The latest statistics from the Office of Textiles and Apparel (OTEXA) show that COVID-19 continued to enlarge its negative impact on U.S. apparel imports in May 2020, and the path to recovery will NOT be straightforward and quick. Specifically:

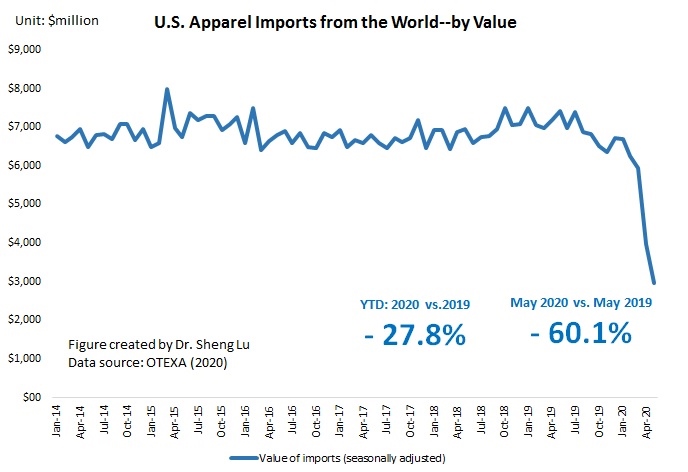

The value of U.S. apparel imports decreased by more than 60% in May 2020 from a year ago, setting a new record of single-month loss in trade volumes. Between January and May 2020, the value of U.S. apparel imports decreased by 27.8% year over year, which has been much worse than the performance during the 2008-2009 global financial crisis (down 11.8%).

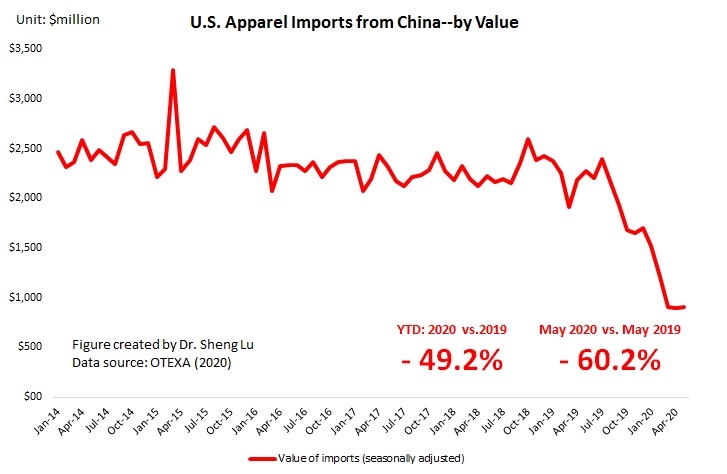

As the first country hit by Covid-19, China’s apparel exports to the U.S. dropped by 60.2% in May 2020 from a year ago, close to its performance in April 2020 (down 59% YoY). While the figure itself is far from exciting, it suggests the sinking of China’s apparel exports could have hit bottom. As an important sign, China regained its position as the largest apparel supplier to the U.S. in May 2020, with 27.2% market shares in value and 41.4% market shares in quantity. Notably, this is a significant rebound from only 11% market shares back in February 2020. Overall, it seems U.S. fashion brands and retailers continue to treat China as an essential and probably indispensable apparel sourcing base, despite a new low of U.S.-China relations and companies’ sourcing diversification strategy. Meanwhile, the official Chinese statistics report a 20.3% drop in China’s apparel exports in the first five months of 2020.

Despite Covid-19, Asia as a whole remains the single largest source of apparel for the U.S. market. Other than China, Vietnam (20.1% YTD in 2020 vs. 16.2% in 2019), ASEAN (34.6% YTD in 2020 and vs. 27.4% in 2019) and Bangladesh (9.4% YTD in 2020 vs.7.1% in 2019) all gain additional market shares in 2020 from a year ago.

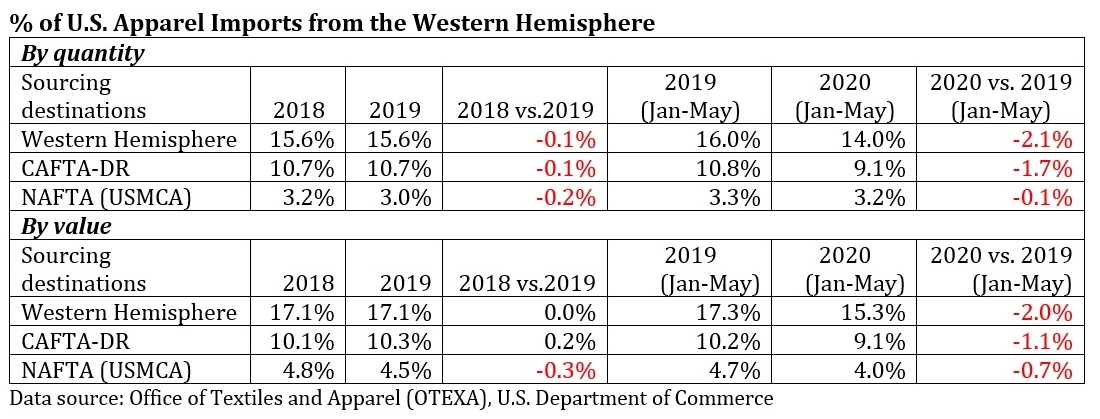

However, no clear evidence has suggested that U.S. fashion brands and retailers are giving more apparel sourcing orders to suppliers from the Western Hemisphere. In the first five months of 2020, still, only 9.1% of U.S. apparel imports came from CAFTA-DR members (down from 10.3% in 2019) and 4.0% from NAFTA members (down from 4.5% in 2019). Two factors might explain the pattern: 1) Due to factory lock-down, the production capacity in the Western Hemisphere is affected negatively; 2) With an unrepresented high level of unemployment, U.S. consumers are becoming ever more price sensitive. However, apparel produced in the Western Hemisphere, in general, are less price competitive than those made in Asia.

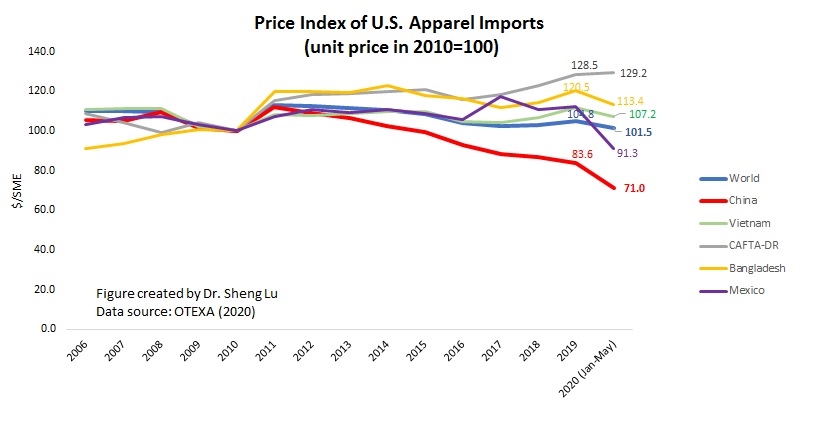

As a reflection of weak demand, the unit price of U.S. apparel imports was lower in the first five months of 2020 (price index =101.5) compared with 2019 (price index =104.7). Imports from China have seen the most notable price decrease so far (price index =71.0 YTD in 2020 vs. 83.5 in 2019).

by Sheng Lu

It is interested to read about the differing opinions that people have about the effect of COVID-19 on the fashion industry. While I do think that one day we will get back on our feet, I am not sure that globalization will really ever look exactly the same. It seems though, that the U.S is not giving up on China’s apparel industry, regardless of the pandemic. Do you think that the Flying Geese Model plays a factor in Asia’s success as the largest source of apparel in the world? Why or why not?

This is not surprising being that our world has been turned upside down in the past 5 months. China is one of the United States’ biggest importers. To see China’s exports decrease 60.2% to the US in May, 2020 is terrifying for this industry. Although China regained its name as the largest apparel supplier to the US, it will take a very long time to raise the numbers back to where they were. Globalization has and will be changed in the future due to this virus. Returning back to its past form will be very difficult considering many countries are still battling how to financially rebound.

I find it interesting that while people are wary of our involvement with China due to Covid, the U.S. has decreased imports from CAFTA-DR and NAFTA members from this same time last year. I would think that imports from these regions would increase, but the decrease may be credited with the fact that there are many restrictions in these regions as a result of the pandemic. It seems that due to high unemployment, people are more price sensitive and this is the leading explanation as to why China has once again become the U.S.’s number one apparel supplier as of May 2020.

It is scary to think about how much damage COVID has done not only to people but also this industry. There is the question of where will brands go from here? One thing that really stood out to me was “With an unrepresented high level of unemployment, U.S. consumers are becoming ever more price sensitive. However, apparel produced in the Western Hemisphere, in general, are less price competitive than those made in Asia”. Will brands be switching over to please their consumers or will they be sticking to places like China that they have been using for years or will China’s prices also decrease because of their large drop in exports. Since people are more price sensitive because of the effects of COVID you would think consumption would just go down instead of wanting more things for a cheaper price.

There have clearly been serious negative effects on the fashion industry since the COVID epidemic struck. As seen on the first graph, from May 2019 to May 2020 there was a 60.1% decrease in US apparel imports. The fashion industry is not alone in this. If there can be a silver lining to the effects of COVID I would say that it is a change for brands to seriously reconsider their supply chains. As you mentioned, there as been an increase in the shares of the US apparel imports in ASEAN, Vietnam, and Bangladesh. I am curious if this will continue to rise once the global economy begins repair. I am also curious to see how the Western Hemisphere supply chains will develop as the economy repairs.

As we read in one of our articles, Covid-19 has changed a lot of fundamental aspects of the T&A industry around the world such as changes in demand, increase in e-commerce due to shut downs, and more accurate trend forecasting as well as faster but smaller production. Many people believe that the industry will rebound quickly once things get back to normal but I’m curious as to how the industry will rebound after the changes the industry is going through. Some articles had mentioned that consumers have become more aware of social and environmental responsibility during Covid-19 and believe there will be greater demand for these products but I wonder if this will reflect in the products being sold.

As we are all aware, the pandemic has had a huge negative impact on many industries and the textile and apparel industry was not immune. Although, as stated in the article, the decrease in China’s apparel exports seems to have stopped, and instead the numbers are starting to increase. This suggests that although globalization may never return to its previous state, recovery is possible. This could also be an ideal time for companies to rework their supply chains and improve their production processes.

Since the COVID-19 outbreak began in China, the single largest exporter of apparel in the world, it was clear from the start that the virus’s affect on the global T&A sector would be vast. As the graphs demonstrate, there was a significant decrease in both the value of U.S. apparel imports from China and the price index of U.S. apparel imports as a result of COVID-19. The fact that I found the most surprising is that despite their declining market share in U.S. apparel imports, China remains the largest exporter of apparel to the United States. This demonstrates the immense dependence that the U.S. apparel industry has on the cheap labor provided by China.

Its not shocking to see that imports from China have regained their spot as the largest apparel supplier to the US, and it makes sense seeing the lack of disposable money for people around the US in these times. However, it is interesting to learn that imports from CAFTA-DR members is down as well as imports from NAFTA members. Again, this could be due to the US not having as much spending power as before COVID-19 added to the fact imports from China have had such a large price drop.

I found the graphs provided in this article to be particularly interesting, yet I was not surprised by their analysis. Although China was first to be effected by Covid-19, it was also the first to recover. I feel that regardless of a potential shift toward importing from countries other than China, it will not be replaced. China is such a leading force in the T&A industry, therefore despite efforts to reduce sourcing from China, it is an irreplaceable powerhouse for T&A exports. As mentioned in the article, “China regained its position as the largest apparel supplier to the U.S. in May 2020,” despite Covid-19, therefore supporting my viewpoint that China is a permanent fixture as a major exporter of textiles and apparel.

Something I found to be particularly interesting to read about are the actual statistics relative to Covid-19’s impact on the T&A industries throughout different countries. I found it especially surprising that the apparel imports into the U.S. are significantly worse that they were in the 2008-2009 financial crisis, and it leads me to wonder if we will be able to recover fully from this negative impact, as it must have taken quite some time and new regulations to recover the first time it was greatly impacted. Another fact that caught me by surprise is that China’s exports to the U.S. decreased by 60.2% compared to last year, although it did make a gradual recover to some degree. Another thought that I feel is important to address is if perhaps some countries are a bit too dependent on others, or not? This is yet another question I feel can not be completely deemed as having a right or wrong answer, and rather it’s a difference of opinion.

I found it very interesting that despite COVID-19, China still remains the largest apparel source for the United States. This really goes to show how seriously fashion companies take their relationships with their factories in China. At the beginning of the pandemic, I thought that US apparel companies would begin to move out of China and look elsewhere to source from, but as stated in the blog post, it does not seem as though US apparel retailers are moving their sourcing out of Asia and into the western hemisphere. The second reason that was given for the sourcing remaining in China (US consumers are more price-sensitive with the high rate of unemployment) I think can also be tied into the American desire for fast-fashion. Even before COVID-19 hit, many Americans didn’t necessarily care about the quality of their clothes as long as the price wasn’t steep.

I thought it was very interesting how imports from from CAFTA-DR & NAFTA members decreased along with a decrease in imports from China. I feel that China has the ability to become the largest importer to the US if the coronavirus ever ends. It may take time for them to regain their spot, but I think over time it will happen. But until that happens, it is a good time for the US to start importing from other countries.

It has been made pretty clear to me that globalization will never look the same. COVID-19 has given the T&A industry an opportunity to change and reshape the industry. Currently, no clear evidence has suggested that US fashion brands and retailers are near-sourcing from the Western Hemisphere. But, I think that change is on its way in time. There has been a growing demand in U.S. consumers for products “Made in USA”. This demand tied with the tariffs imposed on China and the desire to decrease health risks (due to COVID-19 concerns) by sourcing closer rather than from long distances (overseas)— is likely going to shift sourcing to the Western Hemisphere. But, at the same time I do not think this shift is going to be overwhelmingly huge nor will it effect the textile and apparel industries equally. I think that the U.S. will source more apparel goods from the Western Hemisphere and/or increase (automated) apparel production in the US. I do not see countries within NAFTA and CAFTA changing their sourcing patterns significantly. The U.S. has greater incentives to evolve since they also have the means (capital) to do so.