Trend 1: US fashion companies continue to diversify their sourcing base in 2022

Numerous studies suggest that US fashion companies leverage sourcing diversification and sourcing from countries with large-scale production capacity in response to the shifting business environment. For example, according to the 2022 fashion industry benchmarking study from the US Fashion Industry Association (USFIA), more than half of surveyed US fashion brands and retailers (53%) reported sourcing apparel from over ten countries in 2022, compared with only 37% in 2021. Nearly 40% of respondents plan to source from even more countries and work with more suppliers over the next two years, up from only 17% in 2021.

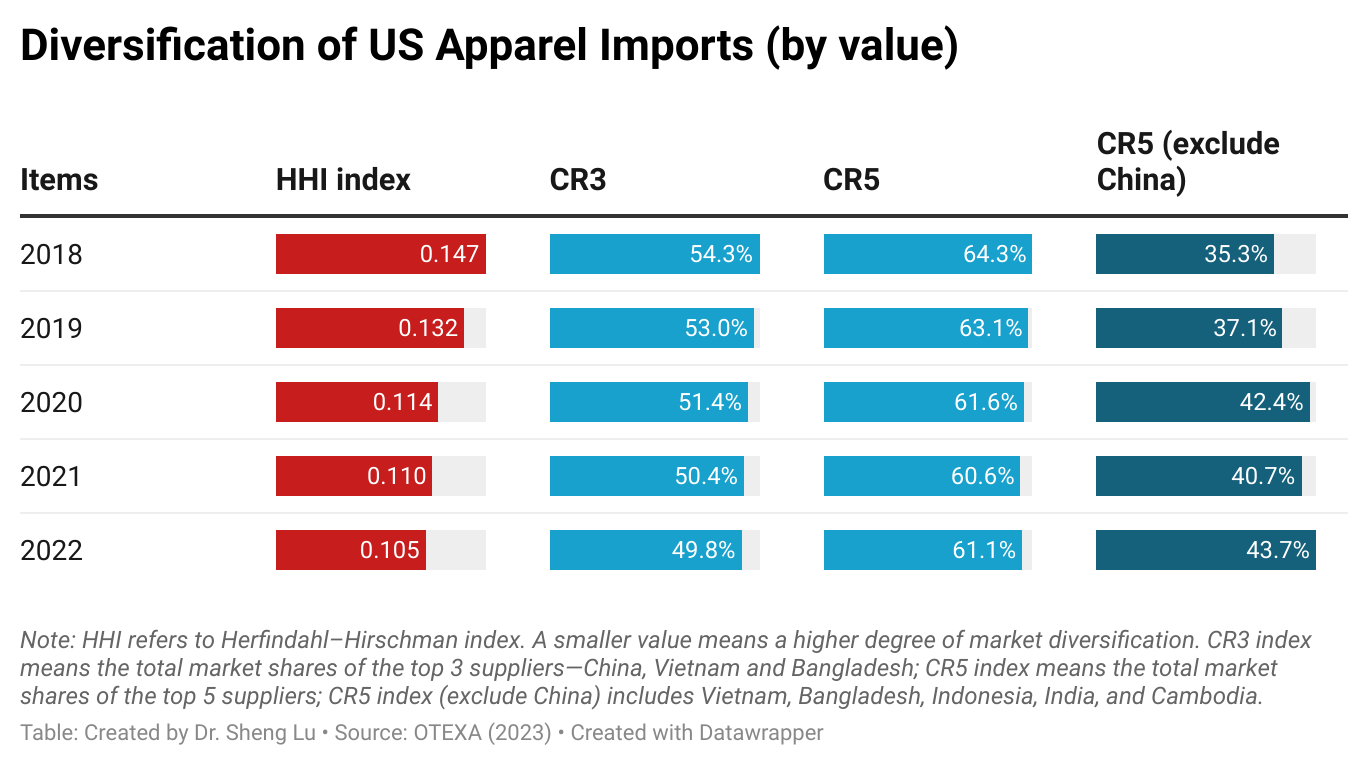

Trade data confirms the trend. For example, the Herfindahl–Hirschman index (HHI), a commonly-used measurement of market concentration, went down from 0.110 in 2021 to 0.105 in 2022, suggesting that US apparel imports came from even more diverse sources.

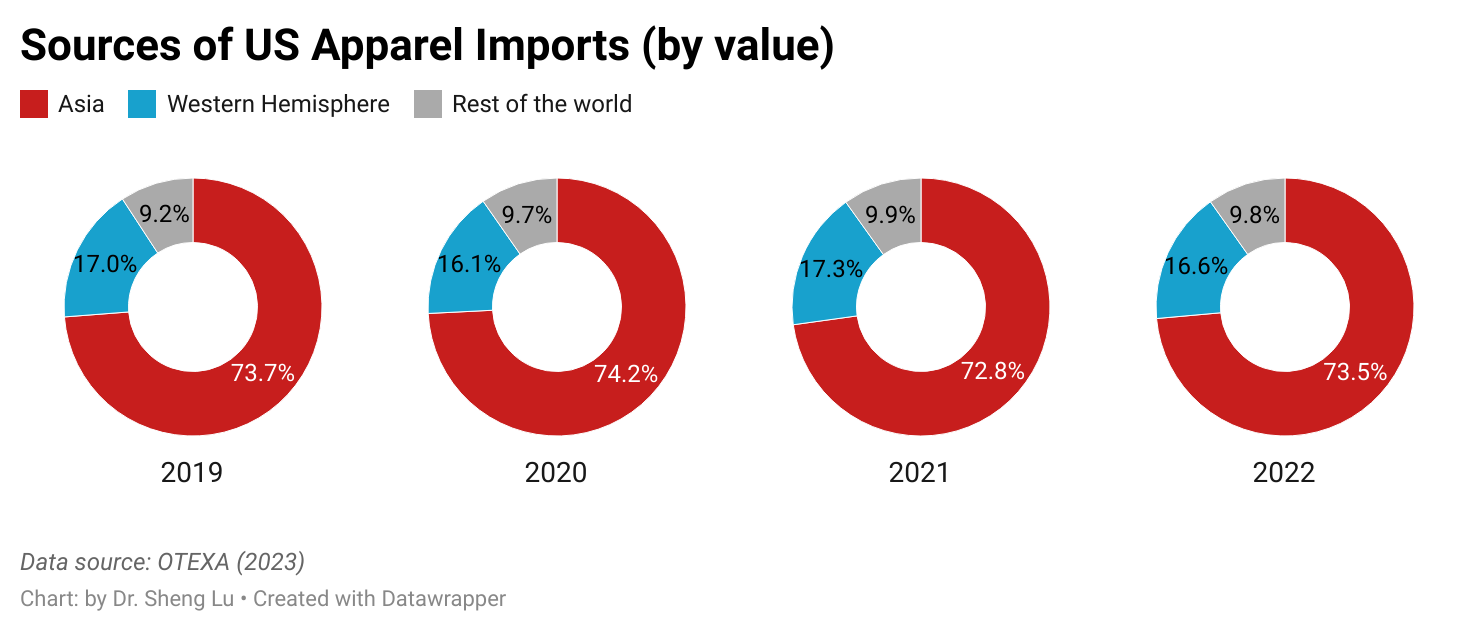

Trend 2: Asia as a whole will remain the dominant source of imports

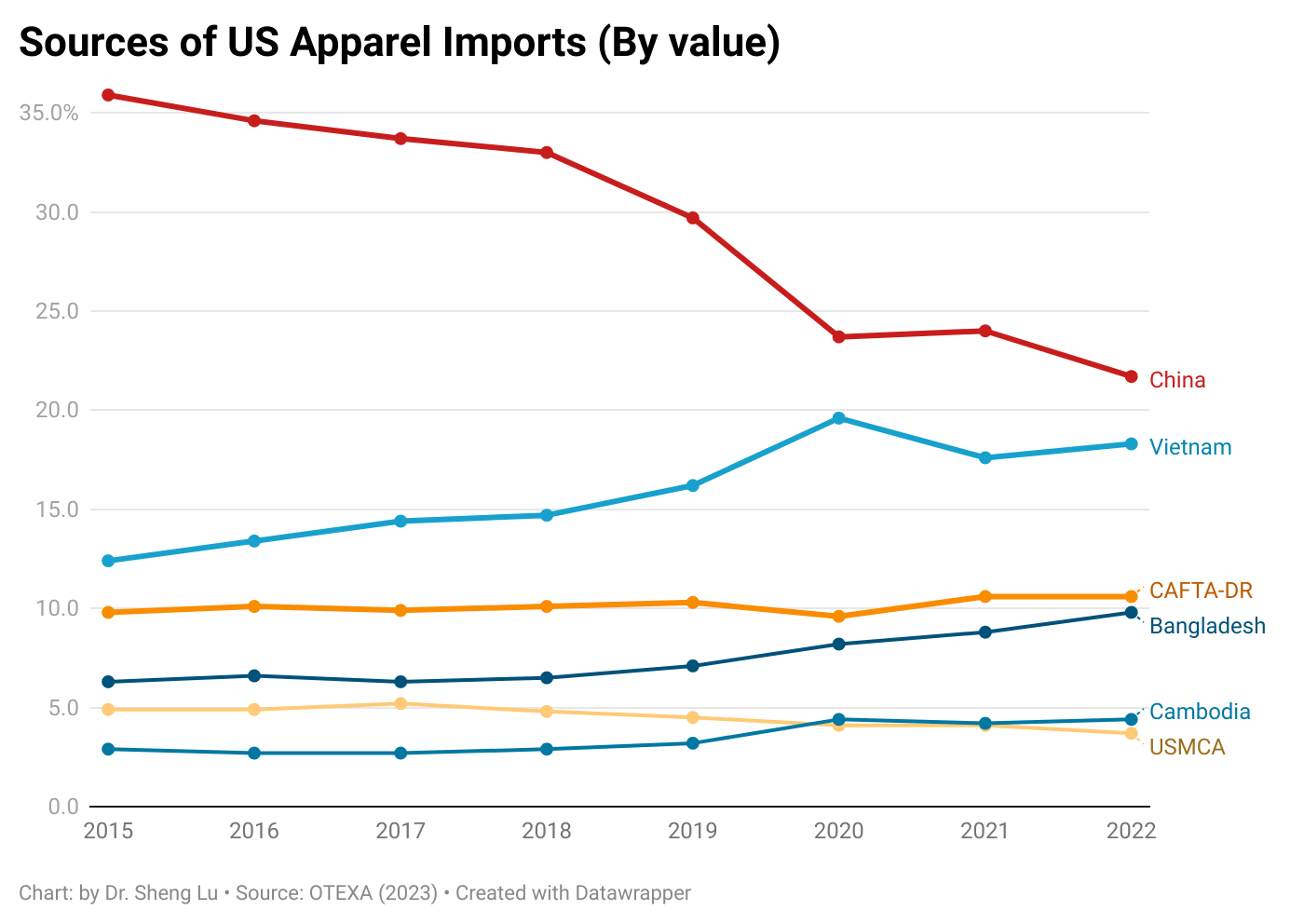

Measured in value, about 73.5% of US apparel imports came from Asia in 2022, up from 72.8% in 2021. Likewise, the CR5 index, measuring the total market shares of the top five suppliers—all Asia-based, i.e., China, Vietnam, Bangladesh, Indonesia, and India, went up from 60.6% in 2021 to 61.1% in 2022. Notably, the CR5 index without China (i.e., the total market shares of Vietnam, Bangladesh, Indonesia, India, and Cambodia) enjoyed even faster growth, from 40.7% in 2021 to 43.7% in 2022.

Additionally, facing growing market uncertainties and weakened consumer demand amid high inflation pressure, US fashion companies may continue to prioritize costs and flexibility in their vendor selection. Studies consistently show that Asia countries still enjoy notable advantages in both areas thanks to their highly integrated regional supply chain, production scale, and efficiency. Thus, US fashion companies are unlikely to reduce their exposure to Asia in the short to medium term despite some worries about the rising geopolitical risks.

Trend 3: US fashion companies’ China sourcing strategy continues to evolve

Several factors affected US apparel sourcing from China negatively in 2022:

- One was China’s stringent zero-COVID policy, which led to severe supply chain disruptions, particularly during the fall. As a result, China’s market shares from September to November 2022 declined by 7-9 percentage points compared to the previous year over the same period.

- The second factor was the implementation of the Uyghur Forced Labor Prevention Act (UFLPA) in June 2022, which discouraged US fashion companies from sourcing cotton products from China. For example, only about 10% of US cotton apparel came from China in the fourth quarter of 2022, down from 17% at the beginning of the year and much lower than nearly 27% back in 2018.

- The third contributing factor was the US-China trade tensions, including the continuation of Section 301 punitive tariffs. Industry sources indicate that US fashion companies increasingly source from China for relatively higher-value-added items targeting the premium or luxury market segments to offset the additional sourcing costs.

Further, three trends are worth watching regarding China’s future as an apparel sourcing base for US fashion companies:

- One is the emergence of the “Made in China for China” strategy, particularly for those companies that view China as a lucrative sales market. Recent studies show that many US fashion companies aim to tailor their product offerings further to meet Chinese consumers’ needs and preferences.

- Second is Chinese textile and apparel companies’ growing efforts to invest and build factories overseas. As a result, more and more clothing labeled “Made in Bangladesh” and “Made in Vietnam” could be produced by factories owned by Chinese investors.

- Third, China could accelerate its transition from exporting apparel to providing more textile raw materials to other apparel-exporting countries in Asia. Notably, over the past decade, most Asian apparel-exporting countries have become increasingly dependent on China’s textile raw material supply, from yarns and fabrics to various accessories. Moreover, recent regional trade agreements, particularly the Regional Comprehensive Economic Partnership (RCEP), provide new opportunities for supply chain integration in Asia.

Trend 4: US fashion companies demonstrate a new interest in expanding sourcing from the Western Hemisphere, but key bottlenecks need to be solved

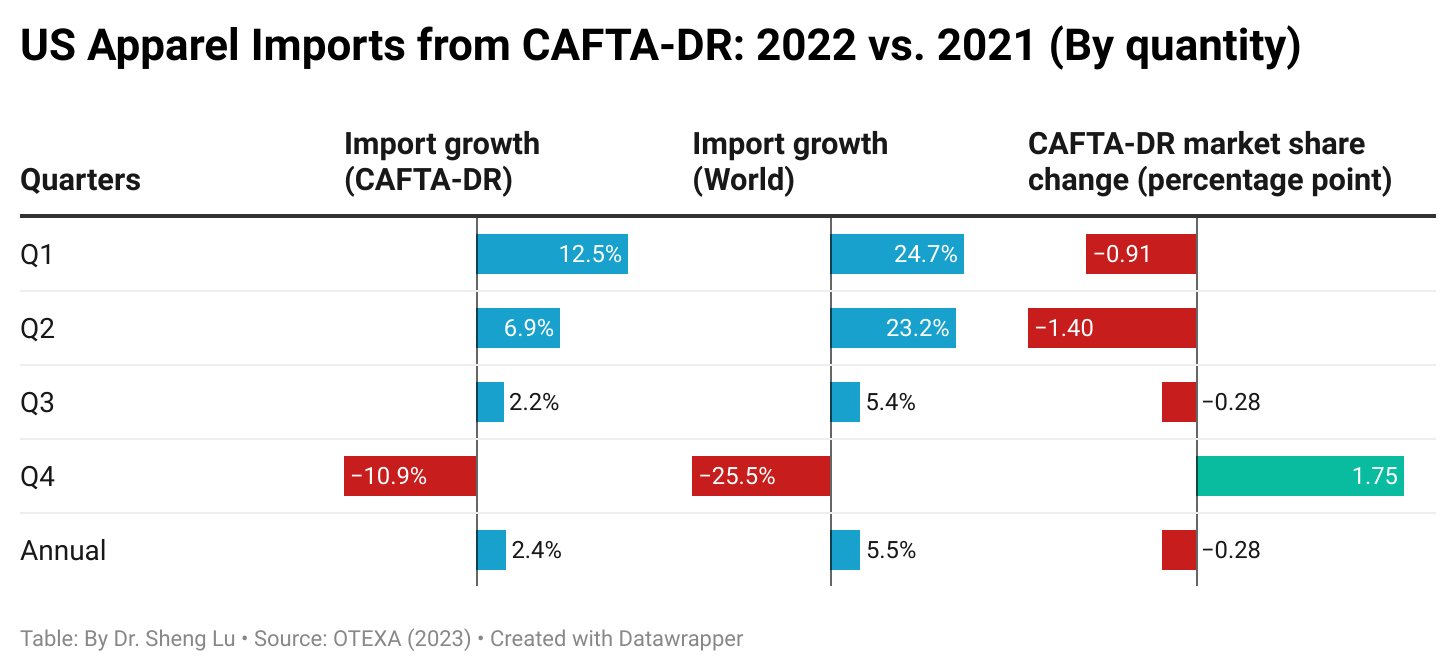

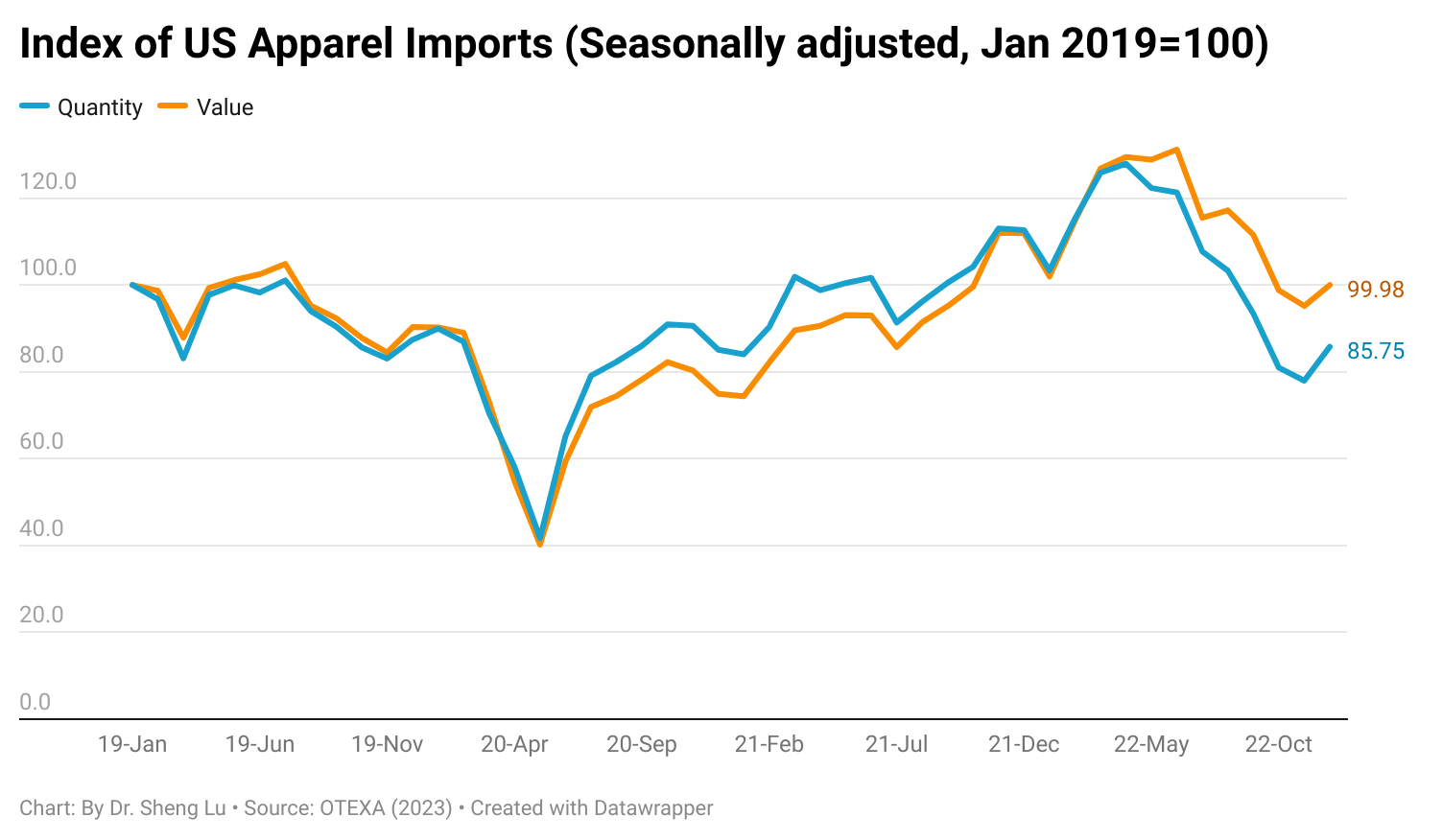

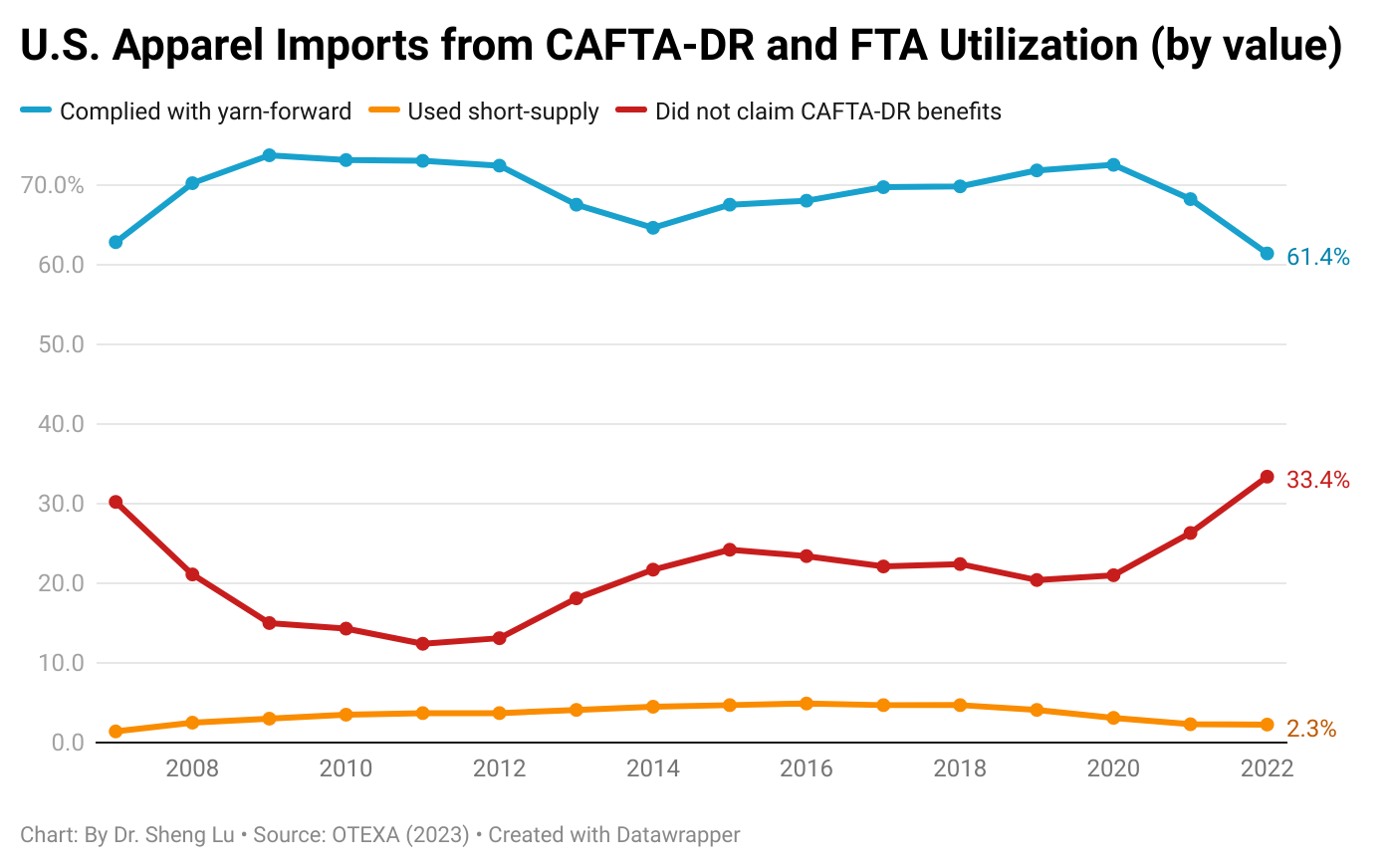

Trade data suggests a mixed picture of near-shoring in 2022. For example, members of the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) and US-Mexico-Canada Trade Agreement (USMCA) accounted for a declining share of US apparel imports in 2022, measured in quantity and value. While CAFTA-DR and USMCA members showed an increase in their market share of US apparel imports in the fourth quarter of 2022, reaching 10.7% and 3.1%, respectively, this growth was not accompanied by an increase in trade volume. Instead, US apparel imports from these countries decreased by 11% and 15%, respectively, compared to the previous year. CAFTA-DR and USMCA members’ gain in market share was mainly due to a sharper decline in US apparel imports from the rest of the world (i.e., decreased by over 25% in the fourth quarter of 2022).

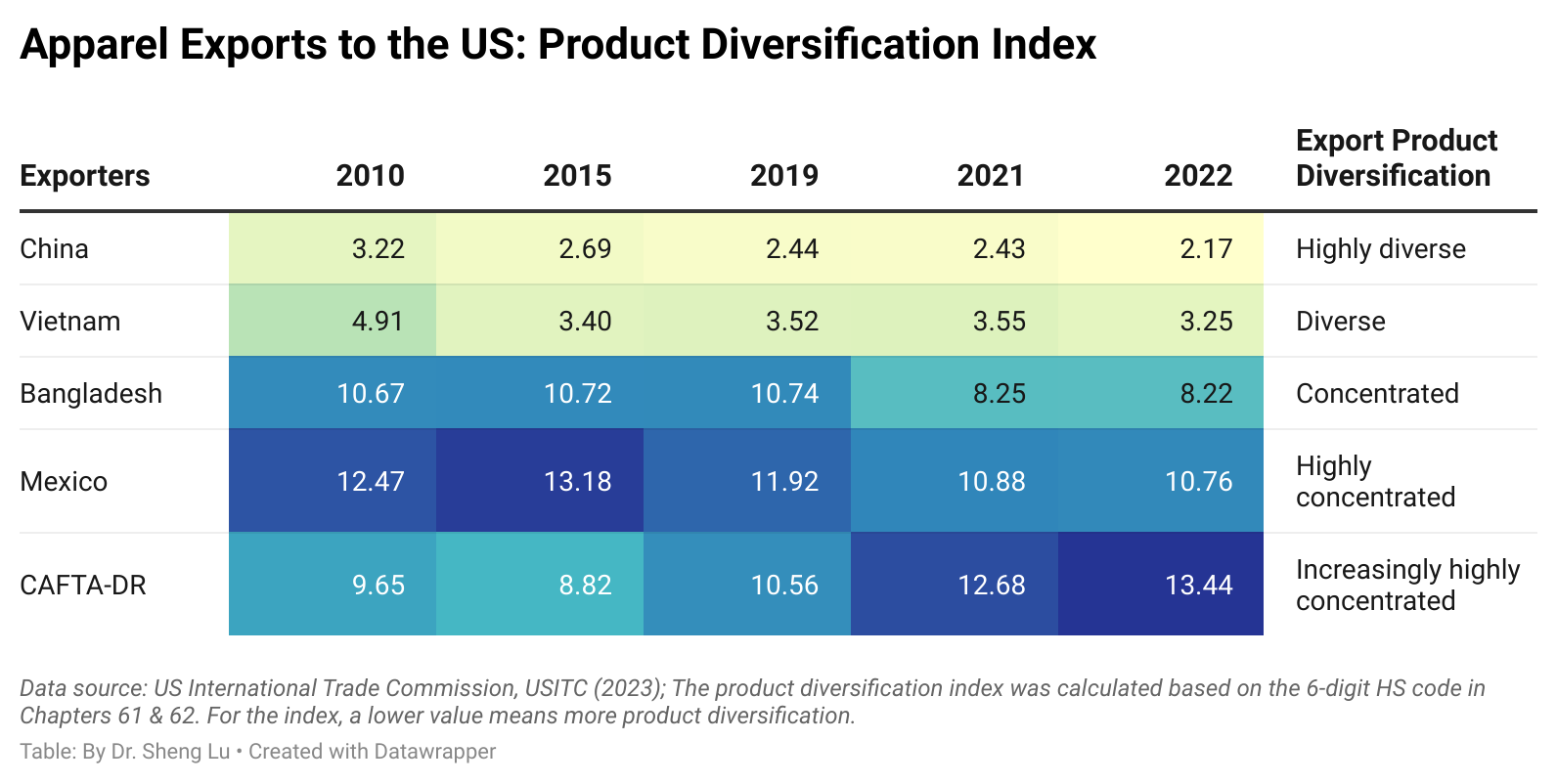

Trade data also suggests two other bottlenecks preventing more US apparel sourcing from CAFTA-DR and USMCA members. One is the lack of product diversity. For example, the product diversification index consistently shows that US apparel imports from CAFTA-DR members and Mexico concentrated on only a limited category of products, and the problem worsened in 2022. The result explained why US fashion companies often couldn’t move souring orders from Asia to CAFTA-DR and USMCA members.

Another problem is the underutilization of the trade agreement. For example, CAFTA-DR’s utilization rate for US apparel imports consistently went down from its peak of 87% in 2011 to only 74% in 2021. The utilization rate fell to 66.6% in 2022, the lowest since CAFTA-DR fully came into force in 2007. This means that as much as one-third of US apparel imports from CAFTA-DR did NOT claim the agreement’s preferential duty benefits. Thus, regarding how to practically grow US fashion companies’ near-shoring, we could expect more public discussions and debates in the new year.

by Sheng Lu

Further reading: Lu, Sheng (2023). Key trends to watch as US apparel imports hit record high in 2022 but slow in 2023. Just-Style.

I enjoyed reading through this blog post. There were a few different questions that came to mind while reading through these key findings.

While companies want to diversify their supply chain in order to mitigate risk, are they able to still manage close relationships with all of their suppliers this way? Does it make it more challenging to do so?

I think that while diversifying your supply chain is a growing trend, having strong relationships with your vendors is also increasingly important to fashion brands. How are companies managing to do both? I imagine that fashion brands will need a larger employee base in order to maintain their many different relationships with suppliers.

Is moving sourcing outside of China actually removing China produced products? So many of the raw materials are still coming from China–they remain such a strong competitors and reliable supplier of raw materials to many other asian countries.

One intriguing finding in the report is that industry stakeholders are giving increased weight to sustainability, with 75% of respondents identifying it as a top priority for their organizations. The report also highlights U.S. initiatives and adoption of sustainable practices. S. fashion businesses, such as the use of eco-friendly materials, ethical sourcing, and energy-saving techniques. The report also points out that there are significant obstacles to implementing sustainability in the sector, such as financial constraints, a lack of supply-chain transparency, and consumer demand for low-cost fast fashion. A thorough analysis of the U.S.’s present situation is provided in the report. S. the fashion industry’s ongoing efforts to adopt more sustainable practices.

Hearing about the US attempting to avoid China and diversify its sourcing is always very interesting to me because, at the end of the day, they always go back to produce from Asian countries. It’s interesting to see one trend suggest that US fashion companies leverage sourcing diversification and sourcing from countries with large-scale production capacity in response to the shifting business environment while another says that China will still remain dominant in US sourcing. I had no idea that 73.5% of US apparel imports came from Asia and that US fashion companies are unlikely to reduce their exposure to Asia in the short to medium term despite some worries about the rising geopolitical risks because of how often some try to move their sourcing to elsewhere. While all of this remains true, it is also interesting to see US companies showing some sort of interest in sourcing from the Western Hemisphere.

One strategy that I find very interesting is the emergence of the “Made in China for China” strategy. It is surprising to read that some companies view China as a lucrative sales market, being that consumers in the Western Hemisphere are of the utmost importance for a lot of big companies and brands. I think it is a smart strategy to focus on the sales market in China because the sales market in the US is becoming extremely competitive and overpopulated, not to mention many of the businesses sell extremely similar products and merchandise.

Also, China finding a loophole in the market by investing in and building companies overseas is very surprising to read. People and brands are starting to stray from the typical “Made in China” label, and the Chinese government is finding new ways to keep brands and retailers coming to them for their sourcing and supplying needs. Reading about how clothes labeled as “Made in Bangladesh” and “Made in Vietnam” could be owned by Chinese investors is surprising.