The full study is available here (need Just-Style subscription)

By leveraging production and trade statistics from government databases, we examined the critical trends of US textile manufacturing and supply. Particularly, we try to understand the strengths and weaknesses of the United States as a textile raw material supplier for domestic garment manufacturers and those in the Western Hemisphere. Below are the key findings:

First, fiber, yarn, and thread manufacturing is a long-time strength in the US, whereas fabric production is much smaller in scale. Specifically, fiber, yarn, and thread (NAICS 31311) accounted for nearly 18% of US textile mills’ total output in 2019. In comparison, less than 13% of the production went to woven fabrics (NAICS 31321) and only about 5% for knit fabrics (NAICS 31324).

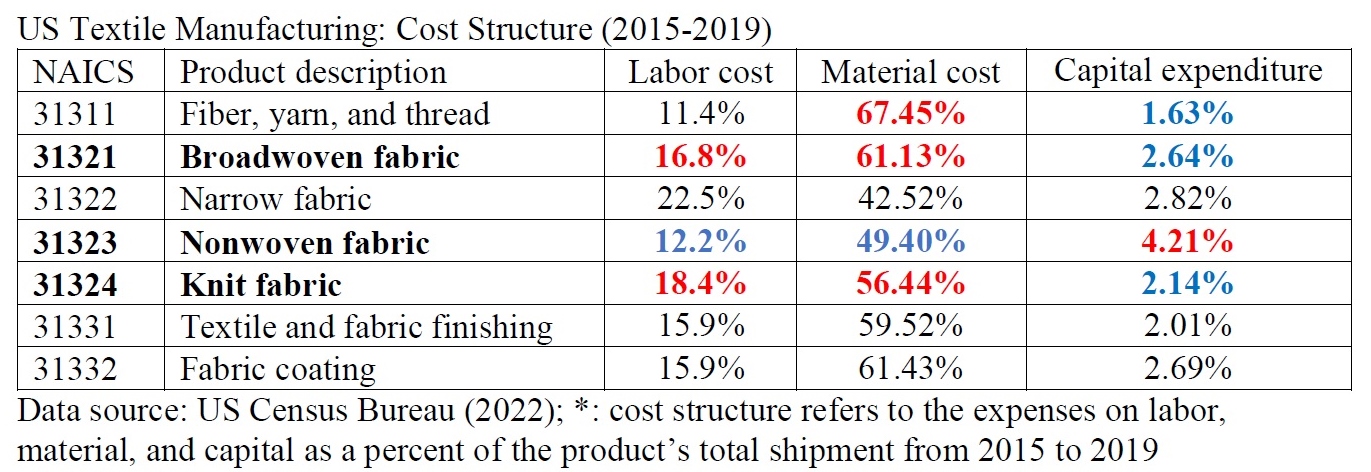

Second, the US textile industry shifts to make more technical textiles and less apparel-related yarns, fabrics, and other raw materials. Data shows that from 2015 to 2019, the value of US fiber, yarn, and thread manufacturing (NAICS code 31311) dropped by as much as 16.8 percent. Likewise, US broadwoven fabric manufacturing (NAICS code 31321) and knit fabric (NAICS code 31324) decreased by 2.0 percent and 2.7 percent over the same period. Labor cost, material cost, and capital expenditure are critical factors behind the structural shift of US textile manufacturing.

Third, the structural change of US textile manufacturing directly affects the role of the US serving as a textile supplier for domestic apparel producers and those in the Western Hemisphere.

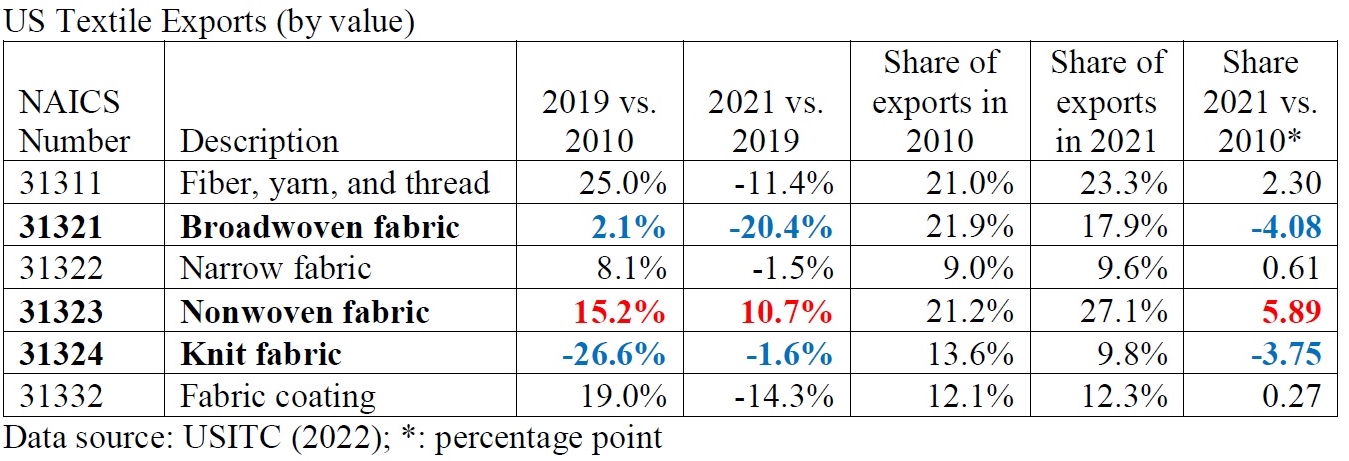

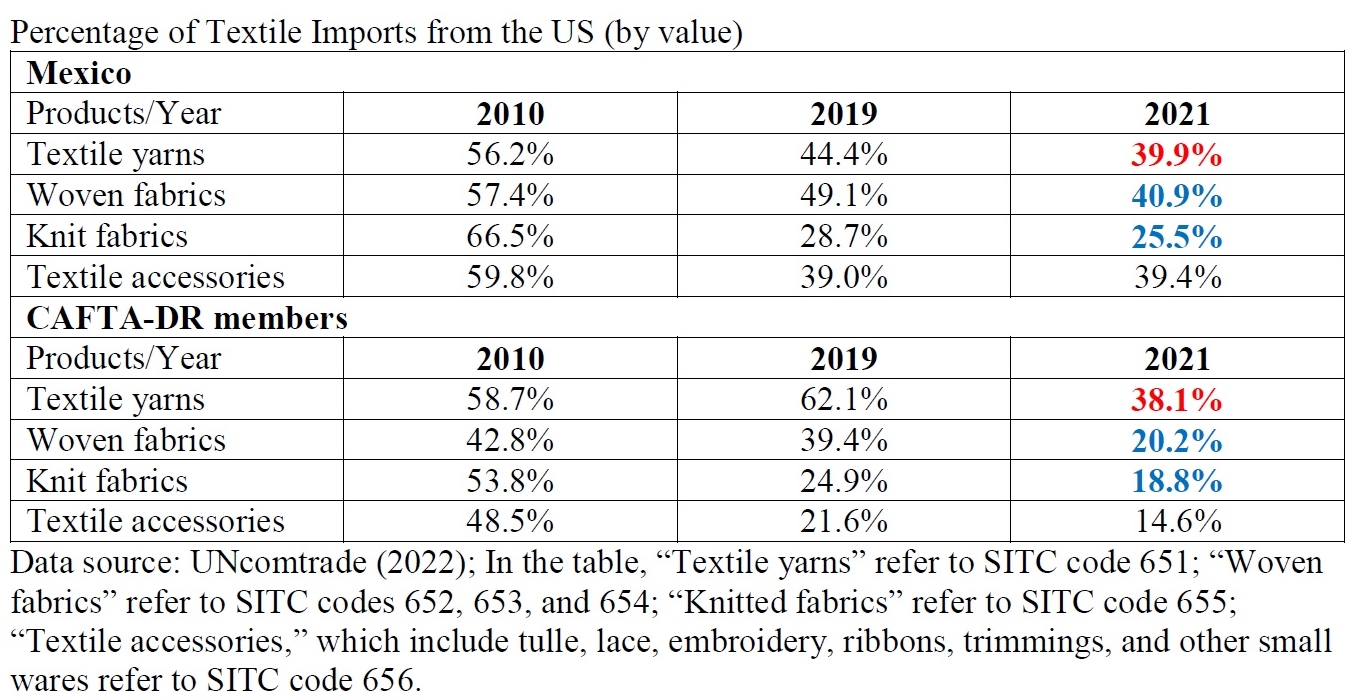

On the one hand, the US remains a critical yarns and threads supplier in the Western Hemisphere. For example, from 2010 to 2019, the value of US fibers, yarn and threads exports (NAICS31311) increased by 25%, much higher than other textile categories. Likewise, in 2021, fibers, yarns, and threads accounted for about 23.3% of US textile exports, higher than 21.0% in 2010. Additionally, nearly 40% of Mexico and CAFTA-DR members’ yarn imports in 2021 (SITC 651) still came from the US, the single largest source. This trend has stayed stable over the past decade.

On the other hand, the US couldn’t sufficiently supply fabrics and other textile accessories for garment producers in the Western Hemisphere, and the problem seems to worsen. Corresponding to the decline in manufacturing, US broadwoven fabric (NAICS 31321) and knit fabric (NAICS 31324) exports decreased substantially.

The US also plays a declining role as a fabric and textile accessories supplier for garment factories in the Western Hemisphere. Garment producers in Mexico and CAFTA-DR members had to source 60%-80% of woven fabrics and 75-82% of knit fabrics from non-US sources in 2021. Likewise, only 40% and 14.6% of Mexico and CAFTA-DR members’ textile accessories, such as labels and trims, came from the US in 2021.

Likewise, the limited US fabric supply affects the raw material sourcing of domestic apparel manufacturers. For example, according to the “Made in the USA” database managed by the Office of Textiles and Apparel (OTEXA), around 36% of US-based apparel mills explicitly say they use “imported material,” primarily fabrics.

The study’s findings echo some previous studies suggesting that textile raw material supply, especially fabrics and textile accessories, could be the single most significant bottleneck preventing more apparel “Made in the USA” and near-sourcing from the Western Hemisphere.

Meanwhile, how to overcome the bottleneck could trigger heated public policy debate. For example, US policymakers could encourage an expansion of domestic fabric and textile accessories manufacturing as one option. However, to make it happen takes time and requires substantial new investments. Also, economic factors may continue to favor technical textiles production over apparel-related fabrics in the US.

As an alternative, US policymakers could make it easier for garment producers in the Western Hemisphere to access their needed fabrics and textile accessories outside the US, such as improving the rules of origin flexibility in CAFTA-DR or USMCA. But this option is likely to face strong opposition from US yarn producers and be politically challenging to implement.

(About the authors: Dr Sheng Lu is an associate professor in fashion and apparel studies at the University of Delaware; Anna Matteson is a research assistant in fashion and apparel studies at the University of Delaware).