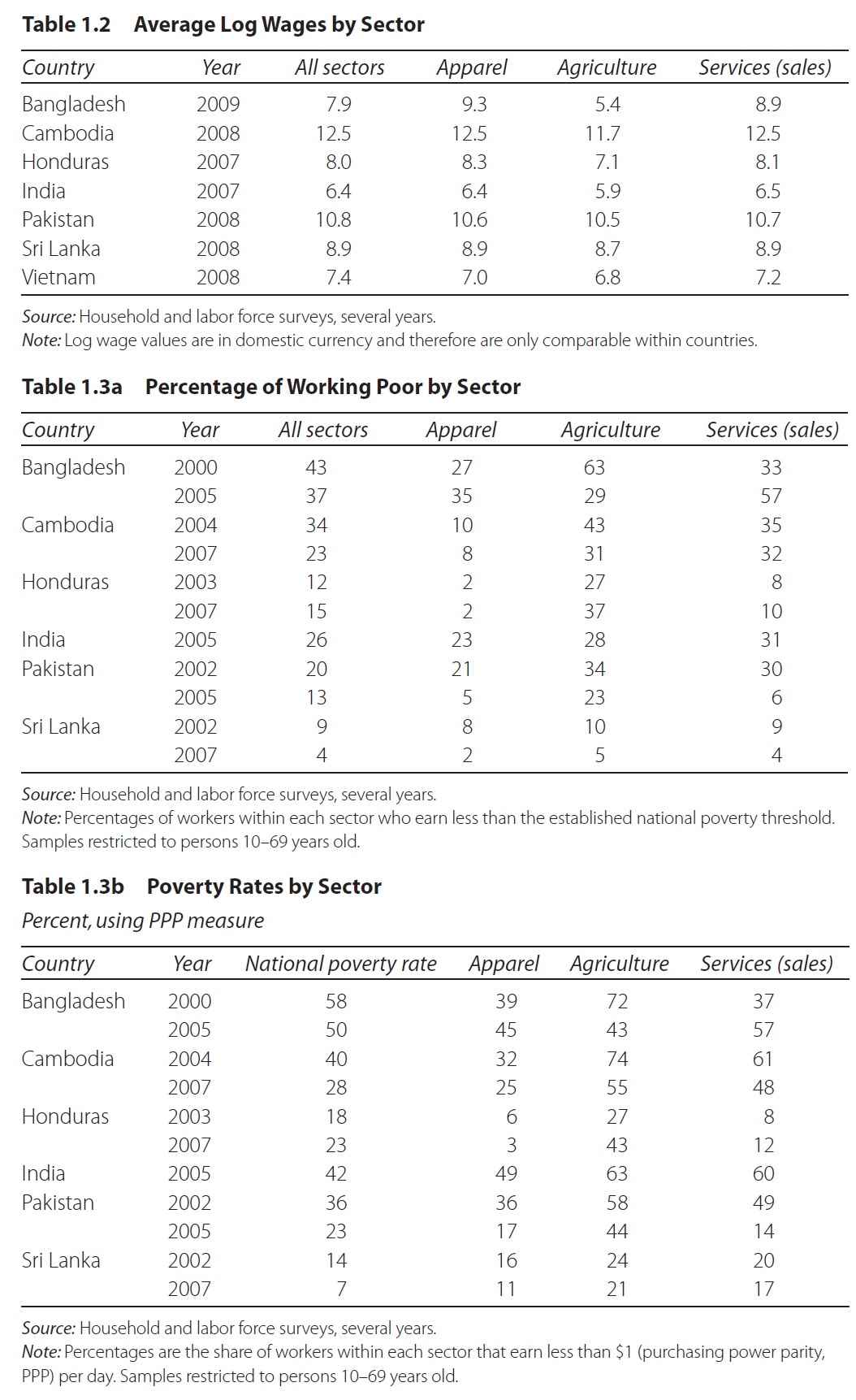

An often ignored fact is that in many developing countries, jobs in the apparel sector are better paid than positions in other sectors. For example, according to a recent study conducted by the World Bank, in Bangladesh, wage level in its apparel sector is 17.7% higher than the average level of all sectors, 72.2% higher than the wage level in the agriculture sector and 4.5% higher than the wage level in the service sector. This is not surprising, because in many developing countries, “moving from agriculture and low-end services into apparel jobs is a channel for social upgrading” (Lopez-Acevedo & Robertson, 2012).

Then, what does an hourly wage of $12 mean in a developed country like the United States? Data from the Bureau of Labor Statistics show that, in 2012, average wage level in the U.S. apparel manufacturing sector (NAICS 315) is 26.2% below the average wage level of all sectors. More specifically, the average wage level for the production occupations is 47.3% below the national average level and 53.6% below the national average level for sewing machine operators, the exact type of job that the hourly wage of $12 refers to.

The point to make here after the comparison is that it is misleading to define “ethical” or comment on “corporate social responsibility” without putting the matter in the context of the stage of development and the nature of the economy. Wage level is not determined by good will, but by the principle of economics 101.

By Sheng Lu

TPP updates: Hong Kong and South Korean textile firms increase FDI in Vietnam

The American Chamber of Commerce in Vietnam recently updates the textile & apparel sectoral negotiation under the TPP. At this point, different stake holders in the negotiation still hold divided views on a number of key issues, such as the rules of origin and short supply list. It is not a country line, but a line between different business types. What is also interesting to watch is that textile firms from Hong Kong and South Korea have taken actions to seize the “strategic opportunity” of investing in Vietnam. In the long run, it is not positive news for the U.S. textile mills to see Vietnam become more self-dependent on textile supply. However, few people believe TPP would conclude by the end of this year…

Full text of the article:

In Vietnam in preparation for the Trans-Pacific Partnership duty-free exports of apparel from Vietnam to the USA in accordance with the Textiles and Apparel Chapter rules of origin.

Senator Richard Burr (R-NC) asked USTR Michael Froman at the Jun 6, 2013 Senate Finance Committee hearing on the nomination, ” … a poorly negotiated TPP agreement could result in the loss of hundreds of thousands of U.S. jobs in the textile sector … If confirmed as the U.S. Trade Representative, will you support the yarn-forward rule of origin?”

Ambassador Froman replied, “The short answer is yes. We have made clear that we need clear rules of origin with yarn-forward at the center, we need rules against trans-shipments … the yarn-forward fule is a central part of our approach to textiles.” Click this link to see a C-SPAN video of the Senate Finance Committee hearing (0:27:41).

The “yarn forward” rule of origin means that all products in a garment from the yarn stage forward must be made in one of the countries that is party to the TPP agreement. In simple terms, the “yarn forward” rule means that the benefits of the agreement accrue to producers in TPP member countries rather than producers in non-TPP countries.

Perhaps in response, Mr. Nguyen Vu Tung, Deputy Chief of Mission at Vietnam’s Embassy to the USA in Washington, said at a conference on Jun 19, 2013, that the latest U.S. offer “is really, really difficult for us to accept.” Unless the two sides can reach a breakthrough, “I’m really concerned about the prospect of Vietnam to conclude the successful negotiation of TPP,” he said. According to the report, ”U.S. textile producers sell billions of dollars of yarn and fabric each year to U.S. free trade partners in Latin America, where it is turned into clothing and sent back to the United States. They fear without the yarn forward rule, Vietnam will be able to shut down that trade by importing yarn and fabric from China to make clothing to ship duty-free to the United States.”

Deputy Chief of Mission Nguyen Vu Tung made the comment at a conference organized by the Woodrow Wilson Center in Washington on The Trans-Pacific Partnership: New Rules for a New Era, Jun 19, 2013 (3 hours), with opening remarks by Robert Zoellick, former U.S. Trade Representative, former U.S. Deputy Secretary of State, and former World Bank President. Click the link to see a video of the webinar.

While political leaders and diplomats discuss the Trans-Pacific Partnership rules of origin, Hong Kong, South Korean, and Australian firms are developing and planning major textiles FDI in Vietnam to produce yarn and fabric, the supporting textiles industry for apparel production.

Korea’s Kyungbang inaugurates new $40 million yarn facility in Binh Duong; plan to develop the largest yarn-spinning in Asia. When the plant is extended in its second and third phase (with registered investment of $160 million), it will be the largest mill in Asia.

Texhong has has already invested $200 million in a plant in Dong Nai Province, and committed in Jul 2012 $300 million to a factory in Quang Ninh, which should be operational in the 2nd half of 2013.

Last year [2012] Texhong said it would invest $300 million to build a new yarn factory in Quang Ninh.. When the second-phase investment is completed next year [2014] its annual capacity will more than double to 110,000 tonnes of yarn.

Australia’s Woolmark® helps develop yarn-forward wool products in Vietnam. Today there are close to 50 companies in Vietnam using Australian wool. “When we started the project, none of the manufacturing partners knew anything about wool, and some of them had never even felt it,” said AWI project manager Jimmy Jackson. Initially we ran training courses to explain wool’s properties, benefits and features for manufacturing and producing garments. The next step was to introduce the manufacturers to suppliers of Australian wool yarns. We also had to explain the Woolmark standards and requirement in terms of both wear and laundering performance. Now that the Vietnamese manufacturers are confident in producing quality wool garments, AWI will introduce them to global retail and brand buyers.

Can the U.S. Negotiate a High-standard TPP

From 30′–38′ was the remark made by Steve Lamar, Executive Vice President of the American Apparel and Footwear Association (AAFA). From the view of the U.S. apparel industry, TPP will help diversify the import sources, promote export (note: AAFA members “produce everywhere and sell everywhere in the world”) and facilitate regulatory coherence of trade regulations. Steve hoped that the TPP outcome will be: 1) useable and relevant to the business community, not only for today, but also for the next 20 years; 2) can provide flexibility for AAFA members in implementing their supply chain strategy in today’s global economy. Steve also believes that complication is the largest obstacle for the TPP negotiation, given the increasing number of countries getting involved and so many agendas included.

Other distinguished speaker in the event include Barbara Weisel, Assistant U.S. Trade Representative for Southeast Asia and the Pacific. Barbara summarized the TPP history, the perspectives from the USTR and latest negotiation updates, very informative.

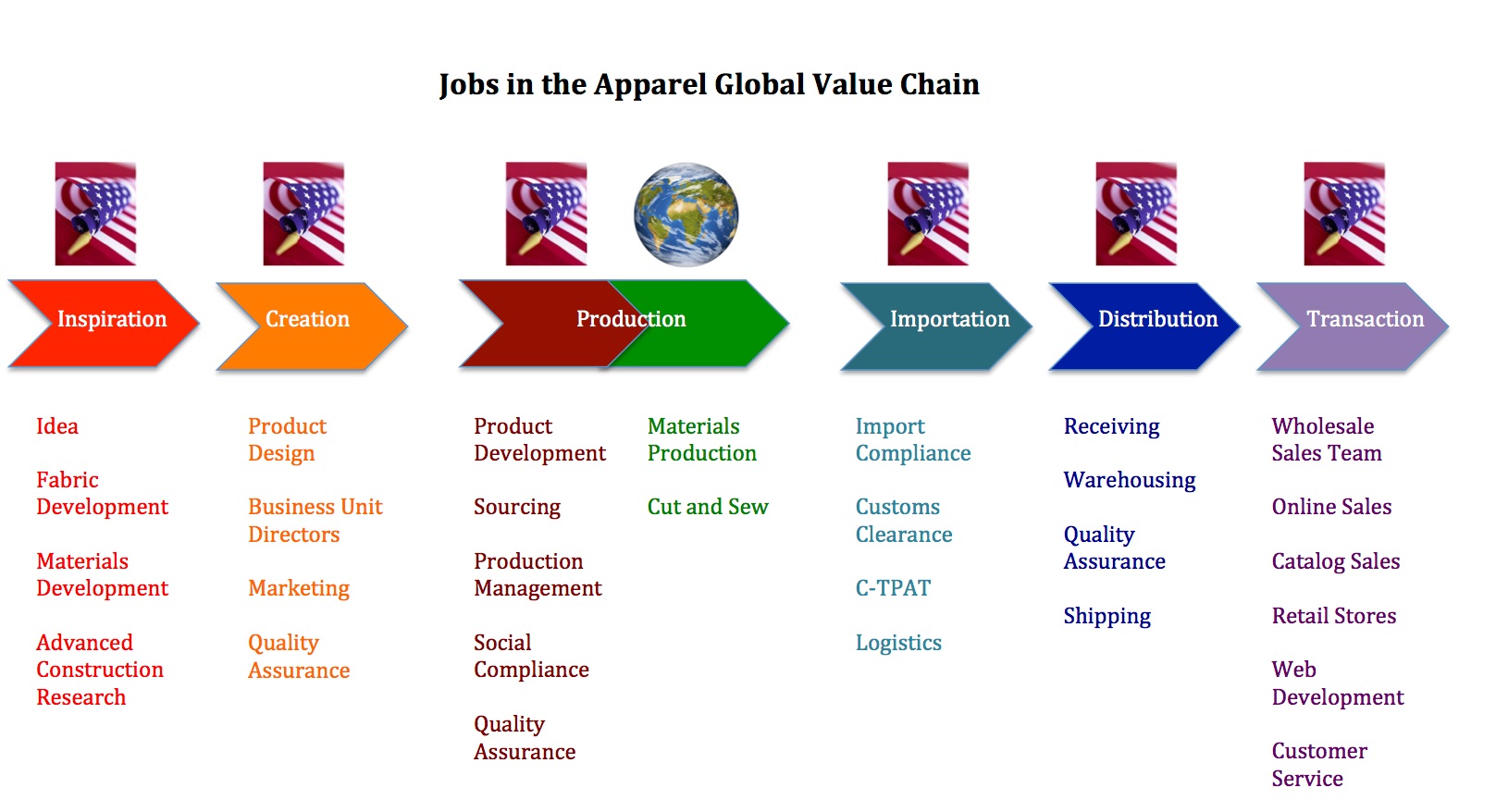

A Global View in Mind Means More Job and Career Oppertunities in the Fashion Apparel Industry

(Note: the functions & jobs below the U.S. flag mean they are based in the United States; Remember, apparel are “made in the world”–just like iphone and ipad. Even imports contain U.S. added value.)

Source: Moongate Association (2012). Analyzing the Value Chain for Apparel Designed in the United States and Manufactured Overseas

Building Collapse Kills 200 Bangladeshi Garment Workers

When can tragedy as such come to an end!?

NewYork Times reports today (April 25, 2013)

“A building housing several factories making clothing for European and American consumers collapsed into a deadly heap on Wednesday, only five months after a horrific fire at a similar facility prompted leading multinational brands to pledge to work to improve safety in the country’s booming but poorly regulated garment industry.

The Bangladeshi news media reported that inspection teams had discovered cracks in the structure of Rana Plaza on Tuesday. Shops and a bank branch on the lower floors immediately closed. But the owners of the garment factories on the upper floors ordered employees to work on Wednesday, despite the safety risks.

International attention was focused on labor conditions in Bangladesh five months ago, with the fatal fire at Tazreen Fashions, a garment factory near Dhaka. That fire brought pledges from government officials and many global companies to tighten safety standards.

Bangladesh is the world’s second-leading garment exporter, trailing only China, but the industry has been plagued by concerns over safety and angry protests over rock-bottom wages. The industry has grown rapidly in the past decade, particularly as rising wages in China have pushed many global clothing companies to look for lower costs elsewhere. Bangladesh has the lowest labor costs in the world, with the minimum wage for garment workers set at roughly $37 a month.

Such low labor costs have attracted not just Walmart but almost every major global clothing company, including Sears, Gap, Tommy Hilfiger and many others. Bangladesh now has more than 5,000 garment factories, employing more than 3.2 million workers, many of them women, and advocates credit the industry for lifting people out of poverty, even with such low wages. Exports also provide a critical source of foreign exchange that helps the government offset the high costs of imported oil.

But critics have argued that the outsize importance of the industry has made the government reluctant to take steps that could increase costs or alienate foreign brands. Labor unions are almost nonexistent, and a labor organizer, Aminul Islam, was tortured and murdered last year. The case remains unsolved. Meanwhile, some factory owners say they cannot raise wages or invest in upgrading facilities because of the low prices paid by Western brands.

The news was also covered by CNN:

http://www.cnn.com/2013/04/25/world/asia/bangladesh-building-collapse/index.html

NPR News Discussion

http://www.npr.org/2013/05/02/180557959/ethical-fashion-is-the-tragedy-in-bangladesh-a-final-straw

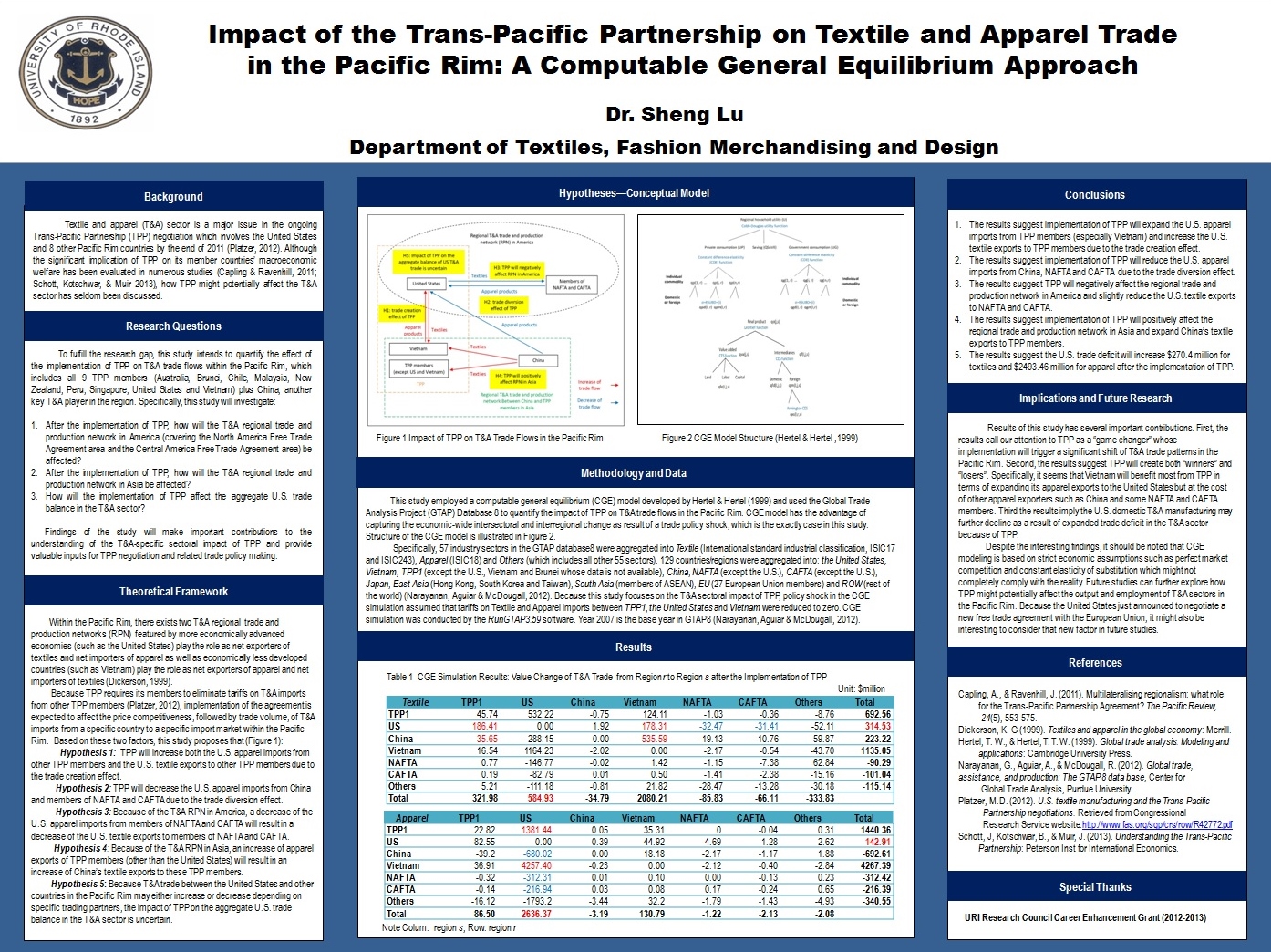

Impact of the Trans-Pacific Partnership on Textile and Apparel Trade in the Pacific Rim

Citation: Lu, S. (2013). Impact of the Trans-Pacific Partnership on textile and apparel trade in the Pacific Rim. World Trade Organization Focus, 20(5), 67-77.

For questions, please contact the author: shenglu@mail.uri.edu

Three U.S. Textile Organizations Merge

If you’ve finished the third part of the T-shirt book, you should remember Auggie Tantillo and the American Manufacturing Trade Action Coalition (AMTAC) under his leadership. On March 28, 2013, AMTAC together with the National Textile Association (NTA) joined the National Council of Textile Organization (NCTO), which will become the flagship organization representing the interests of the U.S. textile industry (textile mills and texile product mills which produce fibers, yarns, fabrics, home textiles and industrial textiles). This new movement could strengthen the voice of the U.S. textile industry in Washington DC, but at the same time can also be read as a sign of the declining industry base of AMTAC and NCTO.

The press release of the merger can be downloaded from here