Japan has one of the world’s largest apparel consumption markets, with retail sales totaling USD$100bn in 2021, only after the United States (USD$476bn) and China (USD$411bn). Meanwhile, like many other developed economies, most apparel consumed in Japan are imported, making the country a considerable sourcing and market access opportunity for fashion companies and sourcing agents around the globe.

Japanese fashion companies primarily source apparel from Asia. Data shows that Japanese fashion brands and retailers consistently imported more than 90% of clothing from the Asia region, much higher than their peers in the US (about 75%), the EU (50%), and the UK (about 60%). This pattern reflects Japan’s deep involvement in the Asia-based textile and apparel supply chain.

Notably, Japan’s apparel imports from Asia often contain textile raw materials “made in Japan.” Data shows that in 2021, about 65% of Japan’s yarn exports, 75% of woven fabric exports, and 90% of knit fabric exports went to the Asia region, particularly China and ASEAN members. Understandably, in Japan’s apparel retail stores, it is not rare to find clothing labeled “made in China” or “Made in Vietnam” but include phrases like “high-quality luster unique to Japanese fabrics” and “with Japanese yarns” in the product description.

The Global value chain analysis further shows that of Japan’s $5.32 billion gross textile exports in 2017, around 34% (or $1.79 billion) contributed to export production in other economies, mainly China ($496 million), Vietnam ($288 million), South Korea ($98 million), and Taiwan ($92 million).

China remains Japan’s top apparel supplier at the country level. However, Japanese fashion brands and retailers have been diversifying their sourcing base. Since the elimination of the quota system in 2005, China, for a long time, was the single largest apparel supplier for Japan, with an unparalleled market share of more than 80% measured by value. However, as “Made in China” became more expensive, among other factors, China’s market share dropped to 56.4% in 2021. Japanese fashion brands and retailers actively seek China’s alternatives like their US and EU counterparts. Notably, Japan’s apparel imports from Vietnam, Bangladesh, and Indonesia have grown particularly fast, even though their production capacity and market shares are still far behind China’s.

As Japanese fashion companies source from more places, the total market shares of the top 5 apparel suppliers, not surprisingly, had dropped from over 94% back in 2010 to only 82.3% in 2021, measured by value. Similarly, the Herfindahl-Hirschman Index (HHI), commonly used to calculate market concentration, dropped from 0.64 in 2011 to 0.35 in 2021 for Japan’s apparel imports. In other words, Japanese fashion companies’ apparel sourcing bases became ever more diverse.

We can observe the same pattern at the company level. For example, the Fast Retailing Group, the largest Japanese apparel retailer which owns Uniqlo, used to source nearly 100% of its products from China. However, as of 2021, the Fast Retailing Group sourced finished apparel from over 550 factories in more than 20 countries. While about half of these factories were in China, the Fast Retailing Group had strategically developed production capacity in Vietnam, Bangladesh, Indonesia, and India. On the other hand, in April 2021, the Fast Retailing Group opened a 3D-knit factory in Shinonome, allowing the company to re-shoring some production back to Japan.

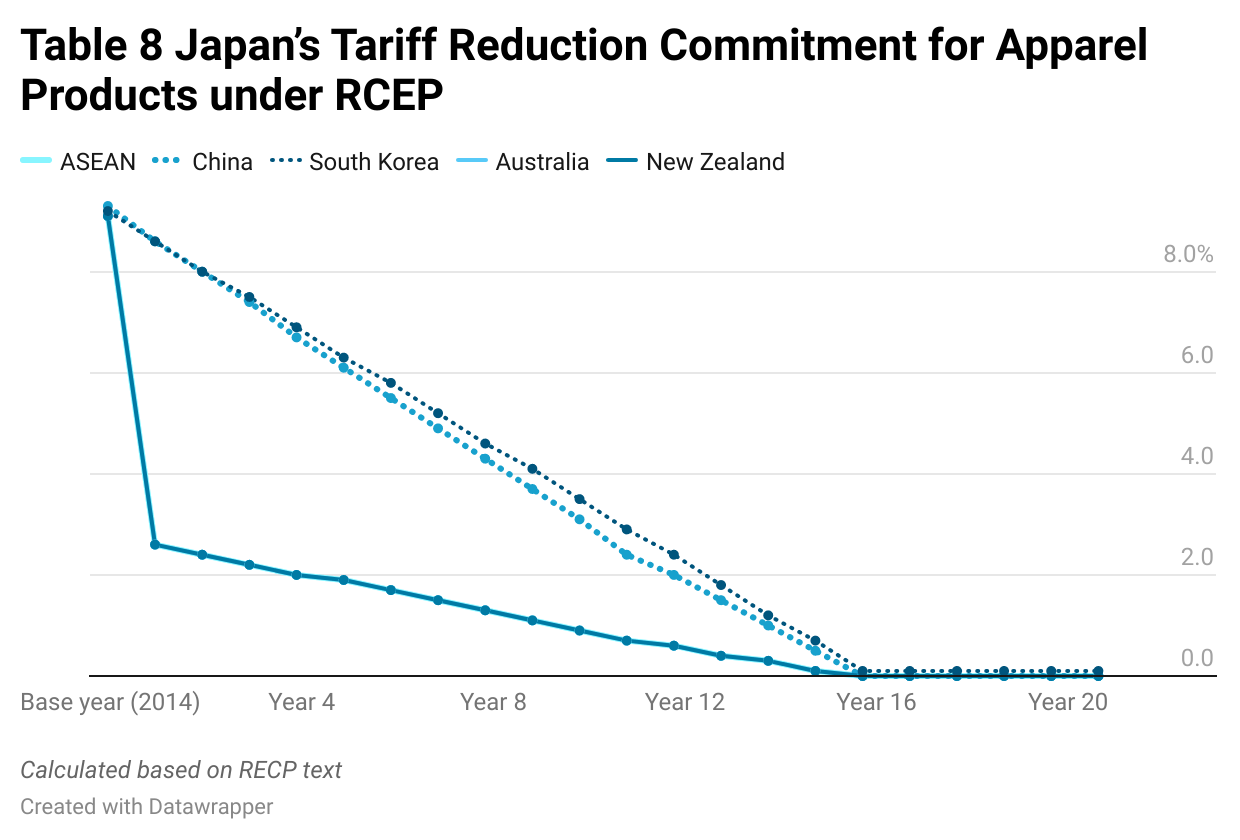

Additionally, Japan is a member of the Regional Comprehensive Economic Partnership (RCEP), the world’s most economically influential free trade agreement. Notably, Japan commits to reducing its apparel import tariffs to zero for RCEP members following a 21-year phaseout schedule. However, as Table 8 shows, Japan’s tariff cut for apparel products is more generous toward ASEAN members and less for China and South Korea due to competition concerns. For example, by 2026, Japan’s average tariff rate will be reduced from 9.1% today to only 1.9% for apparel imports from ASEAN members but will remain above 6% for imports from China. Given the tariff difference, it can be highly expected that ASEAN members such as Vietnam could become more attractive sourcing destinations for Japanese fashion companies.

by Sheng Lu

Further reading: Lu, Sheng (2022). Japan’s apparel market has strong sourcing potential. Just-Style.

That much of the apparel from Asia that enters Japan has “Made in Japan textile/yarn” is much similar to what happens in Mexico and CAFTA region. For the reason that the TEXTILE portion in a garment is the MAINSTAY of the cost!!!

I think it is really interesting how Japan has begun to diversify their supply chain to other countries rather than just China. By using countries in such close proximity to Japan, I can only imagine how short the supply chain process truly is. In comparison to the United States, Japanese retailers such as Fast Retailing Group, probably have a much faster turn around to producing new collections as they are sourcing closer to home. A US retailer like Forever 21 may have a longer supply chain process as they too are sourcing from East Asia, but are not nearly as close as Japan is. The apparel market in Japan has the opportunity to gain even more success due to their close proximity to many key countries that are sourcing hubs. This then raises the questions of, how will the US compete? Will US apparel retailers look to bring their sourcing closer to home to compete with Japan’s fast production rates?

Great thoughts! My question is why Japanes fashion companies also choose to diversify their apparel sourcing base, particuarlly to reduce their “China exposure”? Unlike the case in the US, there is NO trade war between Japan and China and both countries are members of RCEP. Also, this diversification trend started BEFORE the pandemc. Hope our lectures this week will inpsire new ideas.

I find it very interesting how Japanese fashion companies are choosing to diversify their apparel sourcing base as China becomes more expensive. The Fast Retailing Group which is the largest Japanese apparel group formally sourced all of its products from China. The Fast Retailing Group is now sourcing apparel from more than 20 countries. This is great for developing countries as it gives them more economic opportunities. It is very interesting that Japan has committed to decrease tariffs for apparel products which is appealing to Japanese fashion companies as they can source in ASEAN countries with only a 1.9% tariff. This is beneficial for both ASEAN members and Japanese fashion companies because they can source in a diverse way.

then why didn’t the US do the same?Why does the US textile industry always oppose tariff cut? for example: https://twitter.com/NCTO/status/1518631750028734466

It is interesting to see that Japan is focusing on diversifying their supply chain and making less in China than they previously have. I am curious how their plan has been affected by covid because they started diversifying before the pandemic. I believe it would encourage them to keep diversifying their supply chain even further. We have seen major supply chain problems because of the pandemic causing more brands and countries to find new places to manufacture goods. By Japan already starting this process they are ahead of the trend. I would be interested to learn more about how they were affected compared to the U.S. brands.

After reading this blog post, it is extremely interesting to me that Japan imports from Asia but all raw materials coming from Asia say that they are made in Japan. Although this is understandable to find, it usually states phrases such as “high quality luster” or “with Japanese yarns” in the description as well. I also find it intriguing that Japan is beginning to diversify their supply chain to places in such close proximity. I would consider this an advantage because there will be a much quicker turnover rate compared to places like the U.S. who are sourcing larger distances. I would love to know how Japan is going to continue using this to their advantage in the future.

After learning about forced labor in China and how sourcing from China is not actually “cheap”, contrary to popular belief, I believe this is a good idea for Japan. I think diversifying their sourcing from other places in Asia such as Vietnam could boost Japan’s economy. Not only would it allow for easier imports since the sourcing is still taking place in Asia and not the US or EU, but it would also help Japan create strong relationships with other countries rather than constantly relying on China for sourcing.

I agree with this statement. There is not much reason to continue sourcing from China when Vietnam is just as close, and can produce at a cheaper rate. However, Japanese brands need to be willing to make these changes to moving to another country. According to the video “Why China’s Xinjiang Cotton is hard to boycott” (https://www.youtube.com/watch?v=9CB6qWnMf_Y), brands produce in China due to its vast production infrastructure which makes it hard to leave. And brands need to be willing to burden the costs of moving information to another country to begin to produce there.

We have recently learned about forced labor in China as well as know about the terrible working conditions that happen in many factories all over the world. We have come to discover that there is a lot of hidden information as well as secrets that come with sourcing from China. It might be viewed as the best Cheap option but there is a reason why it is so cheap. As mentioned by some other students I do think it is a good idea for Japan to keep diversifying their souring. There are other places in Asia that could raise Japan’s economy. There are so many places in close proximity that would allow Japan not to lose a lot of money with tariff costs. Places like the US are not as feasible as there would be close and would take a lot of time and money for imports to get to Japan.

I find it very interesting yet not surprising that Japan has been diversifying their apparel sourcing. As China gets more expensive this allows for more developing countries to have a chance and grow in the industry as well.

Is Japan diversifying its sourcing base or moving sourcing from China to elsewhere? Why?

As a nation, China continues to be Japan’s primary source of clothes. The Japanese fashion industry, on the other hand, has been expanding its supply chain. As Japanese fashion companies get their supplies from more places, it’s not surprising that the total market shares of the top 5 apparel suppliers dropped significantly in 2021 as stated in the article. China and South Korea don’t get as much of a cut in clothing tariffs from Japan as ASEAN members do. This is because Japan wants to keep the market competitive. With that in mind, ASEAN countries like Vietnam could become more captivating places for Japanese fashion companies to buy goods instead of China.

I understand that Japan is choosing to diversify their supply chain due to China becoming more expensive, but I do not necessarily see it going as well as they think it will. China’s large production infrastructure makes them powerful in that field and enticing to other countries for sourcing. There are very few, if any, other countries that can live up to brand’s supply chain expectations like China can. So, if Japan is really interested in diversifying their supply chain, they need to be prepared to lower their expectations and accept the implications that come along with that change.

It really is interesting to see Japan concentrating on trying to expand their supply chain and producing less in China than they used to. In relation to the United States, Japanese retailers such as Fast Retailing Group are likely to produce new pieces much faster because they source closer to home. However, since China is a huge hub for production, it makes them very powerful and has drawn in many countries for sourcing because of this. As some of the other comments stated, Japan does not reduce clothing tariffs as much for China and South Korea as it does for ASEAN members. This is due to Japan’s desire to keep the market competitive. With this in mind, ASEAN countries such as Vietnam could become more appealing destinations for Japanese fashion companies to purchase goods rather than China. Overall, Japan’s idea to diversify is a good one, but may not have the effect that they are hoping for due to China’s big sourcing capabilities.

I find it very interesting that Japan is diversifying its sourcing base in order to pull away from China. Many countries are very reliant on China because of the large ecosystem of manufacturers that has developed there over a long period of time. However, China’s economy is developing at a fast rate, this is why they are becoming more expensive. We can see in the Flying Geese model that China is advancing towards more developed tiers of production. It is not only smart, but it is part of the natural supply chain for Japan to source in other regions such as Vietnam, Bangladesh, and Indonesia. If Japan does not invest in these new souring relationships now, they may face larger hurdles once China catches up with them.

I’m not surprised that Japan primarily sources from Asia. Asia is known to be a great supplier with a low cost but still high quality garments. I think it’s smart for Japan to diversify their sourcing bases. There is a saying that one of my business professor’s quote, “Don’t put all your seeds into one basket” and I believe that goes for everything in life. Even though China’s economy is doing well, no one can predict what will happen in the future. Also, with learning about China’s controversies in class like Xinjiang cotton, I think it’s smart that Japan has a sourcing base in Vietnam or Bangladesh. Sourcing close to home has its benefits and in the later years, Vietnam, Bangladesh, and Indonesia may look more attractive than China

I think its really smart for Japan choosing to diversity their supply chain because of many reason. Like we mentioned before in class, diversifying allows for countries to not put all their eggs in one basket. It provides different paths and sources for Japan. It also provides other opportunities for surrounding countries to become stronger. With the increase cost of sourcing from China and also the issues that China is having with forced labor, I think its smart for other countries to also diversify and not put all their eggs in China’s basket.

I find it very interesting that Japan is choosing to diversify outside of Chinese sourcing. There are no trade issues between China and Japan, and many just assume it is cheap to source there, however, we have learned it is actually expensive. Because Japan is one of the world’s largest apparel consumption markets, I believe diversifying would be good for the country. Like we saw during COVID, China has been in and out of strict lockdowns, and diversifying sourcing for Japan could avoid things like this. Expanding into countries such as Vietnam, Bangladesh, and Indonesia which are smaller will be a big change from what it is from China, and it will be interesting to see how Japan navigates such changes.

I found this article very interesting. I think that by Japan choosing to diversify their sourcing bases outside of China is interesting. I think Japan is moving in the right direction by diversifying their sourcing bases, and not putting all of their eggs in one basket. I think that in the future other countries will see that this is working and will also diversify their sourcing bases. I found it interesting that some apparel has made in Japan on the garment tag. We see “made in China” so often, that it is almost weird to see clothing that is made from anywhere else. By expanding into Vietnam, Bangladesh and Indonesia, Japan is keeping its sourcing close to home which can have many benefits in the present as well as the future

It is interesting to see Japan following a similar pattern as the United States, in that both countries are actively looking to decrease their dependence on China. Over the last two decades, China has emerged on the world stage as an economic powerhouse partly on the strength of textile and apparel exports. To answer Dr. Lu’s question above, I think US and Japanese companies are removing business from China, rather than diversifying their sourcing networks. While Bangladesh, Vietnam, India, and Indonesia are emerging as attractive sourcing partners, these players already have established business with the US and Japanese companies. If these companies were truly looking to diversify, I would beg to argue that they would explore opportunities outside of the continent, instead of shifting production from China to other Asian countries.

It is definitely interesting that Japan has decided to diversify it’s sourcing base away from China. I feel this because China is only growing in this manufacturing industry and serve as many countries’ main exporter. A reason why this could be is that as China continues to grow their labor is growing in price as they move towards high level of production opposed to those who are just beginning and have lower prices such as Bangladesh and Vietnam. From an economic standpoint this is a smart decision for them.

I believe that this can actually be a good thing for Japan. As we’ve learned before, it is not always great to put all your eggs in one basket. We also learned that it is actually not as cheap as you would think to source from China which is because China is growing into a large economy with many other benefits. Japan sourcing from other places can actually boost its economy. This would allow easier importing and can also help create more relationships with other countries besides China.

I think Japan’s shifts in apparel imports from China to Vietnam, Bangladesh, and Indonesia is a prime example of the flying geese model. As China is becoming more developed, they are exporting less apparel and more textile products. However, because Japan is more developed than China, they already have a plentiful supply of textiles produced within the country. For these reasons, when China began to shift more to textile exports, Japan shifted to Vietnam, Bangladesh, and Indonesia for more apparel exports because those countries are more labor intensive and less developed.

What a great blog post! Japan diversifying it’s sourcing portfolio is a key response to how the Covid-19 pandemic impacted the supply chain of companies around the world. The hardships faced during the pandemic showed companies that having a main source will create a detrimental affect to their supply chain if a discrepancy happens. I believe that Japan diversifying it’s sourcing is a great idea to ensure that their supply chain is not hit as directly as it was during 2020. It is interesting to see if other countries will follow these footsteps to ensure that damage is prevented. Although the United States has strong ties within CAFTA regions and China, I would like to see a greater portfolio to ensure that American companies and consumers are protected when tragedies have the potential to affect the supply chain.

I find it very interesting that Japan is shifting its sourcing away from China. I am interested to see in the future what our world’s largest producing countries are considering that the United States, although for different reasons, has also been trying to shift away from relying on China so heavily in sourcing their products. In addition, China has been growing and improving as a country. Maybe soon they will shift from being a major exporter to a major importer. I think that is healthy for Japan to begin sourcing in other countries. This creates competition as well as connections and relationships that can benefit other growing countries.

I thought this article was very interesting. It was surprising to see that Japan imported merchandise from Asia. It was more interesting to see that Asia remained Japan’s top source for sourcing, but they are searching to diversify their supply chain as well. There are many factors contributing to Japan’s desire to diversify their supply chain. Japan sourcing from Asia probably comes with various advantages such as faster turn around times, ease of transportation, and easier communication. With China’s growing concerns of working with China, it would be wise for Japan to find alternative suppliers in countries like Vietnam, Bangladesh, or Indonesia. Forming new relationships with diverse suppliers would decrease Japan’s reliance on Asia.

I think that Japan starting to source from other countries and not mainly China will make a big impact on other countries economy. With Chinas prices rising steadily it only makes sense to start cutting back sourcing mainly from them and start to import from countries like Vietnam, Bangladesh and Indonesia as said in the blog article. Even those these countries are still behind China in their production capacity, with more companies and countries starting to source from them it could allow them to continue to grow and eventually be closer or equal to China’s capacity level. This will allow Japan to cut back on costs they would have had when sourcing with China and grow their economy, I think this is a smart decision.

Japan sourcing from countries other than China has the ability to bring benefits to both countries. First of all I think it is beneficial to not only source from one main country. Too much reliance on one sourcing base could have its risks if something were to go wrong. Especially with things like Covid affecting trade and manufacturing. Talking about how it is beneficial for countries to source from multiple places as they can keep good relations with multiple different countries allowing more room for growth. They can continue to source through countries like Vietnam and Bangladesh rich in labor. This has the ability to help these countries and strengthen their relations. This also grows trade as a whole and can help out more countries.

From an economic standpoint, I believe that Japan’s move in a different direction will not only benefit themselves, but also supply a country more in need of job opportunities and overall national wealth more of an opportunity to thrive. With the benefit of lower wage costs and ultimately production costs for Japan, they are able to make higher profits due to the increase in diversifying their sourcing base. Vietnam, Indonesia, and Bangladesh are all examples of where Japan is heading in hopes of starting something new for themselves. Like in the finance world, diversifying in product sourcing can be beneficial for many reasons. One specifically that stood out to me being a finance major, is that if something goes wrong with one of the nations they rely so heavily on such as China, and their sourcing plans get ruined, Japan would be in need of creating new relationships with other nations in hopes of finding another source of producing and manufacturing goods that are demanded. I decided to look at this topic from a different point of view to be insightful to those who may also relate and see it in a new light.

I think it’s a great idea for Japan to continue diversifying its supply chain. Economically, I think it will benefit Japan a lot, and allow them to branch out rather than just source from one specific place. In addition, diversifying their supply chain allows for developing countries to gain more job opportunites and grow economically. Additionally, since Japan chooses to source from countries in Asia, the close proximity allows for garments to be produced relatively quickly and be more cost-effective.