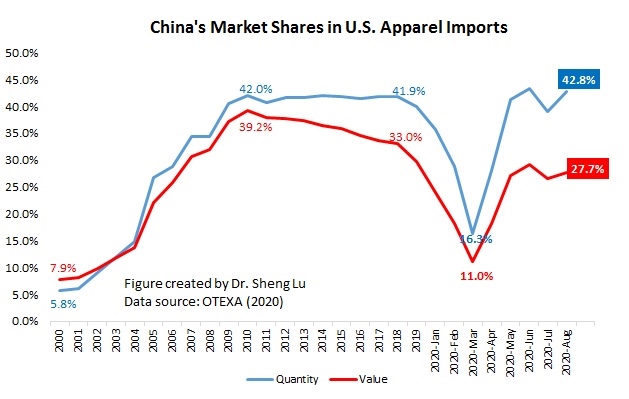

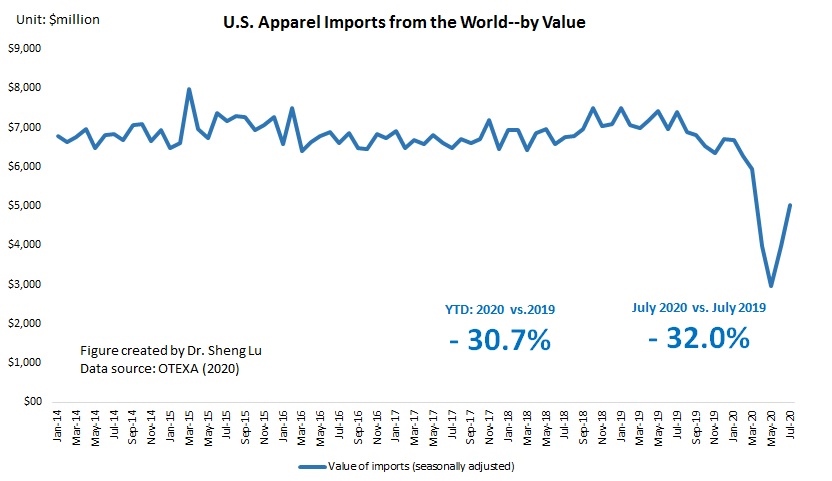

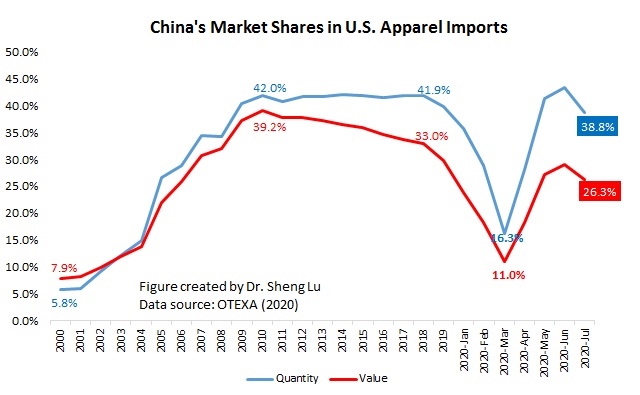

The prospect of China as a textile and apparel sourcing base for US fashion companies is becoming ever more intriguing. While China remains the top textile and apparel supplier to the US market, US fashion companies have been actively seeking China’s alternatives due to concerns ranging from rising wages, trade wars to perceived supply chain risks.

Recently, VF Corporation, one of the most historical and largest US apparel corporations, released the entire supply chain of its 20 popular apparel items, such as Authentic Chino Stretch, Men’s Merino Long Sleeve Crewe, and Women’s Down Sierra Parka. VF Corporation used 326 factories worldwide to make these apparel items and related textile raw materials. We conducted a statistical analysis of these factories, focusing on exploring their geographic locations, production features, and related factors. The results help us gain new insights into VF Corporation’s supply chain strategy and offer a unique firm-level perspective to understand China’s outlook as a textile and apparel sourcing base for US fashion companies. Specifically:

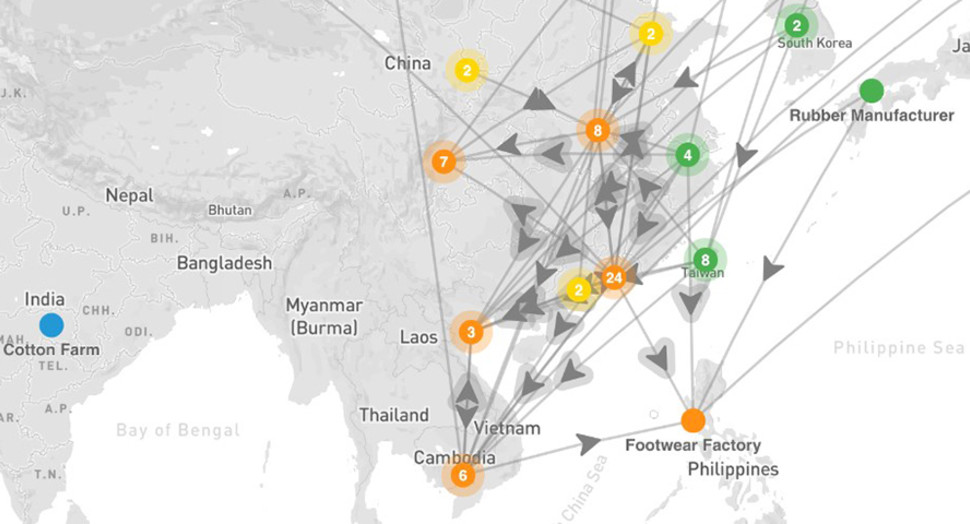

First, China remains the single largest sourcing base across VF Corporation’s entire textile and apparel supply chain. Specifically, as many as 113 (or 35%) of the total 326 factories used by VF Corporation are China-based, far exceeding any other country or region. Besides China, VF Corporation sourced products from the US (42), Taiwan (31), South Korea (16), Mexico (13), Honduras (12), Vietnam (11), Indonesia (8), as well as a few EU countries, such as Germany, Czech Republic, and France.

Notably, thanks to its unparalleled production capacity, China also offered the most variety of textiles and apparel among all suppliers. Chinese factories supplied products ranging from chemicals, yarns, fibers, trims, threads, labels, packing materials to finished garments. In comparison, most other countries or regions serve a narrower role in VF Corporation’s supply chain. For example, 65% of US-based factories supplied yarns, threads, trims, and fabrics; 80% of Taiwan-based factories supplied trims, fabrics, and zippers; and VF Corporation used most factories from Vietnam, Mexico, Honduras, and Indonesia to cut and sew garments only.

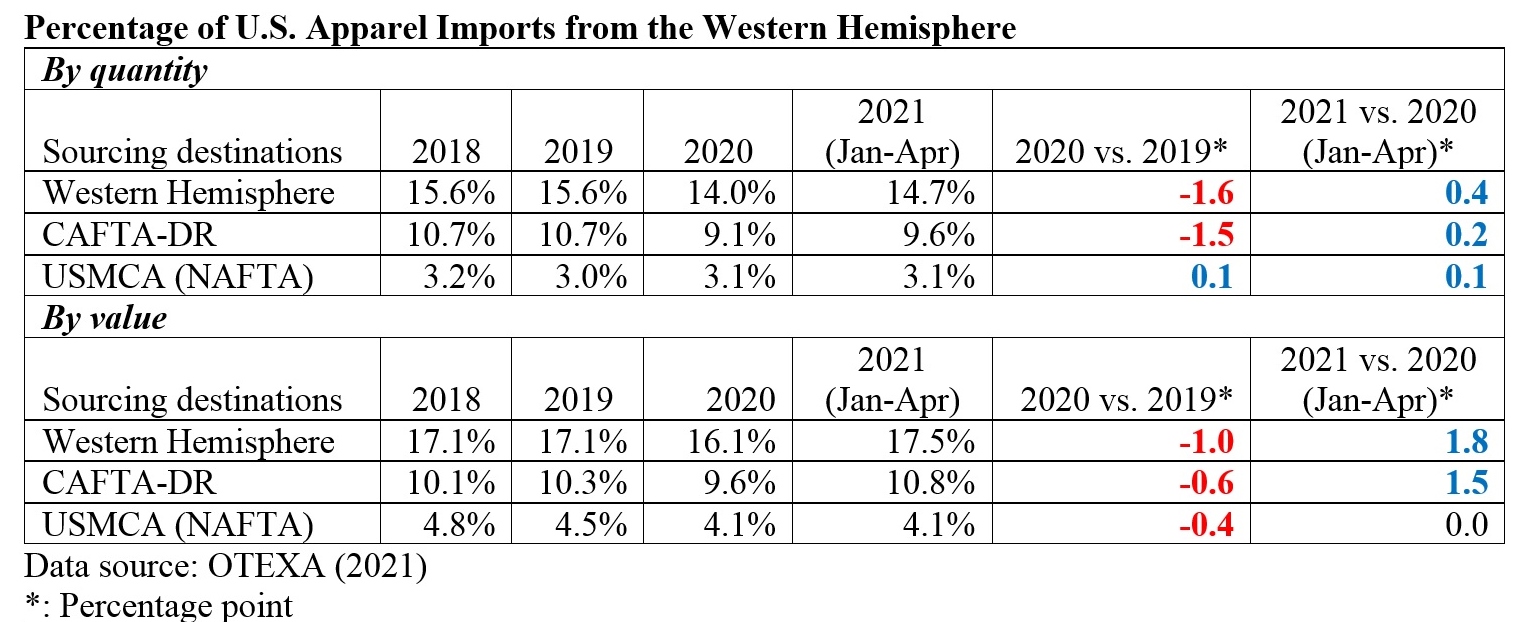

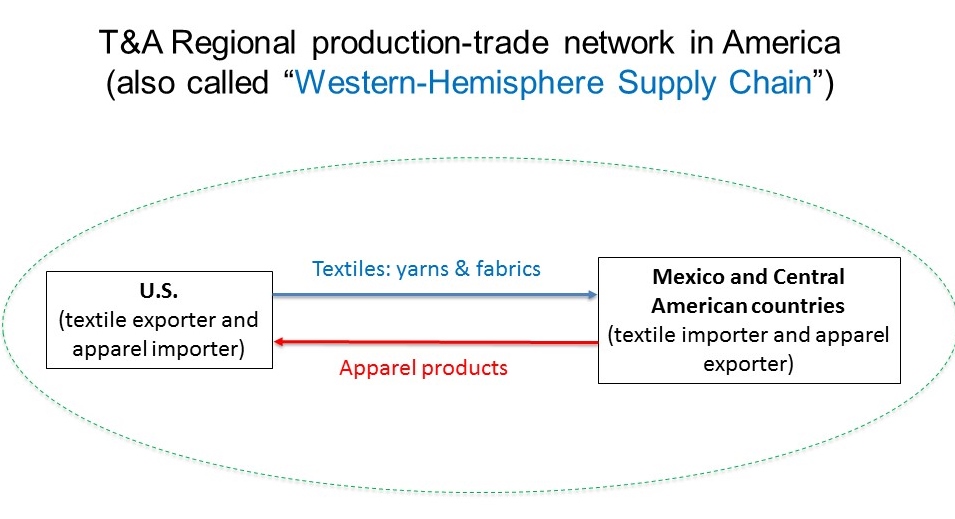

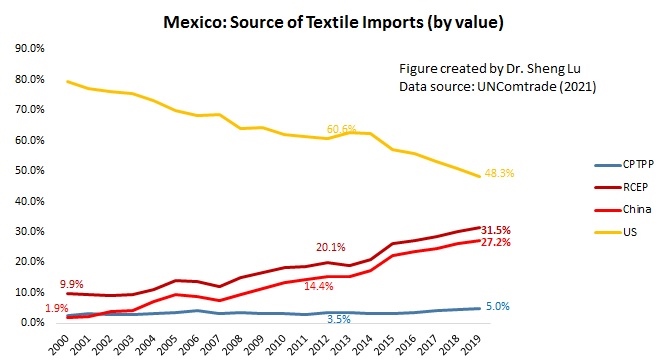

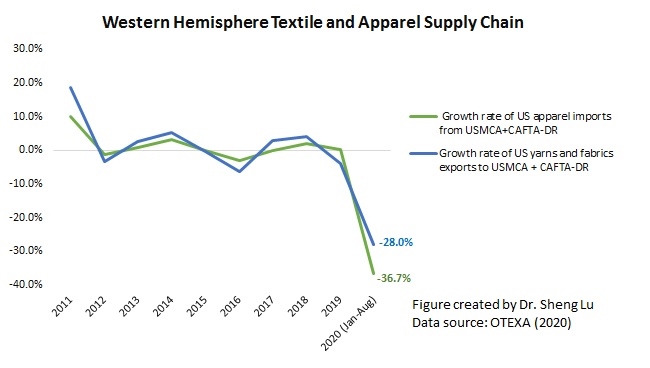

Second, VF Corporation is more likely to source from China when a higher percentage of the production processes across the apparel supply chain happens in Asia. For example, VF did not use any Chinese textile and apparel factory for its Williamson Dickies’s Original 874® Work Pant. Instead, Williamson Dickies’s supply chain was primarily based in the Western Hemisphere, involving the US (yarns, trims, and fabric suppliers), Mexico (fabric suppliers and garment manufacturers), Honduras (garment manufacturers), and Nicaragua (garment manufacturers).

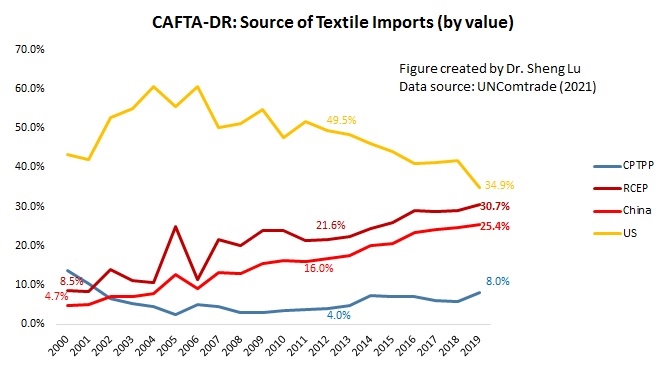

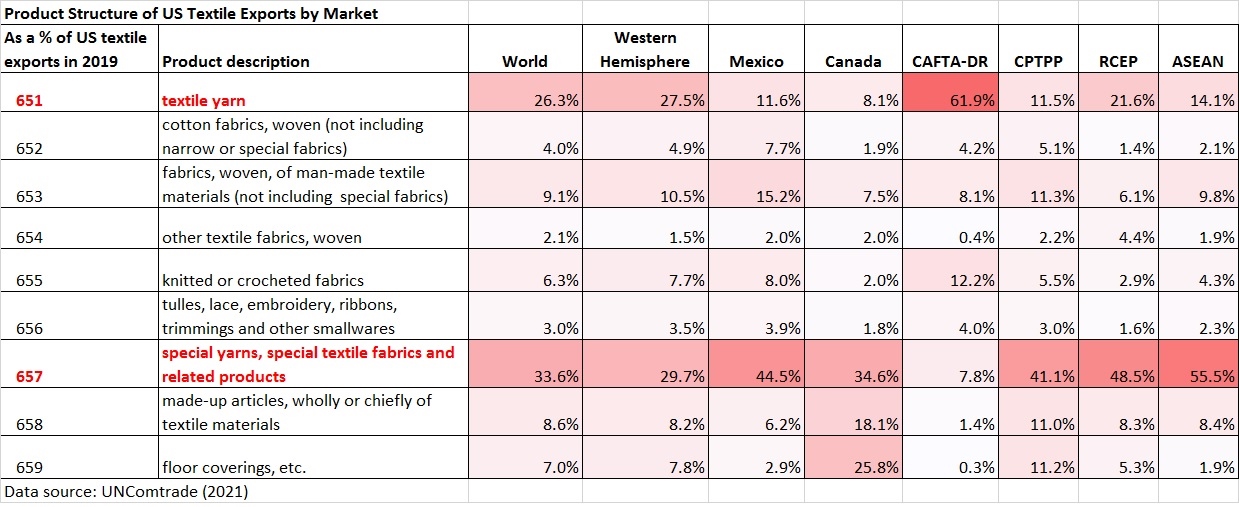

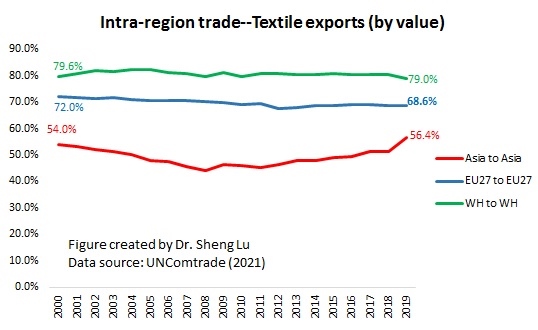

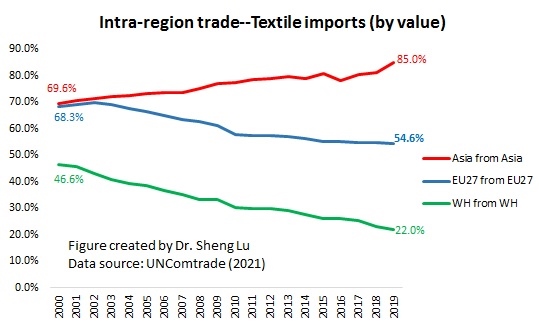

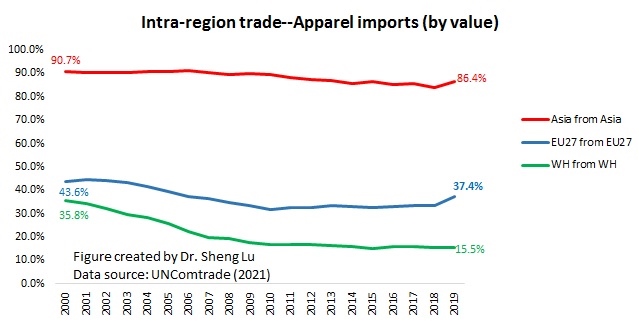

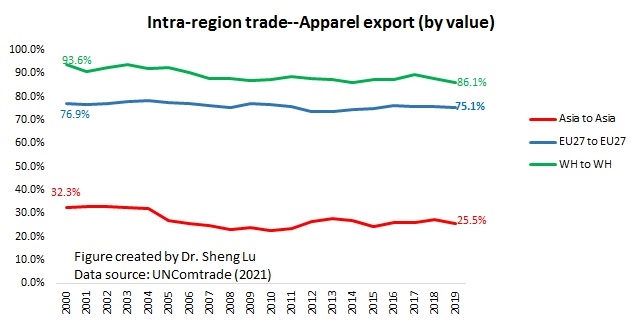

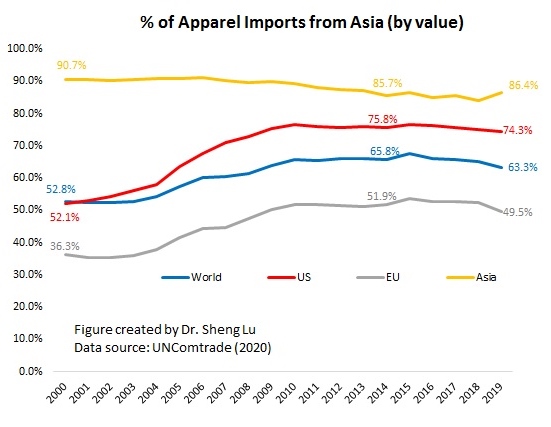

In comparison, VF used China-made textiles for Napapijri’s Parka Coat Celsius. Nearly 83% of this product’s production processes also happened in the Asia region, such as Taiwan (fabrics, zippers, plastic suppliers), Hong Kong (trim suppliers), and Vietnam (garment manufacturers). This pattern reflects China’s deep involvement and central role in the Asia-based regional textile and apparel production network. We may also expect such an Asia-based regional supply chain to become more economically integrated and efficient after implementing the Regional Comprehensive and Economic Partnership (RCEP) and other regional trade facilitation initiatives in the next few years.

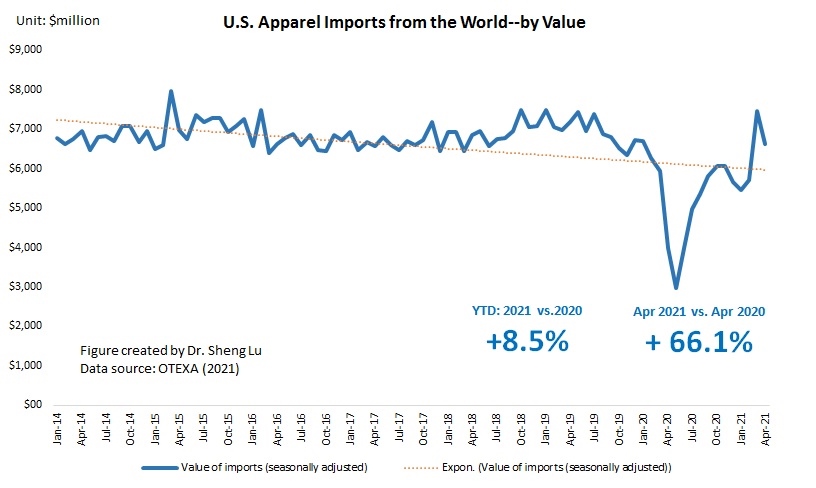

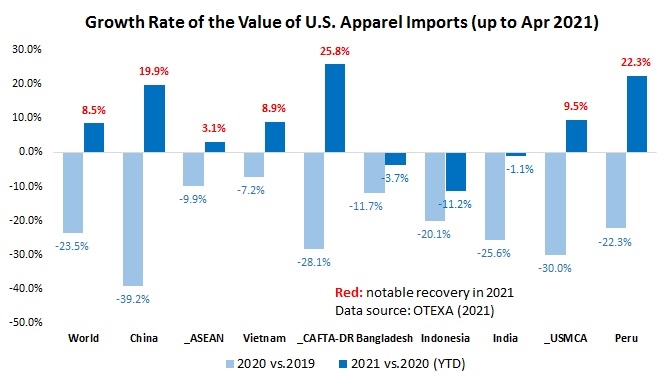

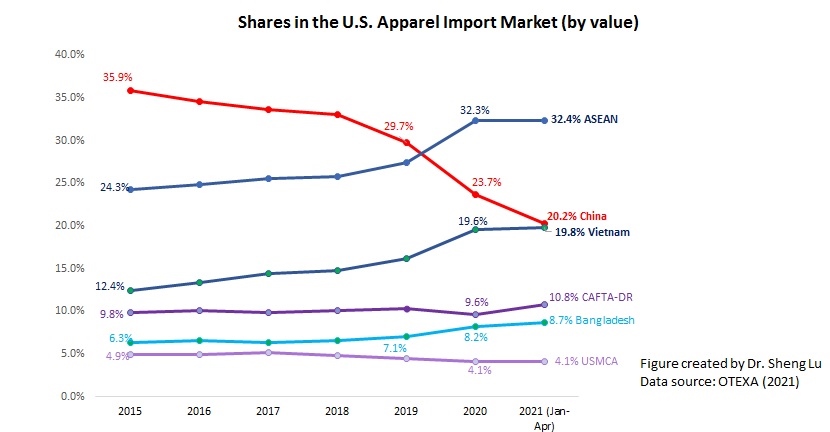

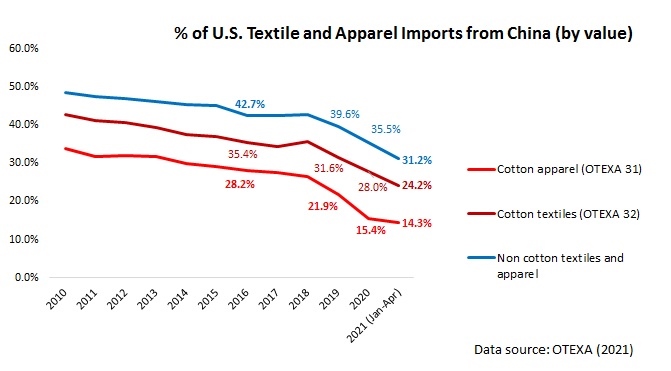

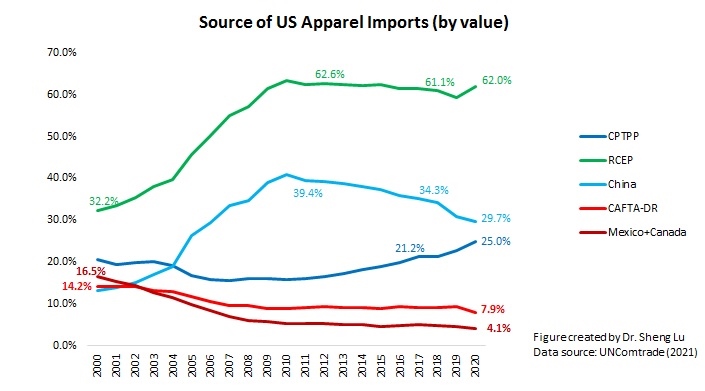

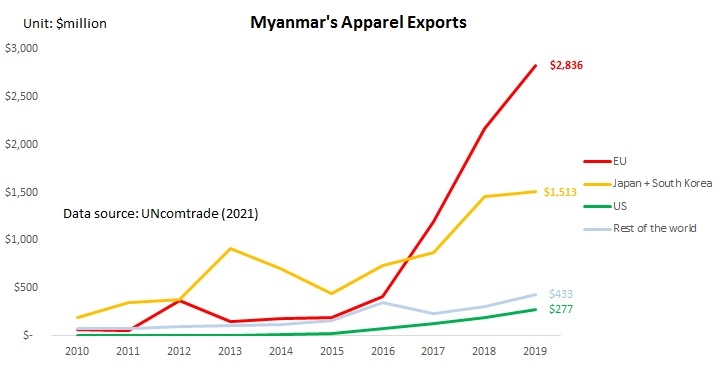

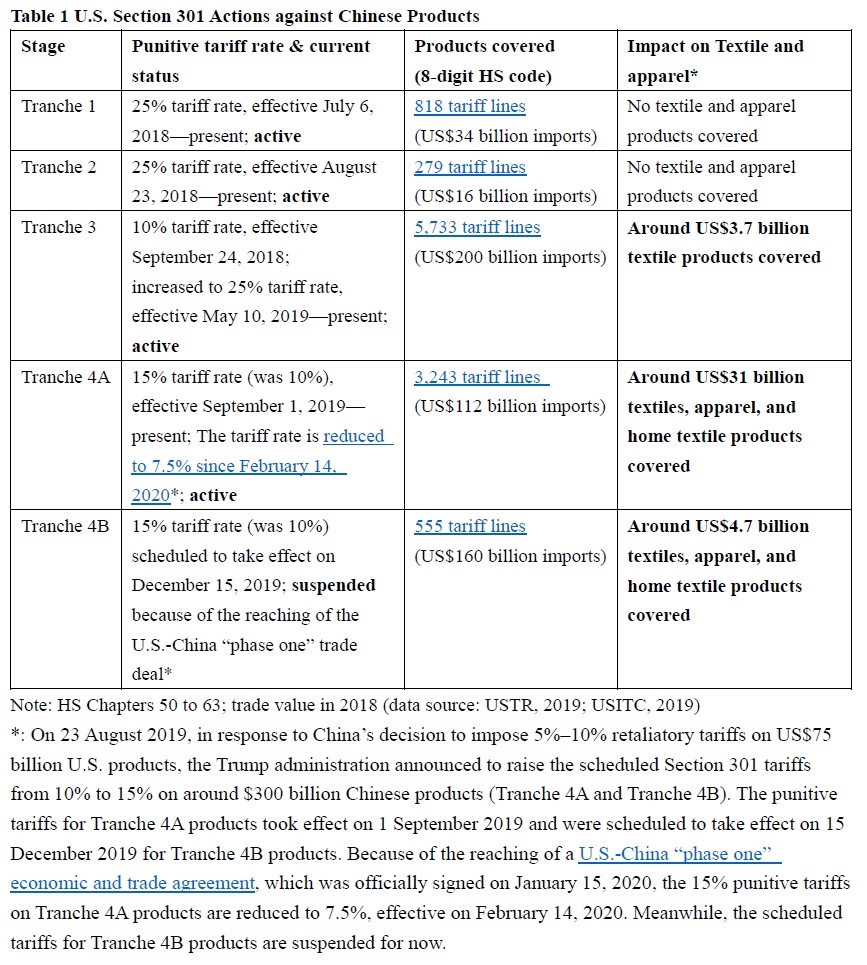

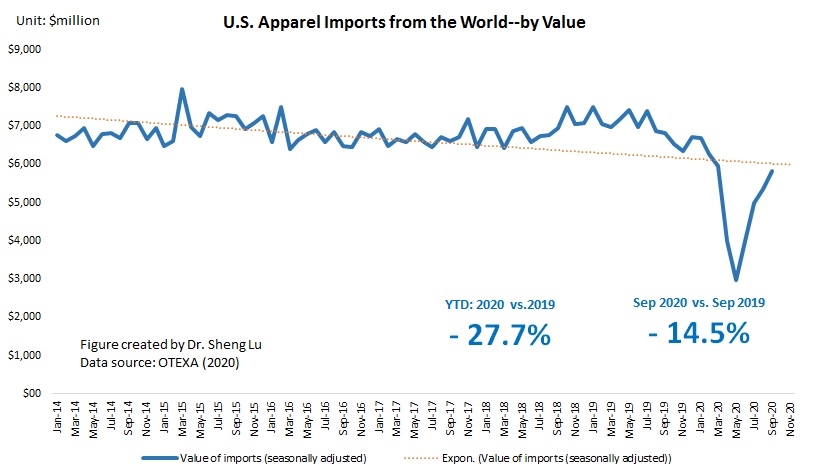

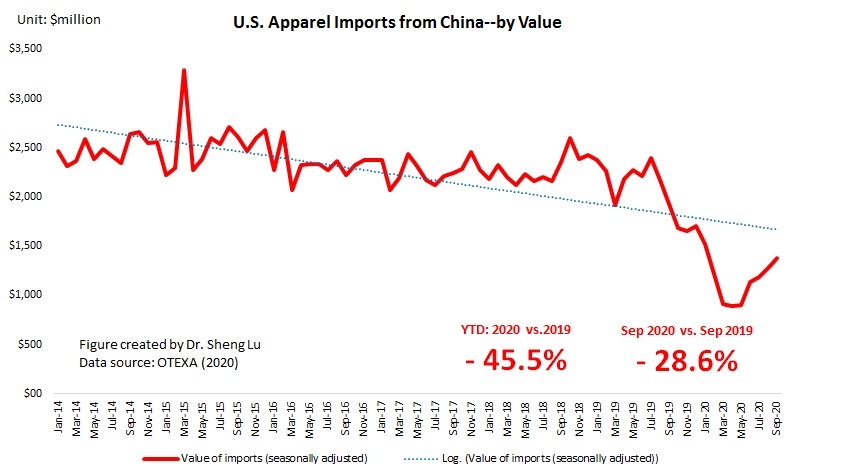

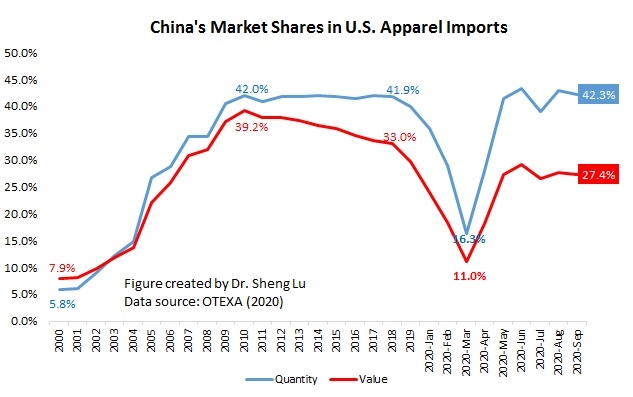

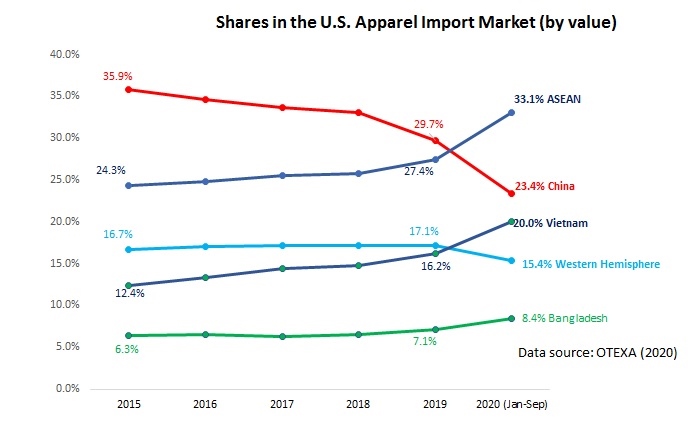

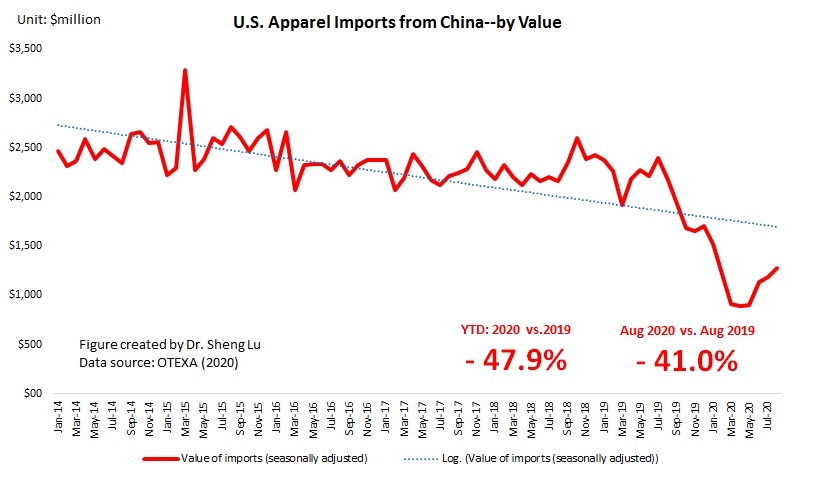

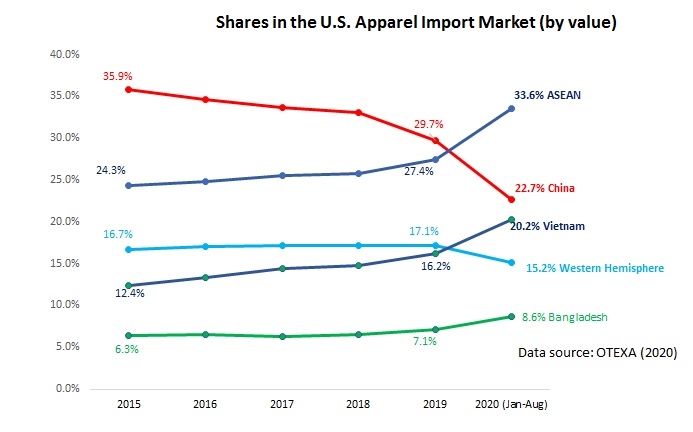

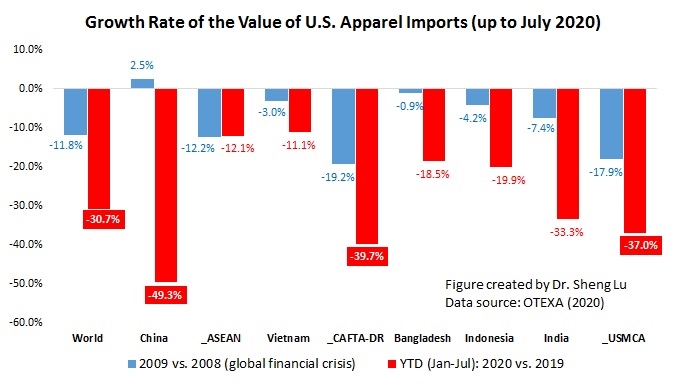

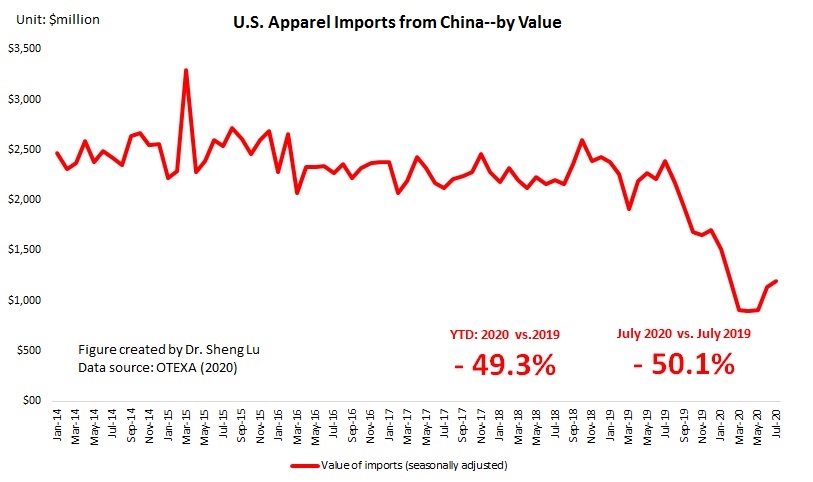

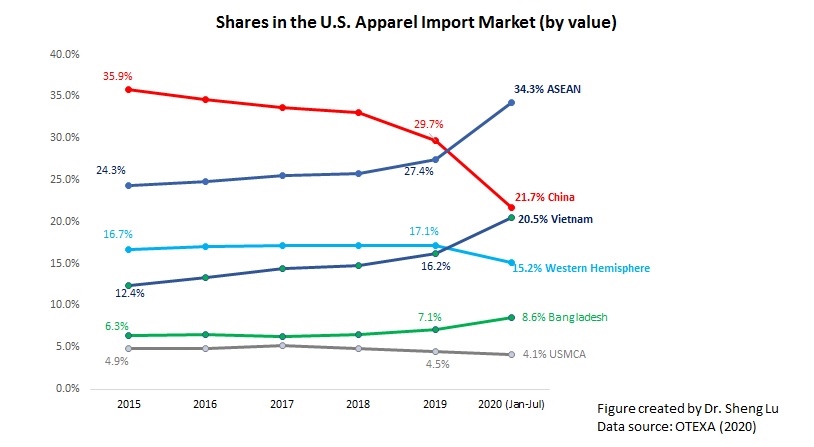

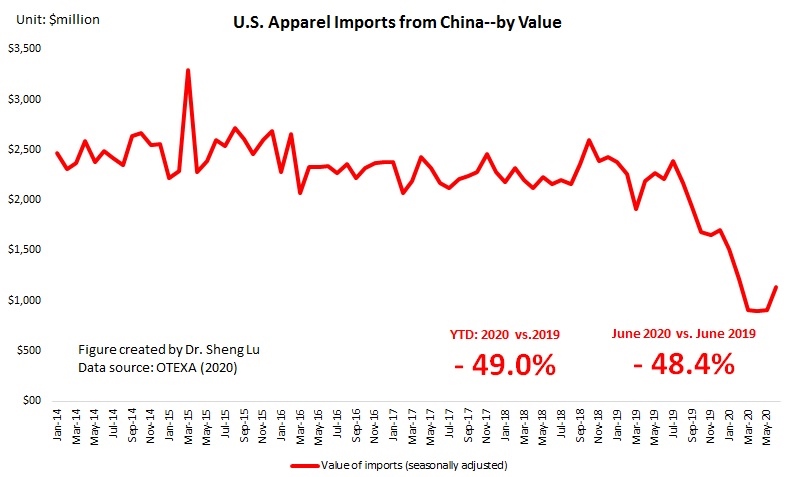

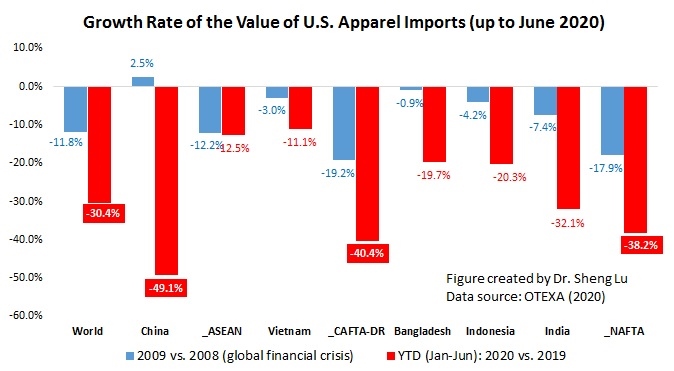

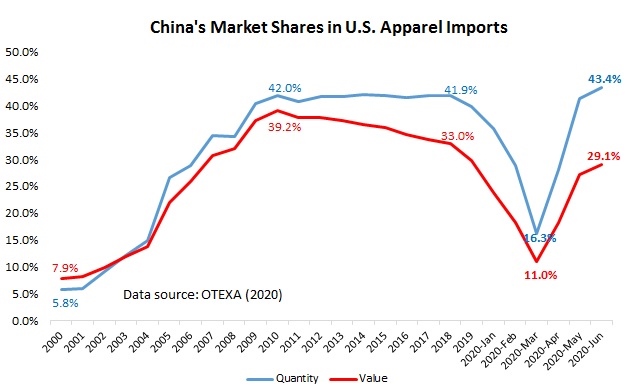

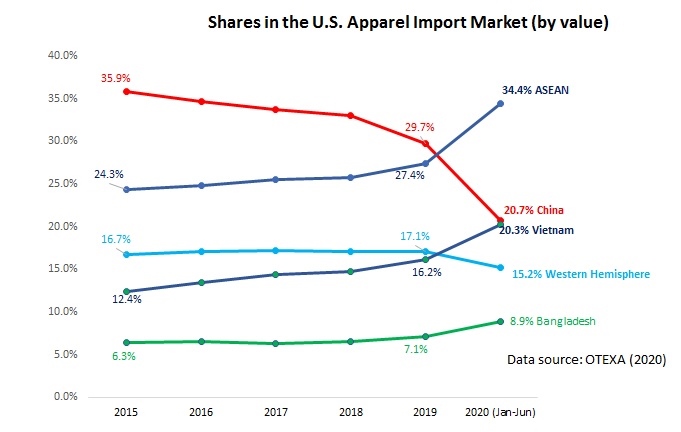

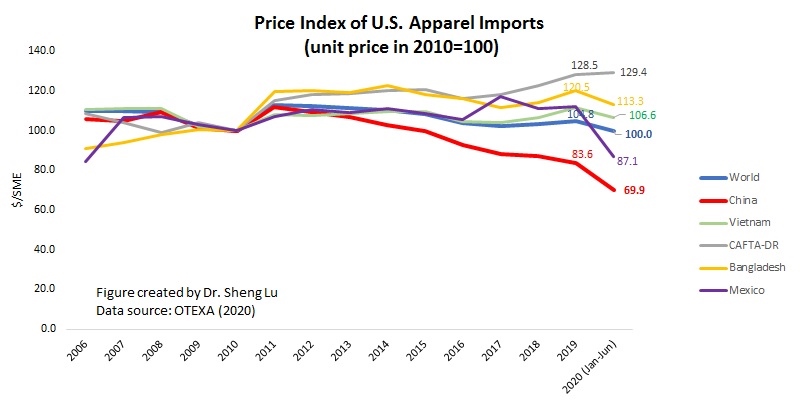

Third, reflecting the evolving nature of China’s textile and apparel industry, the result shows that VF Corporation is more likely to use China as a supplier of textile intermediaries than the finished garment. Due to various reasons, from the US Section 301 tariffs to the wage increases, China already plays a less significant role as a garment supplier for VF Corporation, accounting for just around 10% of the company’s tier 1 suppliers. This result is highly consistent with the official trade statistics—measured by value, only 23.7% of US apparel imports came from China in 2020, a new record low over the past decade.

Fourth, interesting enough, the results indicate that when an apparel item involves more production stages or needs a greater variety of inputs, it will reduce VF Corporation’s likelihood of sourcing from China. For example, the supply chain of Icebreaker’s Men’s Merino 200 Oasis Long Sleeve Crewe included five different processes (e.g., wool fiber, wool yarn, and finished garments). VF Corporation used around 21 various factories and facilities across the supply chain, of which 57.1% were China-based. In comparison, North Face’s Women’s Denali 2 Jacket included around 21 different processes (e.g., polyester yarn, nylon yarn, tape, zipper, trim, polyester interlining, thread, eyelet, label, and finished products). The supply chain included around 24 various factories and facilities, of which only 16.7% were China-based. One possible contributing factor behind this phenomenon is the cost of moving intermediaries across China’s borders. Sourcing from China seems to be disadvantaged by the relatively high trade barriers and a lack of free trade agreements with key trading partners, especially when some components in the supply chain need to come from outside the Asia region, such as the Western Hemisphere and the EU.

Additionally, NO clear evidence suggests that pricing and environmental and social compliance significantly affect VF Corporation’s decision to source from China. For example, the apparel items using either China-made textile raw material or cut and sew in China had a wide price range in the retail market, from as little as $26 to as much as $740. The retail price of those apparel cut and sew in China ranged from $56 to $86, which was neither exceptionally high nor low (i.e., no particular pattern).

Meanwhile, according to VF Corporation, around 61.9% of its China-based factories across the apparel supply chain had received at least one type of “environmental & chemical management certification.” This record was on par with non-Chinese factories (64.8%). Likewise, around 29.0% of China-based tier 1 & tier 2 factories had received one type of “Health, Safety and Social Responsibility Certification(s),” similar to 22.5% of non-Chinese factories. Overall, how US fashion companies like VF Corporation factored in pricing, environmental, and social compliance in their sourcing decisions need to be explored further.

By Sheng Lu

The study will be presented at the 2021 ITAA-KSCT Joint Symposium in November 2021